Question: Part One: Multiple Choice Questions (40 points) 1. Several building. And years ago, e , Tom purchased a structure for $300,000 tha's a certiftied historiceal

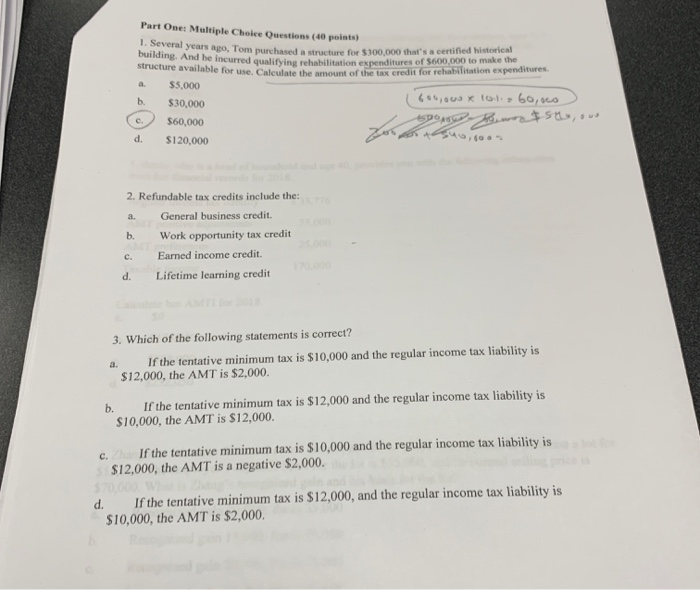

Part One: Multiple Choice Questions (40 points) 1. Several building. And years ago, e , Tom purchased a structure for $300,000 tha's a certiftied historiceal incurred qualifying rehabilitation expenditures of $600,000 to make the structure available for use. Calculate the amount of the tax a. $5,000 b $30,000 c S60.000 d. $120,000 credit for rehabilitation expenditures 2. Refundable tax credits include the: a General business credit. b. Work opportunity tax credit c. Eaned income credit. d. Lifetime learning credit 3. Which of the following statements is correct? a. If the tentative minimum tax is $10,000 and the regular income tax liability is $12,000, the AMT is $2,000. b. If the tentative minimum tax is $12,000 and the regular income tax liability is $10,000, the AMT is $12,000. c. If the tentative minimum tax is $10,000 and the regular income tax liability is $12,000, the AMT is a negative $2,000. d. If the tentative minimum tax is $12,000, and the regular income tax liability is $10,000, the AMT is $2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts