Question: PART TWO (7 marks) (Each question carries one mark) Indicate if the following statements are true or false. 1. No depreciation can be recorded in

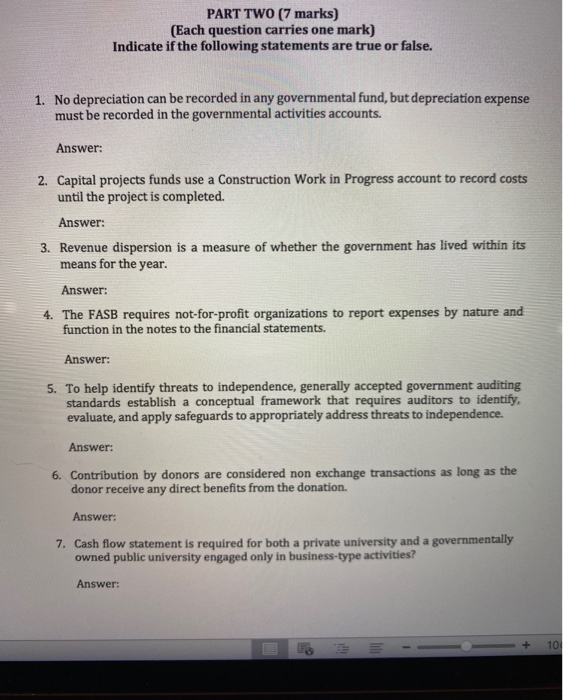

PART TWO (7 marks) (Each question carries one mark) Indicate if the following statements are true or false. 1. No depreciation can be recorded in any governmental fund, but depreciation expense must be recorded in the governmental activities accounts. Answer: 2. Capital projects funds use a Construction Work in Progress account to record costs until the project is completed. Answer: 3. Revenue dispersion is a measure of whether the government has lived within its means for the year. Answer: 4. The FASB requires not-for-profit organizations to report expenses by nature and function in the notes to the financial statements. Answer: 5. To help identify threats to independence, generally accepted government auditing standards establish a conceptual framework that requires auditors to identify, evaluate, and apply safeguards to appropriately address threats to independence. Answer: 6. Contribution by donors are considered non exchange transactions as long as the donor receive any direct benefits from the donation. Answer: 7. Cash flow statement is required for both a private university and a governmentally owned public university engaged only in business-type activities? Answer: 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts