Question: Part1: Base Case Complete the DCF Model using the above data. Calculate NPV and IRR, and somewhere on the Base Case sheet state whether you

Part1: Base Case

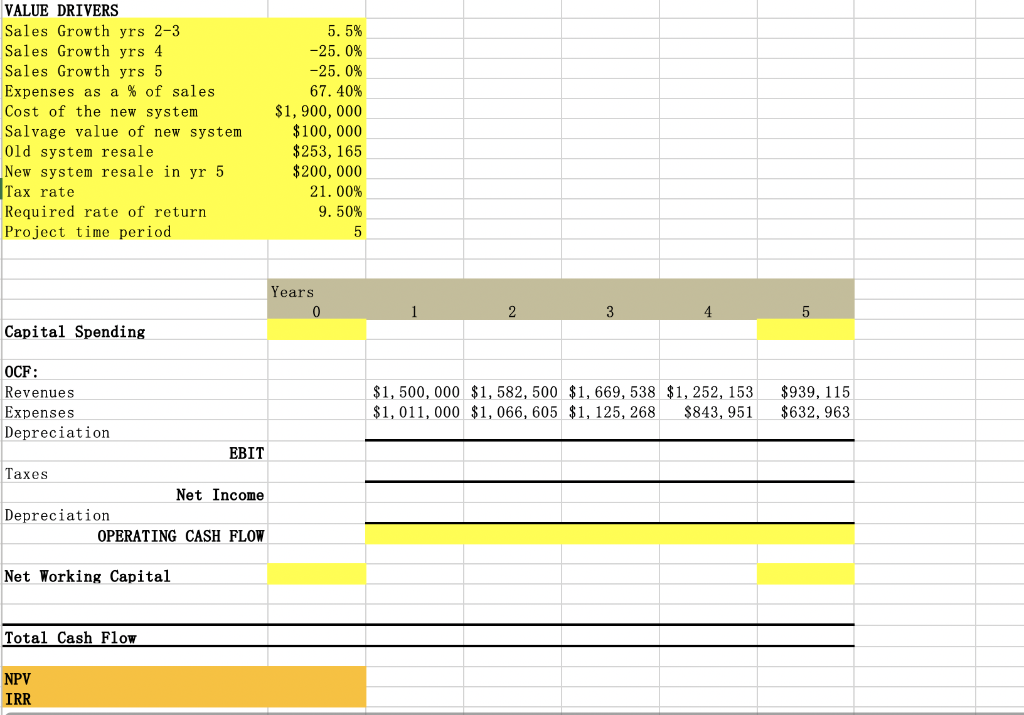

Complete the DCF Model using the above data. Calculate NPV and IRR, and somewhere on the Base Case sheet state whether you would accept or reject the project just on the base case data alone. Note: MMMI has estimated that there is a 55% chance that the base case will occur

Please do it in the excel and follow the format in the second pic and show the process if possible

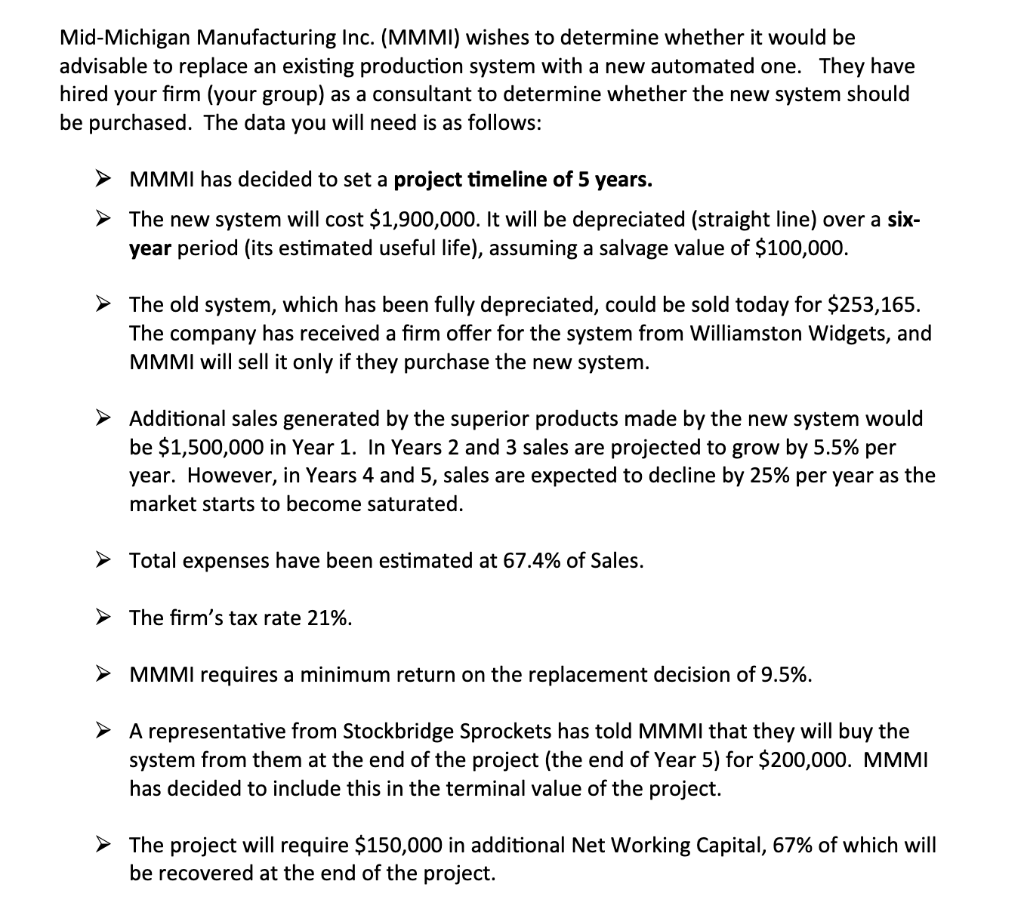

Mid-Michigan Manufacturing Inc. (MMMI) wishes to determine whether it would be advisable to replace an existing production system with a new automated one. They have hired your firm (your group) as a consultant to determine whether the new system should be purchased. The data you will need is as follows: MMMI has decided to set a project timeline of 5 years. The new system will cost $1,900,000. It will be depreciated (straight line) over a six- year period (its estimated useful life), assuming a salvage value of $100,000. > The old system, which has been fully depreciated, could be sold today for $253,165. The company has received a firm offer for the system from Williamston Widgets, and MMMI will sell it only if they purchase the new system. > Additional sales generated by the superior products made by the new system would be $1,500,000 in Year 1. In Years 2 and 3 sales are projected to grow by 5.5% per year. However, in Years 4 and 5, sales are expected to decline by 25% per year as the market starts to become saturated. Total expenses have been estimated at 67.4% of Sales. The firm's tax rate 21%. MMMI requires a minimum return on the replacement decision of 9.5%. > A representative from Stockbridge Sprockets has told MMMI that they will buy the system from them at the end of the project (the end of Year 5) for $200,000. MMMI has decided to include this in the terminal value of the project. The project will require $150,000 in additional Net Working Capital, 67% of which will be recovered at the end of the project. VALUE DRIVERS Sales Growth yrs 2-3 Sales Growth yrs 4 Sales Growth yrs 5 Expenses as a % of sales Cost of the new system Salvage value of new system old system resale New system resale in yr 5 Tax rate Required rate of return Project time period 5. 5% -25. 0% -25. 0% 67. 40% $1,900,000 $100,000 $253, 165 $200,000 21.00% 9. 50% 5 Years 0 1 2 3 5 Capital Spending $1,500,000 $1,582, 500 $1, 669, 538 $1, 252, 153 $1,011, 000 $1,066, 605 $1, 125, 268 $843, 951 $939, 115 $632, 963 OCF: Revenues Expenses Depreciation EBIT Taxes Net Income Depreciation OPERATING CASH FLOW Net Working Capital Total Cash Flow NPV IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts