Question: Participating Notes (guide to study for Quiz over Chapter 6) Chap 6 Understand interest rates and how to use them to evaluate values! 4 (out

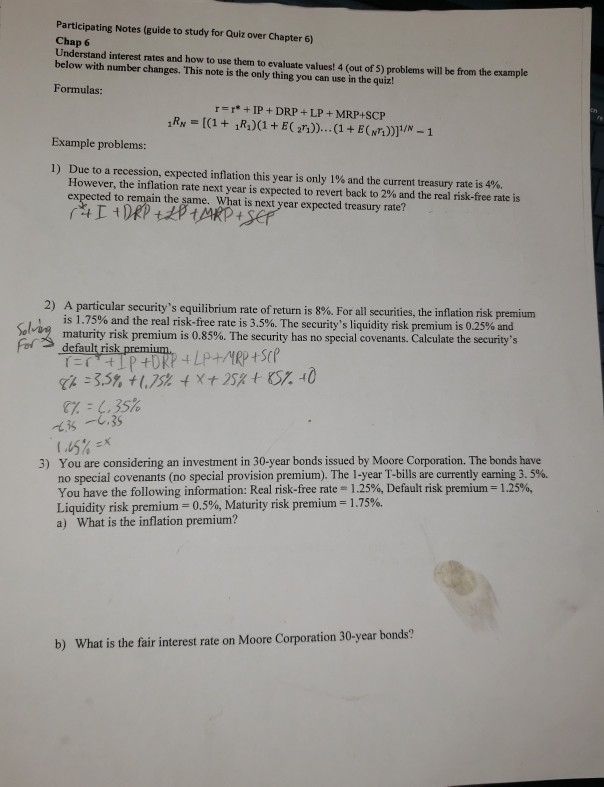

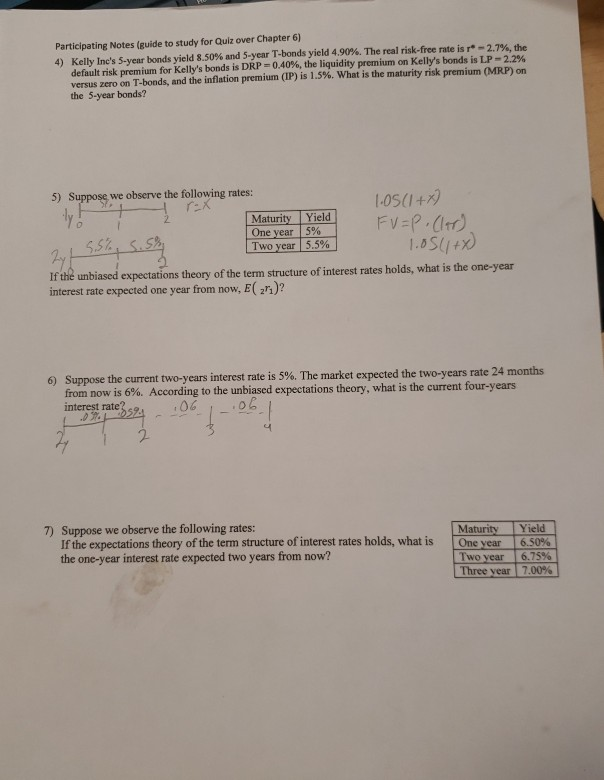

Participating Notes (guide to study for Quiz over Chapter 6) Chap 6 Understand interest rates and how to use them to evaluate values! 4 (out of 5) problems will be from the example below with number changes. This note is the only thing you can use in the quiz! Formulas: R r=r* + IP + DRP +LP+MRP+SCP = [(1 + R.)(1+E(27))...(1 + E( ))]/N - 1 Example problems: 1) Due to a recession, expected inflation this year is only 1% and the current treasury rate is 4%. However, the inflation rate next year is expected to revert back to 2% and the real risk-free rate is expected to remain the same. What is next year expected treasury rate? I + DRP+P + MRP + See You For 2) A particular security's equilibrium rate of return is 8%. For all securities, the inflation risk premium is 1.75% and the real risk-free rate is 3.5%. The security's liquidity risk premium is 0.25% and maturity risk premium is 0.85%. The security has no special covenants. Calculate the security's > default risk premium. = +IP +DRY +LP+RP+SIP 8% = 3.5% + 1.75% +x+ 25% + 85% +0 67. = 4.35% tis-6.35 1.15% * 3) You are considering an investment in 30-year bonds issued by Moore Corporation. The bonds have no special covenants (no special provision premium). The 1-year T-bills are currently earning 3.5%. You have the following information: Real risk-free rate - 1.25%, Default risk premium - 1.25%, Liquidity risk premium = 0.5%, Maturity risk premium - 1.75%. a) What is the inflation premium? b) What is the fair interest rate on Moore Corporation 30-year bonds? 4) Kelly Ine's Syemium for Kellys bonation premium Participating Notes (guide to study for Quit over Chapter 6) 4) Kelly Ine's S-year bonds yield 8.50% and 5-year T-bonds yield 4.90%. The real risk-free rate is re-2.7% the default risk premium for Kelly's bonds is DRP -0.40%, the liquidity premium on Kelly's bonds is LP-2.2% versus zero on T-bonds, and the inflation premium (IP) is 1.5%. What is the maturity risk premium (MRP) on the 5-year bonds? bonds is DRP -0 odsyield 4.90%. The the s ero on T-bonds, and 5) Suppose we observe the following rates: tyr -X 1.05 (1 + x) Maturity Yield FU=P, Clar) One year 5% Two year 5.5% 1.051+x) If the unbiased expectations theory of the term structure of interest rates holds, what is the one-year interest rate expected one year from now, E( 27 )? 241 55% S. 6) Suppose the current two years interest rate is 5%. The market expected the two-years rate 24 months from now is 6%. According to the unbiased expectations theory, what is the current four-years interest rates21- 7) Suppose we observe the following rates: If the expectations theory of the term structure of interest rates holds, what is the one-year interest rate expected two years from now? Maturity Yield One year 16 50% Two year 6.75% Three year 7.00% Participating Notes (guide to study for Quiz over Chapter 6) Chap 6 Understand interest rates and how to use them to evaluate values! 4 (out of 5) problems will be from the example below with number changes. This note is the only thing you can use in the quiz! Formulas: R r=r* + IP + DRP +LP+MRP+SCP = [(1 + R.)(1+E(27))...(1 + E( ))]/N - 1 Example problems: 1) Due to a recession, expected inflation this year is only 1% and the current treasury rate is 4%. However, the inflation rate next year is expected to revert back to 2% and the real risk-free rate is expected to remain the same. What is next year expected treasury rate? I + DRP+P + MRP + See You For 2) A particular security's equilibrium rate of return is 8%. For all securities, the inflation risk premium is 1.75% and the real risk-free rate is 3.5%. The security's liquidity risk premium is 0.25% and maturity risk premium is 0.85%. The security has no special covenants. Calculate the security's > default risk premium. = +IP +DRY +LP+RP+SIP 8% = 3.5% + 1.75% +x+ 25% + 85% +0 67. = 4.35% tis-6.35 1.15% * 3) You are considering an investment in 30-year bonds issued by Moore Corporation. The bonds have no special covenants (no special provision premium). The 1-year T-bills are currently earning 3.5%. You have the following information: Real risk-free rate - 1.25%, Default risk premium - 1.25%, Liquidity risk premium = 0.5%, Maturity risk premium - 1.75%. a) What is the inflation premium? b) What is the fair interest rate on Moore Corporation 30-year bonds? 4) Kelly Ine's Syemium for Kellys bonation premium Participating Notes (guide to study for Quit over Chapter 6) 4) Kelly Ine's S-year bonds yield 8.50% and 5-year T-bonds yield 4.90%. The real risk-free rate is re-2.7% the default risk premium for Kelly's bonds is DRP -0.40%, the liquidity premium on Kelly's bonds is LP-2.2% versus zero on T-bonds, and the inflation premium (IP) is 1.5%. What is the maturity risk premium (MRP) on the 5-year bonds? bonds is DRP -0 odsyield 4.90%. The the s ero on T-bonds, and 5) Suppose we observe the following rates: tyr -X 1.05 (1 + x) Maturity Yield FU=P, Clar) One year 5% Two year 5.5% 1.051+x) If the unbiased expectations theory of the term structure of interest rates holds, what is the one-year interest rate expected one year from now, E( 27 )? 241 55% S. 6) Suppose the current two years interest rate is 5%. The market expected the two-years rate 24 months from now is 6%. According to the unbiased expectations theory, what is the current four-years interest rates21- 7) Suppose we observe the following rates: If the expectations theory of the term structure of interest rates holds, what is the one-year interest rate expected two years from now? Maturity Yield One year 16 50% Two year 6.75% Three year 7.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts