Question: PARTIAL CREDIT--You must use Excel equations and functions (20 pts) Seb is planning to retire in 35 years. Currently, he has $50,000 in his retirement

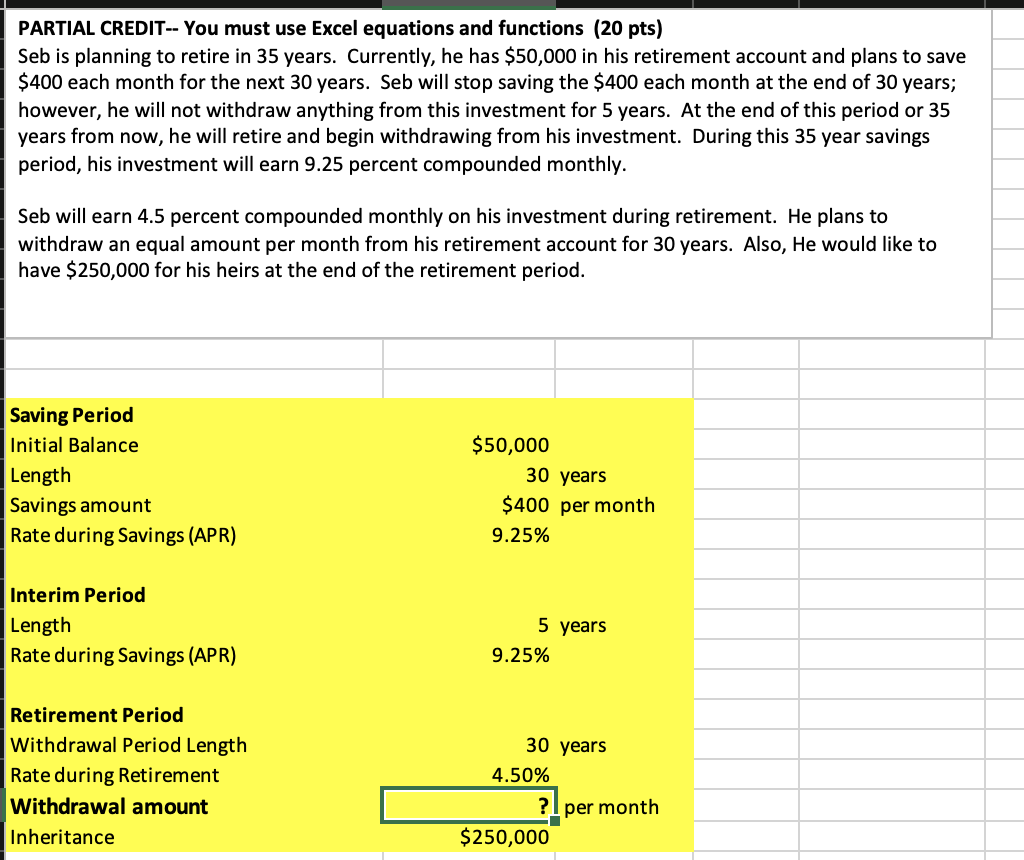

PARTIAL CREDIT--You must use Excel equations and functions (20 pts) Seb is planning to retire in 35 years. Currently, he has $50,000 in his retirement account and plans to save $400 each month for the next 30 years. Seb will stop saving the $400 each month at the end of 30 years; however, he will not withdraw anything from this investment for 5 years. At the end of this period or 35 years from now, he will retire and begin withdrawing from his investment. During this 35 year savings period, his investment will earn 9.25 percent compounded monthly. Seb will earn 4.5 percent compounded monthly on his investment during retirement. He plans to withdraw an equal amount per month from his retirement account for 30 years. Also, He would like to have $250,000 for his heirs at the end of the retirement period. $50,000 Saving Period Initial Balance Length Savings amount Rate during Savings (APR) 30 years $400 per month 9.25% Interim Period Length Rate during Savings (APR) 5 years 9.25% Retirement Period Withdrawal Period Length Rate during Retirement Withdrawal amount Inheritance 30 years 4.50% ? I per month $250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts