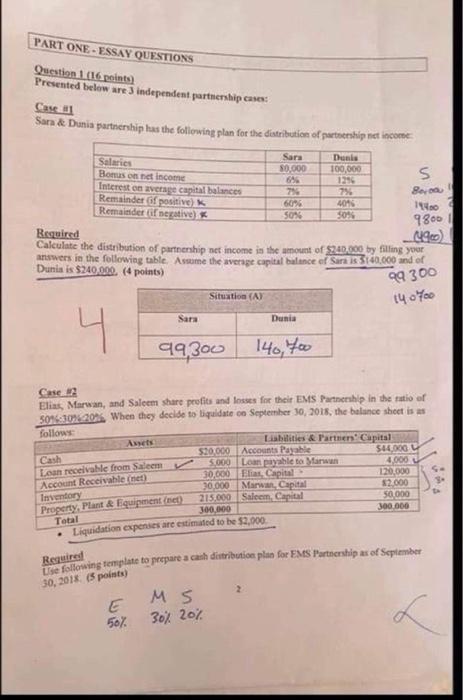

Question: . PART ONE - ESSAY QUESTIONS Question 1 (16 points) Presented below are 3 independent partnership case Case 1 Sara & Dunia partnership has the

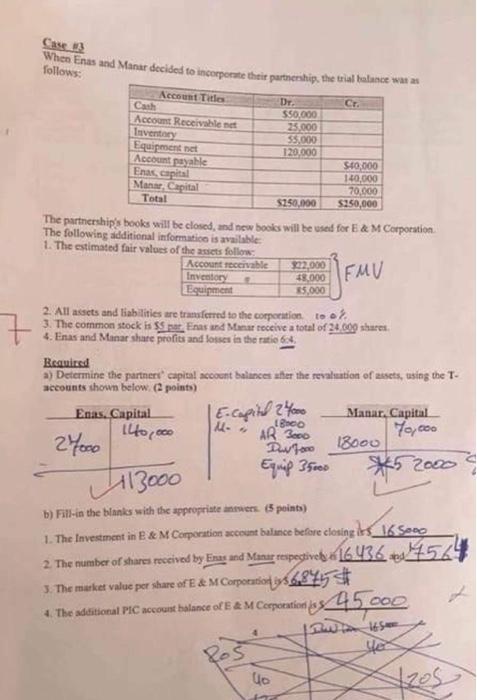

PART ONE - ESSAY QUESTIONS Question 1 (16 points) Presented below are 3 independent partnership case Case 1 Sara & Dunia partnership has the following plan for the distribution of partnership net income Sara Dunia Salaries 80.000 Bonus on net income 100,000 S 1296 Interest on average capital balances By Reminder positive 60% 4018 19 Remainder if negative) 50% 50% 9800 Required 090 Calculate the distribution of partnership net income in the amount of $240.000 by filling your answers in the following table. Assime the average capital balance of Sarais 3140.000 and of Dunia is $240,000. (4 points) Situation (A) Sara Dunia 99 300 1400 4 919300 140, too Case Elins, Marwan, and Saleem share profits and losses for their EMS Partnership in the ratio ar Son3076 20% When they decide to liquidate on September 10, 2018, the balance sheet is us follows Arts Liabilities & Partners Capital $20,000 Cash Accounts Payable 544.000 5000 Lo receive from Saleem Loanable to Maran 4.000 30.000 El Capital 120.000 30.000 Marwan, Capital $2.000 Inventory 215.000 Salcem Capital 50.000 300.000 300.000 Liquidation expenses are estimated to be 2,000 Account Receivable net) Property, Plant & Equipment (net) Total Required Bse following template to prepare a cash distribution plan for EMS Partnership as of September 30, 2018 (5 points) s 56% 30% 20% Case 2 When Enes and Manar decided to incorporate their partnership, the trial balance was 28 follows: Account Titles DT Cash C. 550.000 Accot Receivable et 25.000 Teventary 55.000 Equipment net 120.000 Account payable $40,000 Enas, capital 140,000 Manar, Capital 70.000 Total $250,000 $150,000 The partnership's books will be closed, and new books will be used for E&M Corporation The following additional information is available: 1. The estimated fair values of the assets follow Account receivable $32,000 Inventory Equipment 35,000 2. All assets and liabilities are transferred to the corporation to 3. The common stock is sspor Fras and Manar receive a total of 24.600 shares 4. Enas and Manar share profits and losses in the ratio 6 Beauired a) Determine the partnert' capital account balances after the evaluation of musets, using the T- accounts shown below.points) Manar, Capital Enas. Capital 18 140,000 Yo.com AR 3000 Dur7000 18000 48.000 FMV E. capital 24000 27000 113000 Equip 35000 *520009 The closing bussens 2. The number of shares received by Emas and Manar espectives d 16436 4524 3. The market value per share of E&M Corporation $68455 Corporation as 45.000 b) Fill in the blanks with the appropriate ses 15 points) 4. The additional PIC account balance of E&M 15 ye 805 Uo 7205 PART ONE - ESSAY QUESTIONS Question 1 (16 points) Presented below are 3 independent partnership case Case 1 Sara & Dunia partnership has the following plan for the distribution of partnership net income Sara Dunia Salaries 80.000 Bonus on net income 100,000 S 1296 Interest on average capital balances By Reminder positive 60% 4018 19 Remainder if negative) 50% 50% 9800 Required 090 Calculate the distribution of partnership net income in the amount of $240.000 by filling your answers in the following table. Assime the average capital balance of Sarais 3140.000 and of Dunia is $240,000. (4 points) Situation (A) Sara Dunia 99 300 1400 4 919300 140, too Case Elins, Marwan, and Saleem share profits and losses for their EMS Partnership in the ratio ar Son3076 20% When they decide to liquidate on September 10, 2018, the balance sheet is us follows Arts Liabilities & Partners Capital $20,000 Cash Accounts Payable 544.000 5000 Lo receive from Saleem Loanable to Maran 4.000 30.000 El Capital 120.000 30.000 Marwan, Capital $2.000 Inventory 215.000 Salcem Capital 50.000 300.000 300.000 Liquidation expenses are estimated to be 2,000 Account Receivable net) Property, Plant & Equipment (net) Total Required Bse following template to prepare a cash distribution plan for EMS Partnership as of September 30, 2018 (5 points) s 56% 30% 20% Case 2 When Enes and Manar decided to incorporate their partnership, the trial balance was 28 follows: Account Titles DT Cash C. 550.000 Accot Receivable et 25.000 Teventary 55.000 Equipment net 120.000 Account payable $40,000 Enas, capital 140,000 Manar, Capital 70.000 Total $250,000 $150,000 The partnership's books will be closed, and new books will be used for E&M Corporation The following additional information is available: 1. The estimated fair values of the assets follow Account receivable $32,000 Inventory Equipment 35,000 2. All assets and liabilities are transferred to the corporation to 3. The common stock is sspor Fras and Manar receive a total of 24.600 shares 4. Enas and Manar share profits and losses in the ratio 6 Beauired a) Determine the partnert' capital account balances after the evaluation of musets, using the T- accounts shown below.points) Manar, Capital Enas. Capital 18 140,000 Yo.com AR 3000 Dur7000 18000 48.000 FMV E. capital 24000 27000 113000 Equip 35000 *520009 The closing bussens 2. The number of shares received by Emas and Manar espectives d 16436 4524 3. The market value per share of E&M Corporation $68455 Corporation as 45.000 b) Fill in the blanks with the appropriate ses 15 points) 4. The additional PIC account balance of E&M 15 ye 805 Uo 7205

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts