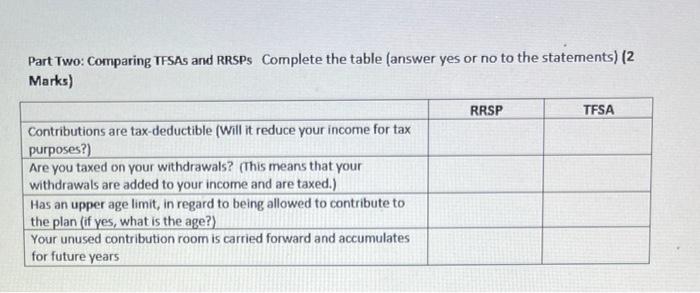

Question: Part Two: Comparing TFSAs and RRSPs Complete the table (answer yes or no to the statements) (2 Marks) RRSP TFSA Contributions are tax deductible (Will

Part Two: Comparing TFSAs and RRSPs Complete the table (answer yes or no to the statements) (2 Marks) RRSP TFSA Contributions are tax deductible (Will it reduce your income for tax purposes?) Are you taxed on your withdrawals? (This means that your withdrawals are added to your income and are taxed.) Has an upper age limit, in regard to being allowed to contribute to the plan (if yes, what is the age?) Your unused contribution room is carried forward and accumulates for future years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts