Question: Part One Case Study Hadi Al - Salman is the manager of the audit of Al - Qahtani Holding Group, a public company that manufactures

Part One Case Study

Hadi Al Salman is the manager of the audit of AlQahtani Holding Group, a public company that

manufactures formed steel subassemblies for other manufacturers. Mr Hadi is planning the

audit and is considering an appropriate amount for overall financial statement materiality to be

$ of its total asset As a result, and after considering the inherent risks associated with

AlQahtanis account receivables, AlSalman has decided to allocate to the account receivables

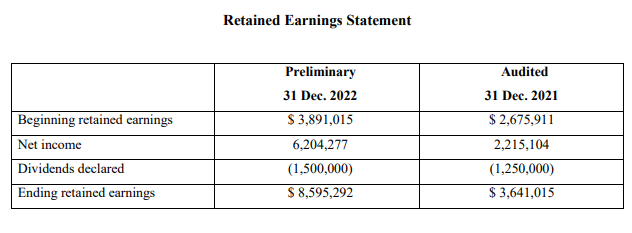

of AlQahtani Holding Group business as a tolerable misstatement rate. A summary of the financial

statement's information is shown below the case.

Additional relevant planning information is summarized;

AlQahtani Group has been a client for years, and Mr Hadi firm has always had a good

relationship with the company. Management and the accounting people have always been

cooperative, honest, and positive about the audit and financial reporting. No material

misstatements were found in the prior years audits. ALSalmans firm has monitored the

relationship carefully, because when the audit was obtained, Abdullah Alqahtani, the CEO, had

the reputation of being a highflyer and had been through bankruptcy at an earlier time in his

career.

Mr Abdullah is a controlling manager who makes all the decisions himself. He gives his

employees responsibility, but he doesn't give them enough authority.

The industry in which AlQahtani Holding Group participates has been in a favorable cycle for

the past years, and that trend is continuing in the current year. Industry profits are reasonably

favorable, and there are no competitive or other apparent threats on the horizon.

Kingdom of Saudi Arabia

Ministry of Education

Imam Abdulrahman Bin Faisal University

College of Business Administration

Department of Accounting

Group Project

Internal controls for AlQahtani Holding Group are evaluated as reasonably effective for all

cycles but not strong. Although the clint supports the idea of control, Mr Hadi has been

disappointed that management has continually rejected his recommendation to improve its

internal audit function.

AlQahtani Holding Group has a contract with its employees that if earnings before taxes,

interest expense, and pension cost exceed $ million for the year, an additional contribution

must be made to the pension fund equal to of the excess.Income Statement

tabletablePreliminary Dec. tableAudited Dec. Sales$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Analysis Insights from the Case Study 1 Overall Financial Statement Materiality Materiality Amount 899018 Percentage of Total Assets 5 This amount is ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock