Question: Parte e Problem 1: Ekson Energy, Inc. (EKS) is an energy company with a market debt-to-equity ratio of 3. Suppose its current cost of debt

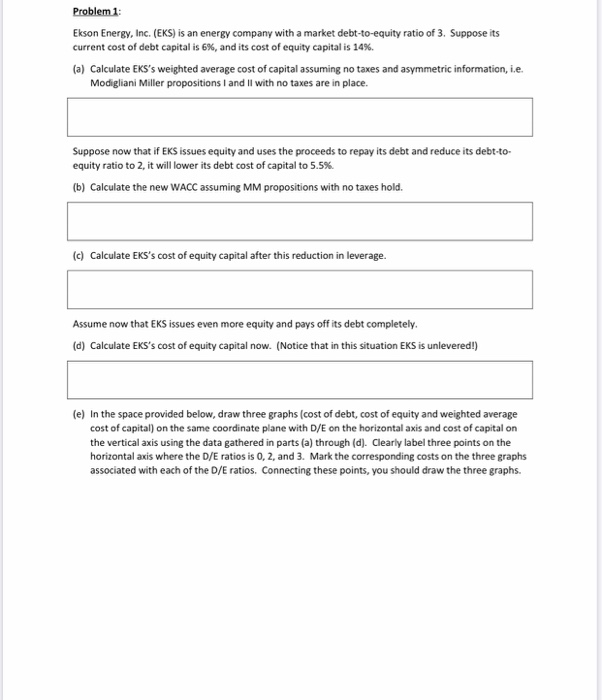

Problem 1: Ekson Energy, Inc. (EKS) is an energy company with a market debt-to-equity ratio of 3. Suppose its current cost of debt capital is 6%, and its cost of equity capital is 14%. (a) Calculate EKS's weighted average cost of capital assuming no taxes and asymmetric information, i.e. Modigliani Miller propositions and Il with no taxes are in place. Suppose now that if EKS issues equity and uses the proceeds to repay its debt and reduce its debt-to- equity ratio to 2, it will lower its debt cost of capital to 5.5% (b) Calculate the new WACC assuming MM propositions with no taxes hold. (c) Calculate EKS's cost of equity capital after this reduction in leverage. Assume now that EKS issues even more equity and pays off its debt completely. (d) Calculate Eks's cost of equity capital now. (Notice that in this situation EKS is unlevered!) (e) in the space provided below, draw three graphs (cost of debt, cost of equity and weighted average cost of capital) on the same coordinate plane with D/E on the horizontal axis and cost of capital on the vertical axis using the data gathered in parts (a) through (d). Clearly label three points on the horizontal axis where the D/E ratios is 0, 2, and 3. Mark the corresponding costs on the three graphs associated with each of the D/E ratios. Connecting these points, you should draw the three graphs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts