Question: Part One: Tax Return Complete a downloaded Form 1120 from the IRS website (irs.gov). To locate this form, type Form 1120 in the search bar

Part One: Tax Return

Complete a downloaded Form 1120 from the IRS website (irs.gov). To locate this form, type "Form 1120" in the search bar at the top of the webpage. Be sure to incorporate any feedback from Project One Milestone into your work for Project One.

Specifically, you must address the following:

- Complete Part One of Form 1120 with no errors. Include the following sections of the form in your response:

- Income

- Deductions

- Tax, Refundable Credits, and Payments

- Prepare Part Two of Form 1120 with no errors. Include the following sections of the form in your response:

- Schedule C

- Schedule J

- Schedule K

- Prepare Part Three of Form 1120 with no errors. Include the following sections of the form in your response:

- Schedule L

- Schedules M-1 and M-2

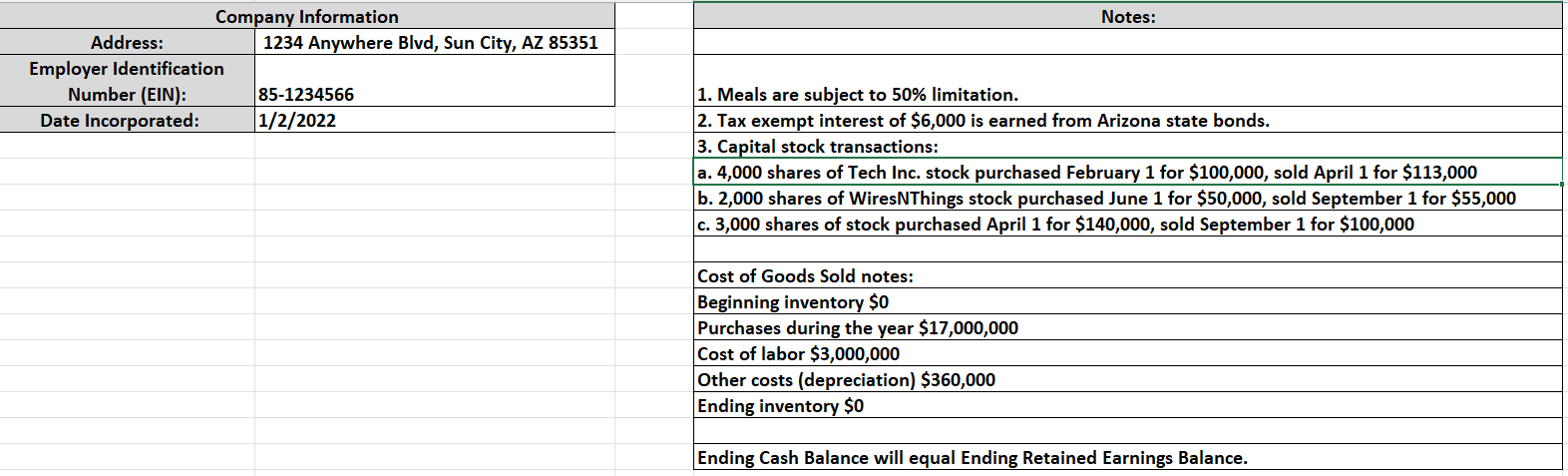

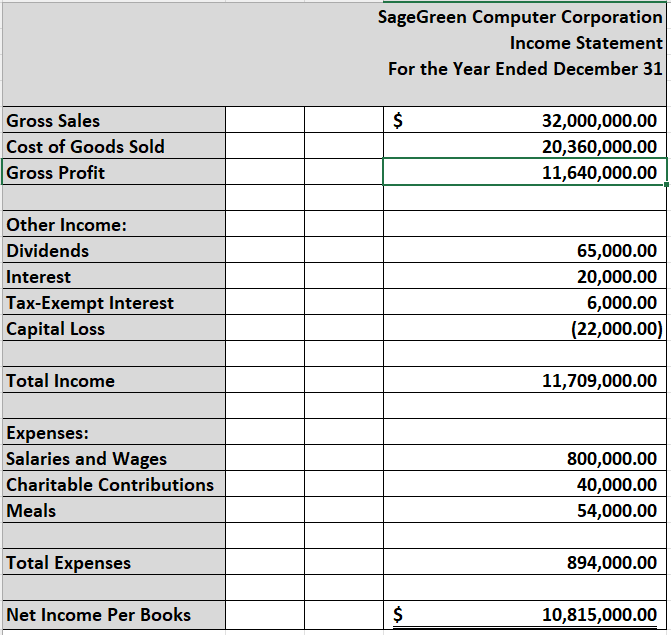

Company Information Notes: Address: 1234 Anywhere Blvd, Sun City, AZ 85351 Employer Identification Number (EIN): 85-1234566 1. Meals are subject to 50% limitation. Date Incorporated: 1/2/2022 2. Tax exempt interest of $6,000 is earned from Arizona state bonds. 3. Capital stock transactions: a. 4,000 shares of Tech Inc. stock purchased February 1 for $100,000, sold April 1 for $113,000 b. 2,000 shares of WiresNThings stock purchased June 1 for $50,000, sold September 1 for $55,000 c. 3,000 shares of stock purchased April 1 for $140,000, sold September 1 for $100,000 Cost of Goods Sold notes: Beginning inventory 50 Purchases during the year $17,000,000 Cost of labor $3,000,000 Other costs (depreciation) $360,000 Ending inventory S0 Ending Cash Balance will equal Ending Retained Earnings Balance. Gross Sales Cost of Goods Sold Other Income: Dividends Interest Tax-Exempt Interest Capital Loss SageGreen Computer Corporation Income Statement For the Year Ended December 31 S 32,000,000.00 20,360,000.00 11,640,000.00 Total Income 11,709,000.00 Expenses: Salaries and Wages 800,000.00 Charitable Contributions 40,000.00 Meals 54,000.00 Total Expenses 894,000.00 Net Income Per Books 10,815,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts