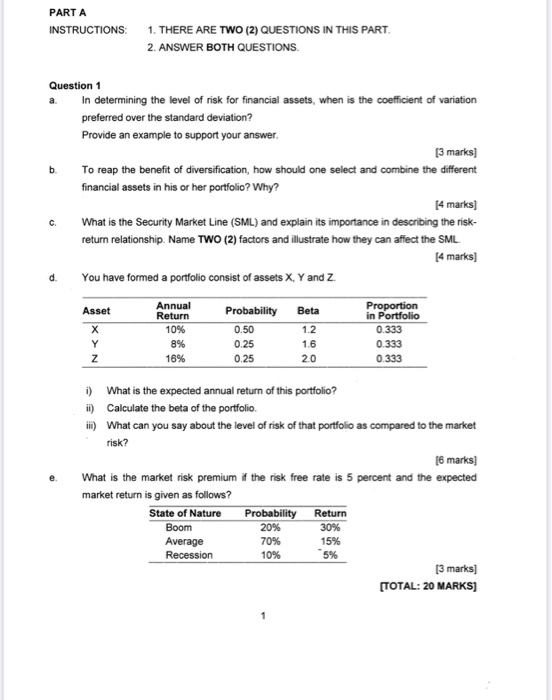

Question: PARTA INSTRUCTIONS: 1. THERE ARE TWO (2) QUESTIONS IN THIS PART 2. ANSWER BOTH QUESTIONS Question 1 In determining the level of risk for financial

PARTA INSTRUCTIONS: 1. THERE ARE TWO (2) QUESTIONS IN THIS PART 2. ANSWER BOTH QUESTIONS Question 1 In determining the level of risk for financial assets, when is the coefficient of variation preferred over the standard deviation? Provide an example to support your answer. [3 marks) b. To reap the benefit of diversification, how should one select and combine the different financial assets in his or her portfolio? Why? [4 marks] c. What is the Security Market Line (SML) and explain its importance in describing the risk- return relationship. Name TWO (2) factors and illustrate how they can affect the SML [4 marks] You have formed a portfolio consist of assets X, Y and Z Asset Beta Annual Return 10% 8% 16% Probability 0.50 0.25 0 25 Proportion in Portfolio 0.333 0.333 0333 i) What is the expected annual return of this portfolio? ii) Calculate the beta of the portfolio i) What can you say about the level of risk of that portfolio as compared to the market risk? [6 marks] What is the market risk premium if the risk free rate is 5 percent and the expected market return is given as follows? State of Nature Probability Return Boom 20% 30% Average 70% 15% Recession 10% 5% [3 marks] [TOTAL: 20 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts