Question: Partial Work Sheet for Williams Mechanic Services shows the Trial Balance, Adjustments, and Adjusted Trial Balance sections. Each section has two columns - Debit and

Partial Work Sheet for Williams Mechanic Services shows the Trial Balance, Adjustments, and Adjusted Trial Balance sections. Each section has two columns Debit and Credit. All values are in dollars. The items listed in the Debit column of the Trial Balance are: Cash: Accounts Receivable: Supplies: Prepaid Insurance: Equipment: Truck: J Williams, Drawing: Salary Expense: Advertising Expense: Truck Operating Expense: Utilities Expense: Miscellaneous Expense: followed by single underscore The total of the Debit column double underlined is shown as $ The items listed in the Credit column of the Trial Balance are: Accumulated Depreciation, Equipment: Accumulated Depreciation, Truck: Accounts Payable: J Williams Capital: Fees earned:followed by single underscore The total of the Credit Column double underlined is shown as $ The items listed in the Debit column of Adjustments are: Salary Expense d: Insurance Expense a: Depreciation Expense, Equipment b: Depreciation Expense, Truck c: Supplies Expense e: followed by single underscore The total of the Debit column of Adjustments double underlined is The items listed in the Credit column of Adjustments are: Supplies e: Prepaid Insurance a: Accumulated Depreciation, Equipment b: Accumulated Depreciation, Truck c: Salaries Payable d: followed by single underscore The total of the Credit column of Adjustments double underlined is The items listed in the Debit column of the Adjusted Trial Balance are given below. Cash: Accounts Receivable: Supplies: Prepaid Insurance: Equipment: Truck: J Williams, Drawing: Salary Expense: Advertising Expense: Truck Operating Expense: Utilities Expense: Miscellaneous Expense: Insurance Expense: Depreciation Expense, Equipment: Depreciation Expense, Truck: Supplies Expense: followed by single underscore The total of the Debit column double underlined is shown as $ The items listed in the Credit column of the Adjusted Trial Balance are given below. Accumulated Depreciation, Equipment: Accumulated Depreciation, Truck: Accounts Payable: J Williams, Capital: Fees earned: Salaries Payable: followed by single underscore The total of the Credit column double underlined is shown as $

Can someone help me for posttrial closing balance?

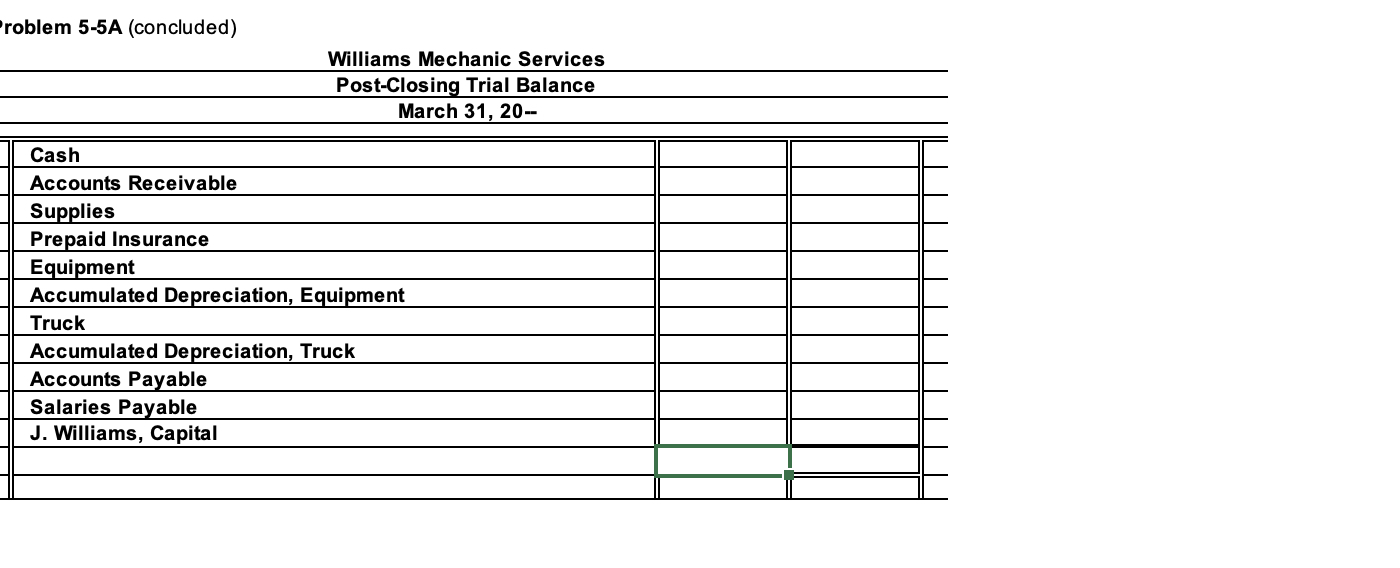

roblem A concluded

Williams Mechanic Services

PostClosing Trial Balance

March

tableCashAccounts Receivable,SuppliesPrepaid Insurance,EquipmentAccumulated Depreciation, Equipment,TruckAccumulated Depreciation, Truck,Accounts Payable,Salaries Payable,J Williams, Capital,

LO

Williams Mechanid Services

prepared the following work sheet

for the year ended March

tableABCDEFGWilliams Mechanic Services,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock