Question: Partial Question 2 0.43 / 1 pts Assume that you are the CFO at Porter Memorial Hospital. The CEO has asked you to analyze two

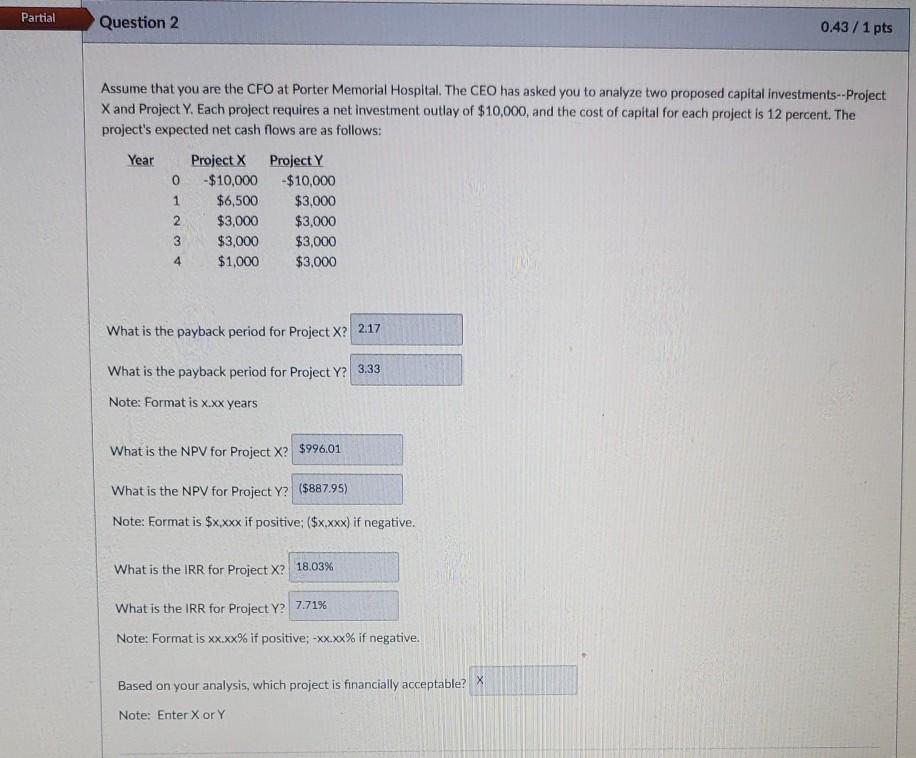

Partial Question 2 0.43 / 1 pts Assume that you are the CFO at Porter Memorial Hospital. The CEO has asked you to analyze two proposed capital investments--Project X and Project Y. Each project requires a net investment outlay of $10,000, and the cost of capital for each project is 12 percent. The project's expected net cash flows are as follows: Year Project X Project Y 0 -$10,000 -$10,000 $6,500 $3,000 2 $3,000 $3,000 3 $3,000 $3,000 $1,000 $3,000 4 What is the payback period for Project X? 2.17 What is the payback period for Project Y? 3.33 Note: Format is x.xx years What is the NPV for Project X? $996.01 What is the NPV for Project Y? ($887.95) Note: Format is $x.xxx if positive: ($x.xxx) if negative. What is the IRR for Project X? 18.03% What is the IRR for Project Y? 771% Note: Format is xx.xx% if positive; -xx.xx% if negative. Based on your analysis, which project is financially acceptable? X Note: Enter X or Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts