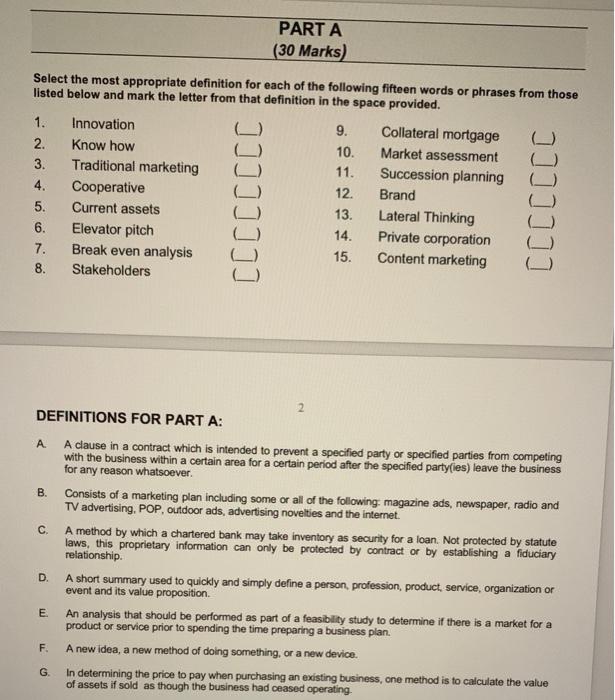

Question: PARTA (30 Marks) Select the most appropriate definition for each of the following fifteen words or phrases from those listed below and mark the letter

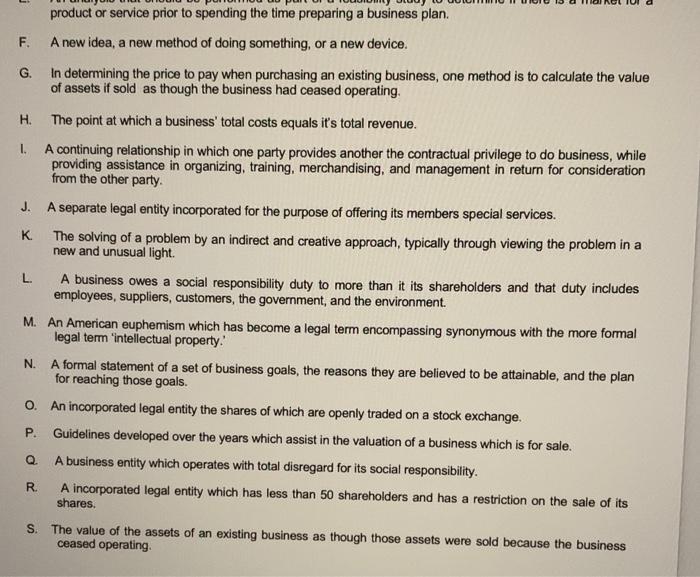

PARTA (30 Marks) Select the most appropriate definition for each of the following fifteen words or phrases from those listed below and mark the letter from that definition in the space provided. 1. Innovation 9. 2. 10. 3. Know how Traditional marketing Cooperative Current assets 11. 4. Collateral mortgage Market assessment Succession planning Brand Lateral Thinking Private corporation Content marketing 12 13. CCCCCCC 5. 6. 14. 7. Elevator pitch Break even analysis Stakeholders 15. 8. 2 DEFINITIONS FOR PART A: A A clause in a contract which is intended to prevent a specified party or specified parties from competing with the business within a certain area for a certain period after the specified party(ies) leave the business for any reason whatsoever. B. C Consists of a marketing plan including some or all of the following magazine ads, newspaper, radio and TV advertising. POP, outdoor ads, advertising novelties and the internet. A method by which a chartered bank may take inventory as Security for a loan. Not protected by statute laws, this proprietary information can only be protected by contract or by establishing a fiduciary relationship. D. D A short summary used to quickly and simply define a person, profession, product service, organization or event and its value proposition An analysis that should be performed as part of a feasibility study to determine if there is a market for a product or service prior to spending the time preparing a business plan. E F F. A new idea, a new method of doing something or a new device. G In determining the price to pay when purchasing an existing business, one method is to calculate the value of assets if sold as though the business had ceased operating product or service prior to spending the time preparing a business plan. F. A new idea, a new method of doing something, or a new device. G. In determining the price to pay when purchasing an existing business, one method is to calculate the value of assets if sold as though the business had ceased operating H The point at which a business' total costs equals it's total revenue. L. A continuing relationship in which one party provides another the contractual privilege to do business, while providing assistance in organizing, training, merchandising, and management in return for consideration from the other party. J. A separate legal entity incorporated for the purpose of offering its members special services. K The solving of a problem by an indirect and creative approach, typically through viewing the problem in a new and unusual light. L. A business owes a social responsibility duty to more than it its shareholders and that duty includes employees, suppliers, customers, the government, and the environment. M. An American euphemism which has become a legal term encompassing synonymous with the more formal legal term 'intellectual property. A formal statement of a set of business goals, the reasons they are believed to be attainable, and the plan for reaching those goals. N. 0. An incorporated legal entity the shares of which are openly traded on a stock exchange. P. Guidelines developed over the years which assist in the valuation of a business which is for sale. Q A business entity which operates with total disregard for its social responsibility. R A incorporated legal entity which has less than 50 shareholders and has a restriction on the sale of its shares. S. The value of the assets of an existing business as though those assets were sold because the business ceased operating