Question: Partial Answer need correction : Hill Industries had sales in 2019 of $6,960,000 and gross profit of $1,126,000. Management is considering two alternative budget plans

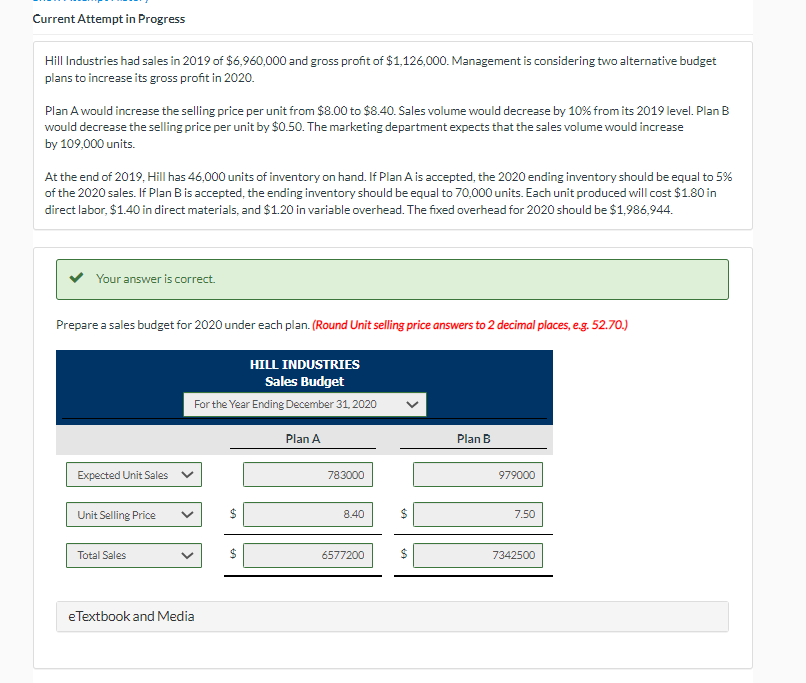

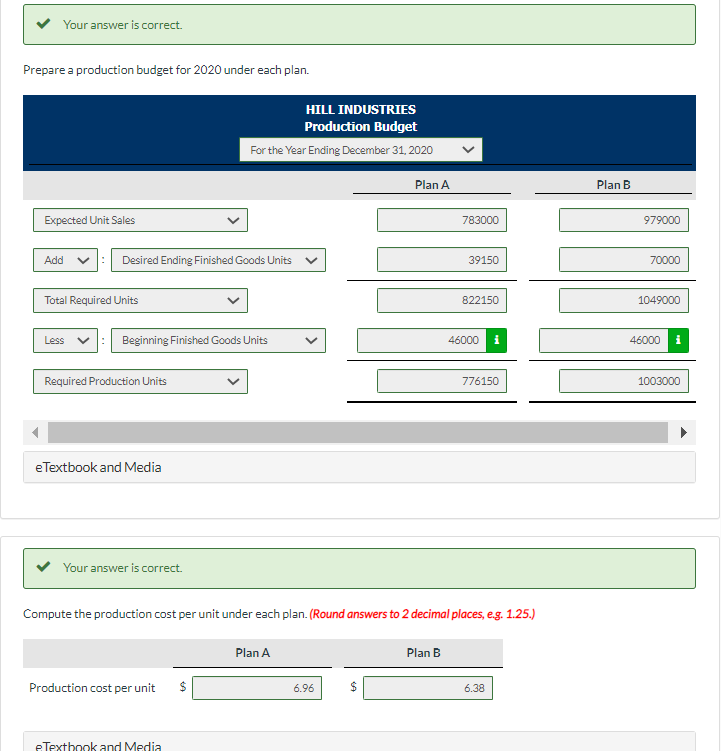

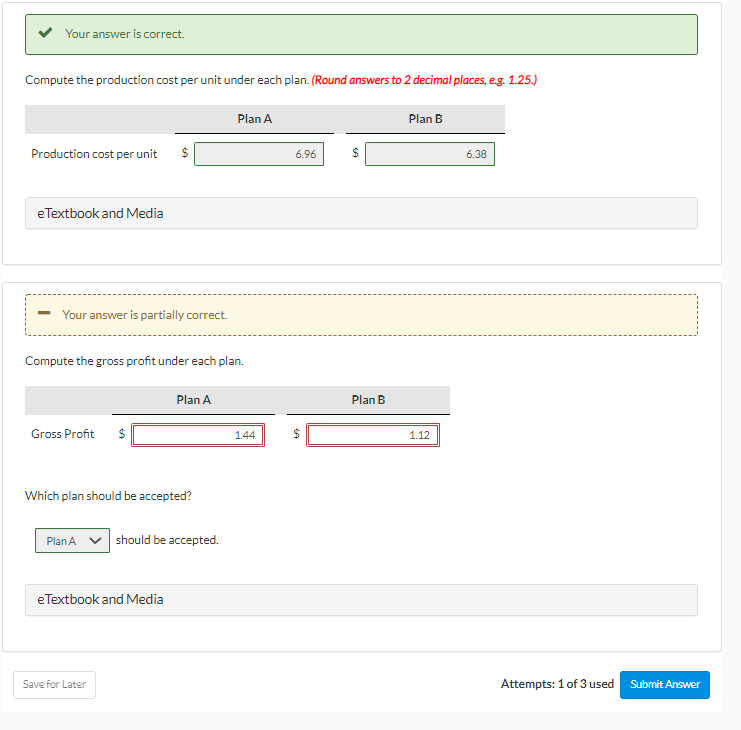

Partial Answer need correction : Hill Industries had sales in 2019 of $6,960,000 and gross profit of $1,126,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2019 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 109,000 units. At the end of 2019, Hill has 46,000 units of inventory on hand. If Plan A is accepted, the 2020 ending inventory should be equal to 5% of the 2020 sales. If Plan B is accepted, the ending inventory should be equal to 70,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2020 should be $1,986,944.

Partial Answer need correction : Hill Industries had sales in 2019 of $6,960,000 and gross profit of $1,126,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2019 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 109,000 units. At the end of 2019, Hill has 46,000 units of inventory on hand. If Plan A is accepted, the 2020 ending inventory should be equal to 5% of the 2020 sales. If Plan B is accepted, the ending inventory should be equal to 70,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2020 should be $1,986,944.

Hill Industries had sales in 2019 of $6,960,000 and gross profit of $1,126,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2019 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 109,000 units. At the end of 2019, Hill has 46,000 units of inventory on hand. If Plan A is accepted, the 2020 ending inventory should be equal to 5% of the 2020 sales. If Plan B is accepted, the ending inventory should be equal to 70,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2020 should be $1,986,944. Your answer is correct. Prepare a sales budget for 2020 under each plan. (Round Unit selling price answers to 2 decimal places, e.g. 52.70.) Your answer is correct. Prepare a production budget for 2020 under each plan. HILL INDUSTRIES Production Budget For the Year Ending December 31, 2020 Plan A Plan B Expected Unit Sales v 783000 979000 Add : Desired Ending Finished Goods Total Required Units \begin{tabular}{|} \hline 39150 \\ \hline 822150 \\ \hline \end{tabular} \( \frac{70000}{\hline 1049000} \) Less V: Beginning Finished Goods Units \begin{tabular}{|l|l|} \hline 46000i \\ \hline \end{tabular} \( \frac{46000 \quad 1}{\hline 1003000} \) eTextbook and Media Your answer is correct. Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.) Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.) eTextbook and Media - Your answer is partially correct. Compute the gross profit under each plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts