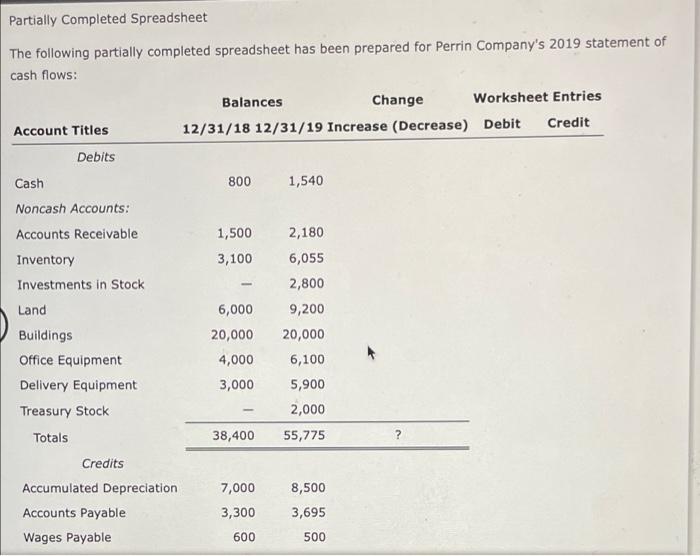

Question: Partially Completed Spreadsheet The following partially completed spreadsheet has been prepared for Perrin Company's 2019 statement of cash flows: Balances Change Worksheet Entries Account Titles

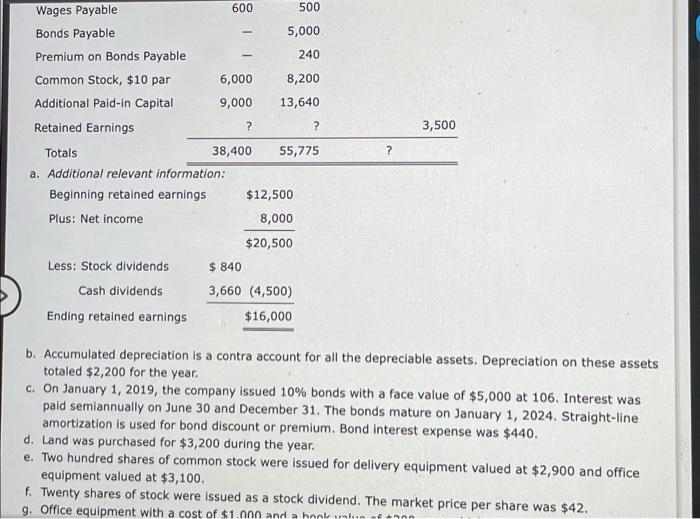

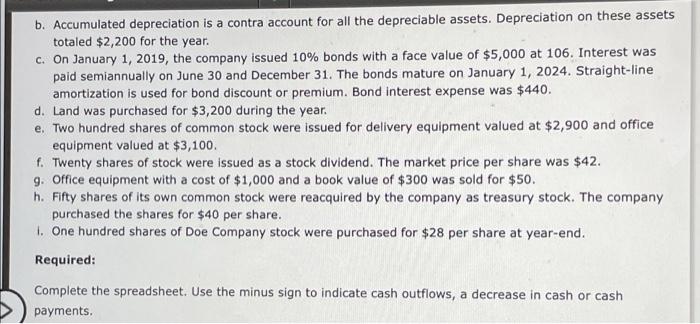

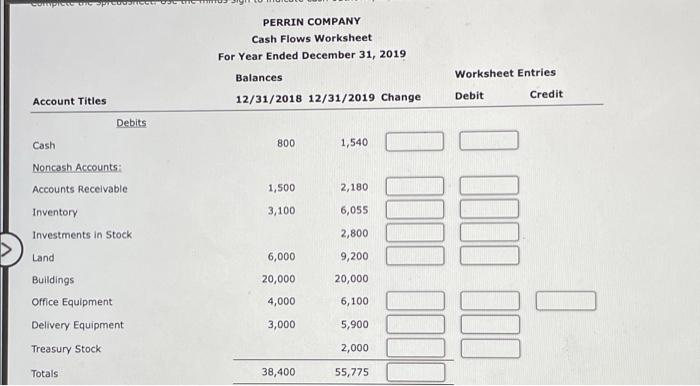

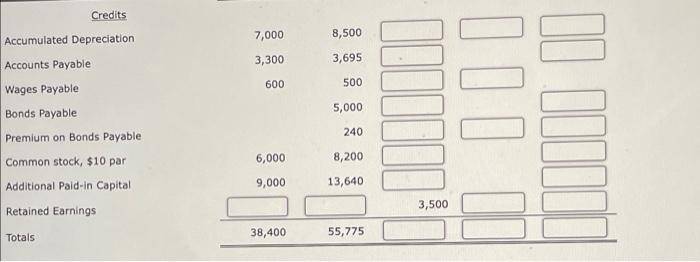

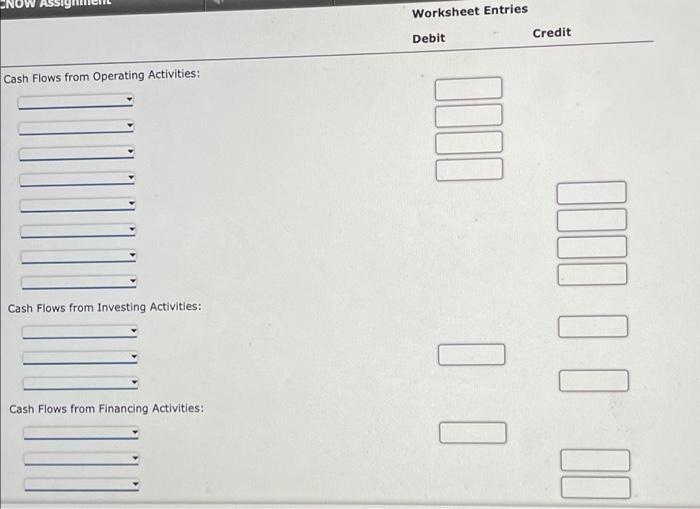

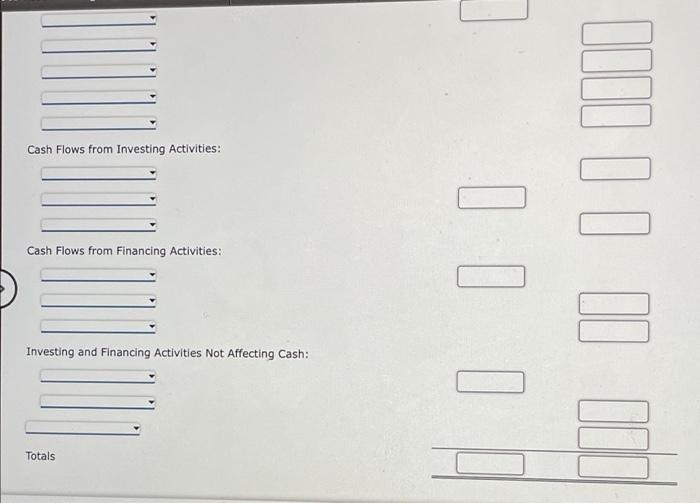

Partially Completed Spreadsheet The following partially completed spreadsheet has been prepared for Perrin Company's 2019 statement of cash flows: Balances Change Worksheet Entries Account Titles 12/31/18 12/31/19 Increase (Decrease) Debit Credit Debits Cash 800 1,540 1,500 3,100 2,180 6,055 2,800 9,200 20,000 6,100 Noncash Accounts: Accounts Receivable Inventory Investments in Stock Land Buildings Office Equipment Delivery Equipment Treasury Stock Totals Credits Accumulated Depreciation Accounts Payable Wages Payable 6,000 20,000 4,000 3,000 5,900 2,000 38,400 55,775 7,000 3,300 8,500 3,695 600 500 3,500 ? Wages Payable 600 500 Bonds Payable 5,000 Premium on Bonds Payable 240 Common Stock, $10 par 6,000 8,200 Additional Paid-in Capital 9,000 13,640 Retained Earnings ? ? Totals 38,400 55,775 a. Additional relevant information: Beginning retained earnings $12,500 Plus: Net income 8,000 $20,500 Less: Stock dividends $ 840 Cash dividends 3,660 (4,500) Ending retained earnings $ 16,000 b. Accumulated depreciation is a contra account for all the depreciable assets. Depreciation on these assets totaled $2,200 for the year. c. On January 1, 2019, the company issued 10% bonds with a face value of $5,000 at 106. Interest was paid semiannually on June 30 and December 31. The bonds mature on January 1, 2024. Straight-line amortization is used for bond discount or premium. Bond interest expense was $440. d. Land was purchased for $3,200 during the year. e. Two hundred shares of common stock were issued for delivery equipment valued at $2,900 and office equipment valued at $3,100. f. Twenty shares of stock were issued as a stock dividend. The market price per share was $42. 9. Office equipment with a cost of $1.000 and a han set b. Accumulated depreciation is a contra account for all the depreciable assets. Depreciation on these assets totaled $2,200 for the year. c. On January 1, 2019, the company issued 10% bonds with a face value of $5,000 at 106. Interest was paid semiannually on June 30 and December 31. The bonds mature on January 1, 2024. Straight-line amortization is used for bond discount or premium. Bond interest expense was $440. d. Land was purchased for $3,200 during the year. e. Two hundred shares of common stock were issued for delivery equipment valued at $2,900 and office equipment valued at $3,100. f. Twenty shares of stock were issued as a stock dividend. The market price per share was $42. 9. Office equipment with a cost of $1,000 and a book value of $300 was sold for $50. h. Fifty shares of its own common stock were reacquired by the company as treasury stock. The company purchased the shares for $40 per share. 1. One hundred shares of Doe Company stock were purchased for $28 per share at year-end. Required: Complete the spreadsheet. Use the minus sign to indicate cash outflows, a decrease in cash or cash payments. COM PERRIN COMPANY Cash Flows Worksheet For Year Ended December 31, 2019 Balances Worksheet Entries Account Titles 12/31/2018 12/31/2019 Change Debit Credit Debits Cash 800 1,540 Noncash Accounts Accounts Receivable Inventory 1,500 2,180 3,100 6,055 Investments in Stock 2,800 Land 6,000 9,200 Illl lll 20,000 20,000 Buildings Office Equipment 4,000 6,100 Delivery Equipment 3,000 5,900 Treasury Stock 2,000 Totals 38,400 55,775 Credits 7,000 8,500 3,300 3,695 600 500 5,000 Accumulated Depreciation Accounts Payable Wages Payable Bonds Payable Premium on Bonds Payable Common stock, $10 par Additional Pald-in Capital Retained Earnings 10 240 6,000 8,200 9,000 13,640 3,500 Totals 38,400 55,775 Worksheet Entries Debit Credit Cash Flows from Operating Activities: 11 Cash Flows from Investing Activities: Il IIII II I Cash Flows from Financing Activities: Cash Flows from Investing Activities: III II II I 1 Cash Flows from Financing Activities: Investing and Financing Activities Not Affecting Cash: Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts