Question: Partial solution: what is the amount ($) that goes with the I+$ set up for this type of NPV break-even analysis? The equipment will be

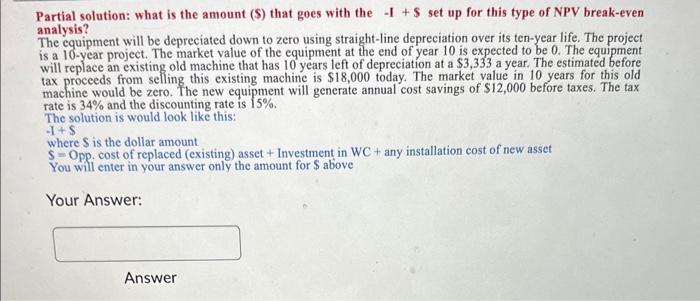

Partial solution: what is the amount (\$) that goes with the I+$ set up for this type of NPV break-even analysis? The equipment will be depreciated down to zero using straight-line depreciation over its ten-year life. The project is a 10-year project. The market value of the equipment at the end of year 10 is expected to be 0 . The equipment will replace an existing old machine that has 10 years left of depreciation at a \$3,333 a year. The estimated before tax proceeds from selling this existing machine is $18,000 today. The market value in 10 years for this old machine would be zero. The new equipment will generate annual cost savings of $12,000 before taxes. The tax rate is 34% and the discounting rate is 15%. The solution is would look like this: 1+$ where S is the dollar amount S= Opp. cost of replaced (existing) asset + Investment in WC+ any installation cost of new asset You will enter in your answer only the amount for $ above Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts