Question: PART TWO IS THE ONLY PART I NEED SOLVED Mid-Michigan Manufacturing Inc. (MMMI) wishes to determine whether it would be advisable to replace an existing

PART TWO IS THE ONLY PART I NEED SOLVED

Mid-Michigan Manufacturing Inc. (MMMI) wishes to determine whether it would be advisable to replace an existing production machine with a new one. The have hired your firm as a consultant to determine whether the new machine should be purchased. The data you will need is as follows:

- MMMI has decided to set a project timeline of 4 years.

- The new machine will cost $1,100,000. It will be depreciated (straight line) over a five-year period (its estimated useful life), assuming a salvage value of $100,000.

- The old machine, which has been fully depreciated, could be sold today for $253,165. The company has received a firm offer for the machine from Williamston Widgets, and will sell it only if they purchase the new machine.

- Additional Sales generated by the superior products made by the new machine would be $665,000 in Year 1. In Years 2 & 3 sales are projected to grow by 8.5% per year. However, in Year 4, sales are expected to decline by 5% as the market starts to become saturated.

- Total expenses have been estimated at 60.75% of Sales.

- The firm is in the 21% marginal tax bracket and requires a minimum return on the replacement decision of 9%.

- A representative from Stockbridge Sprockets has told MMMI that they will buy the machine from them at the end of the project (the end of Year 4) for $100,000. MMMI has decided to include this in the terminal value of the project.

- The project will require $100,000 in Net Working Capital, 54% of which will be recovered at the end of the project.

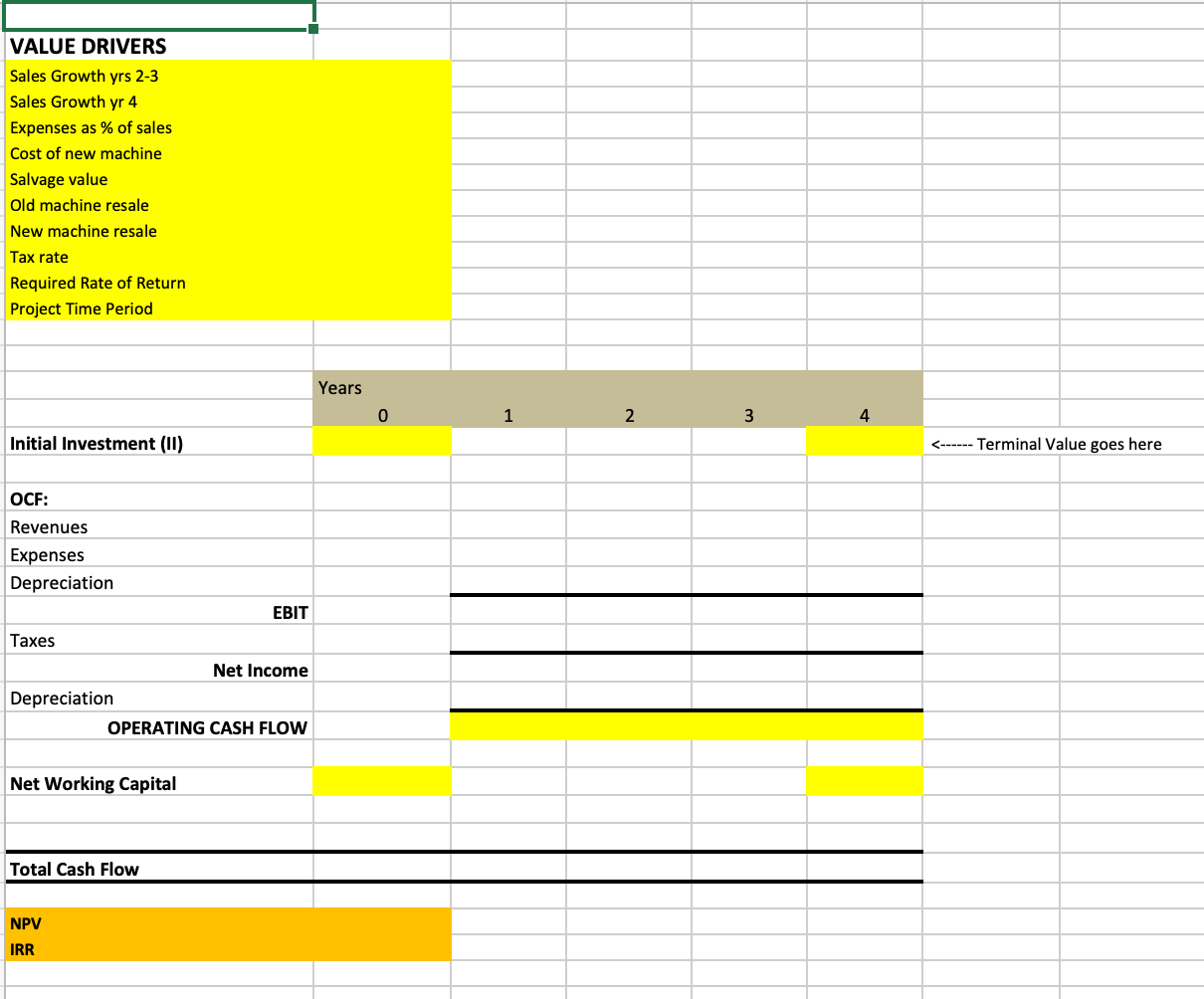

Build a DCF model using this template, and answer the questions using the results from the DCF analysis.

PT. 2

Perform scenario analysis on your Model based on the following:

Assume Sales Growth in Years 2 & 3 are 7% instead of 8.5% (Year 4s projections remain a sales decline of 5%). Also assume costs are 61.0% of sales instead of 60.75%.

**In this excel sheet I need to see-

What is the Year 2-4 Total Cash Flow?

What is the Year 3 Revenue?

NPV of the Project

RR of the project

VALUE DRIVERS Sales Growth yrs 2-3 Sales Growth yr 4 Expenses as % of sales Cost of new machine Salvage value Old machine resale New machine resale Tax rate Required Rate of Return Project Time Period Years - 3 4 Initial Investment (1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts