Question: Part one: Multiple-chole questions (8 points *3 - 24 points) Gary Wells Inc. plans to issue perpetual preferred stock with an annual of $8 per

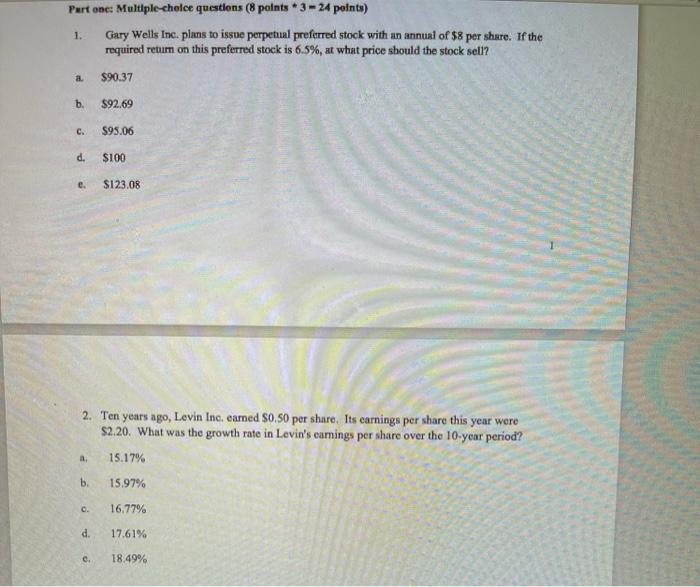

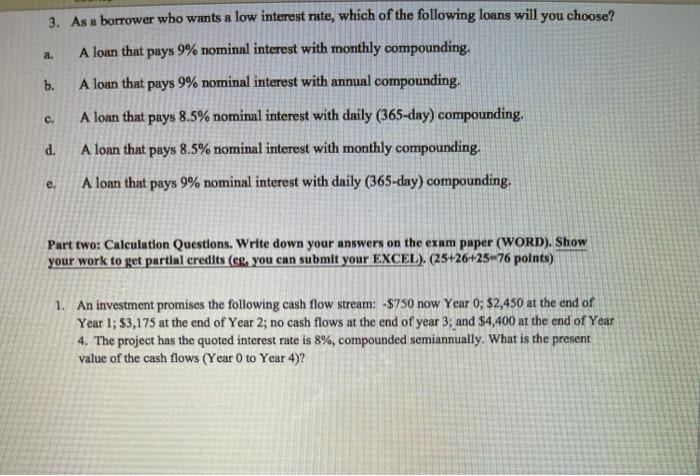

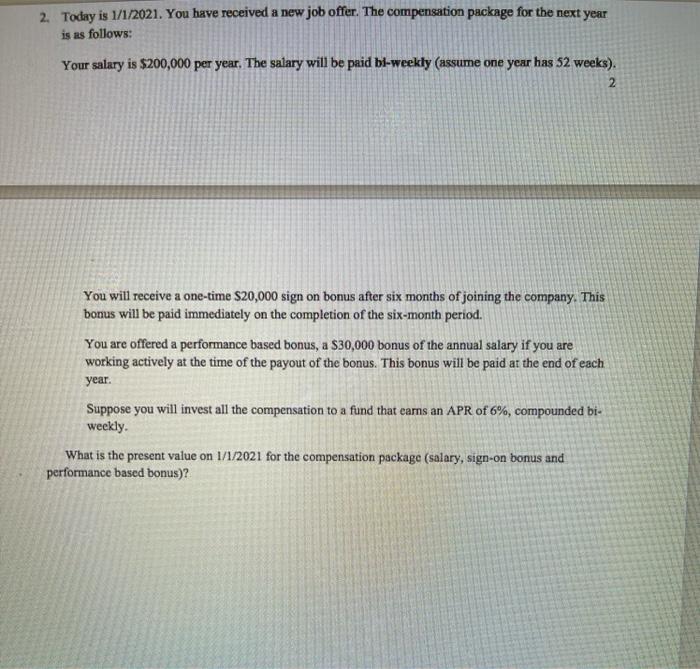

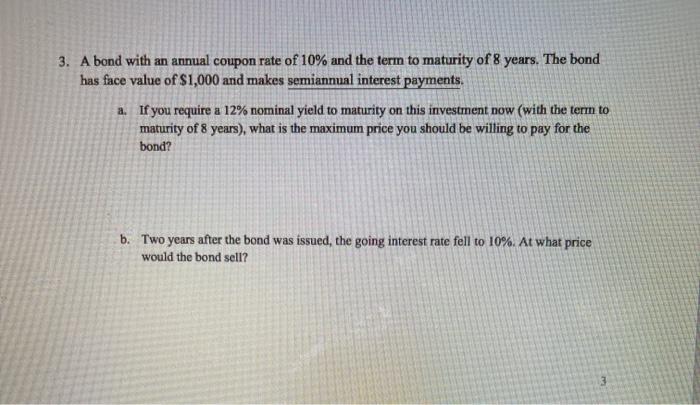

Part one: Multiple-chole questions (8 points *3 - 24 points) Gary Wells Inc. plans to issue perpetual preferred stock with an annual of $8 per share. If the required return on this preferred stock is 6,5%, at what price should the stock sell? 1. a. $90.37 b. S92.69 c. $95.06 d. $100 e. $123.08 2. Ten years ago, Levin Inc. camned $0.50 per share. Its earnings per share this year were $2.20. What was the growth rate in Levin's camings per share over the 10-year period? 15.17% b. 15.97% o. 16,77% d. 17.61% e. 18.49% 3. As a borrower who wants a low interest rate, which of the following loans will you choose? A loan that pays 9% nominal interest with monthly compounding, b. A loan that pays 9% nominal interest with annual compounding. a. c. d. A loan that pays 8.5% nominal interest with daily (365-day) compounding. A loan that pays 8.5% nominal interest with monthly compounding. A loan that pays 9% nominal interest with daily (365-day) compounding. e. Part two: Calculation Questions. Write down your answers on the exam paper (WORD). Show your work to get partial credits (eg, you can submit your EXCEL). (25+26+25 76 points) 1. An investment promises the following cash flow stream: - $750 now Year 0; $2,450 at the end of Year 1; 53,175 at the end of Year 2; no cash flows at the end of year 3; and $4,400 at the end of Year 4. The project has the quoted interest rate is 8%, compounded semiannually. What is the present value of the cash flows (Year Oto Year 4)? 2. Today is 1/1/2021. You have received a new job offer. The compensation package for the next year is as follows: Your salary is $200,000 per year. The salary will be paid bi-weekly (assume one year has 52 weeks). 2 You will receive a one-time $20,000 sign on bonus after six months of joining the company. This bonus will be paid immediately on the completion of the six-month period. You are offered a performance based bonus, a $30,000 bonus of the annual salary if you are working actively at the time of the payout of the bonus. This bonus will be paid at the end of each year. Suppose you will invest all the compensation to a fund that cams an APR of 6%, compounded bi- weekly. What is the present value on 1/1/2021 for the compensation package (salary, sign-on bonus and performance based bonus)? 3. A bond with an annual coupon rate of 10% and the term to maturity of 8 years. The bond has face value of $1,000 and makes semiannual interest payments. a. If you require a 12% nominal yield to maturity on this investment now (with the term to maturity of 8 years), what is the maximum price you should be willing to pay for the bond? b. Two years after the bond was issued, the going interest rate fell to 10%. At what price would the bond sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts