Question: (Parts (a), (b) and (c) are separate so you cannot use information from one in any other.) 4. Suppose the capital asset pricing model holds.

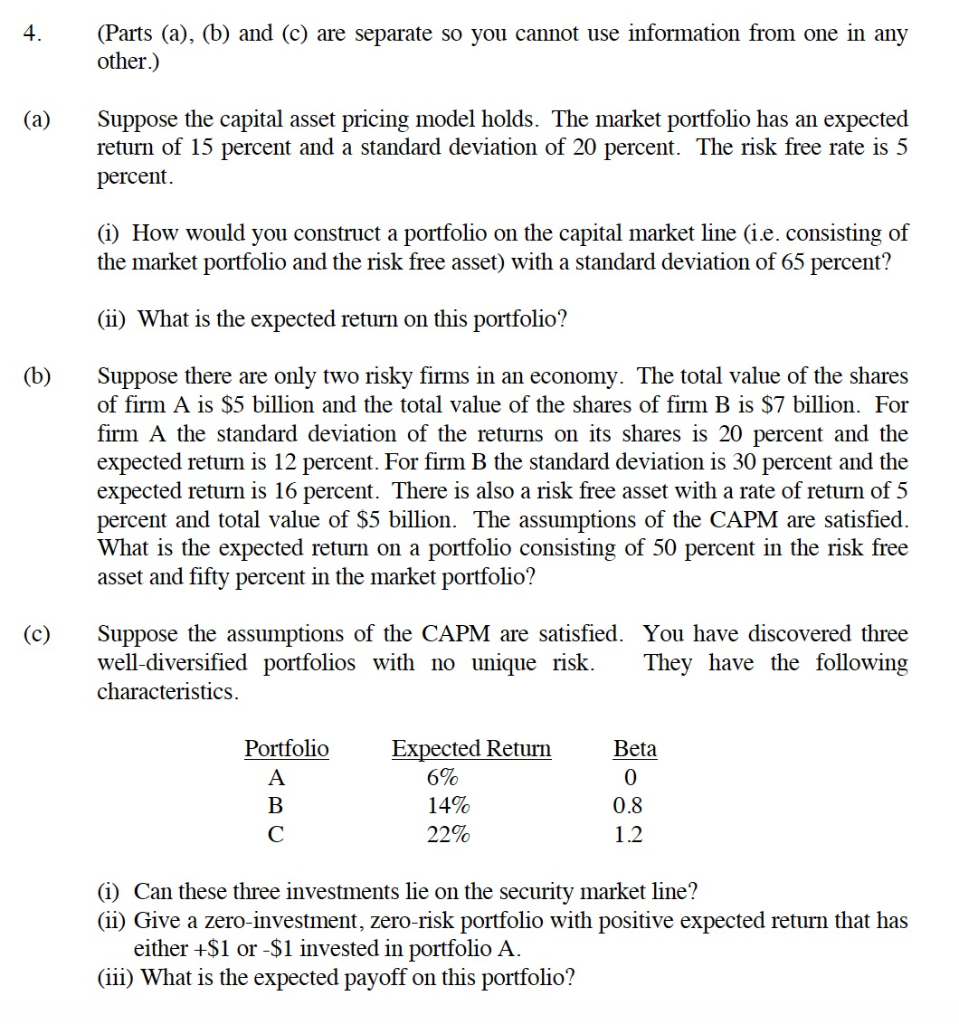

(Parts (a), (b) and (c) are separate so you cannot use information from one in any other.) 4. Suppose the capital asset pricing model holds. The market portfolio has an expected return of 15 percent and a standard deviation of 20 percent. The risk free rate is 5 (a) percent. (i) How would you construct a portfolio on the capital market line (ie. consisting of the market portfolio and the risk free asset) with a standard deviation of 65 percent? (i) What is the expected return on this portfolio? (b) Suppose there are only two risky firms in an economy. The total value of the shares of firm A is $5 billion and the total value of the shares of firm B is $7 billion. For firm A the standard deviation of the returns on its shares is 20 percent and the expected return is 12 percent. For firm B the standard deviation is 30 percent and the expected return is 16 percent. There is also a risk free asset with a rate of return of 5 percent and total value of S5 billion. The assumptions of the CAPM are satisfied What is the expected return on a portfolio consisting of 50 percent in the risk free asset and fifty percent in the market portfolio? (c) Suppose the assumptions of the CAPM are satisfied. You have discovered three well-diversified portfolios with no unique risk. They have the following characteristics Portfolio Expected Return Beta 6% 1 4% 0 0.8 22%- 1.2 (i) Can these three investments lie on the security market line? (ii) Give a zero-investment, zero-risk portfolio with positive expected return that has either +$1 or -$1 invested in portfolio A (iii) What is the expected payoff on this portfolio? (Parts (a), (b) and (c) are separate so you cannot use information from one in any other.) 4. Suppose the capital asset pricing model holds. The market portfolio has an expected return of 15 percent and a standard deviation of 20 percent. The risk free rate is 5 (a) percent. (i) How would you construct a portfolio on the capital market line (ie. consisting of the market portfolio and the risk free asset) with a standard deviation of 65 percent? (i) What is the expected return on this portfolio? (b) Suppose there are only two risky firms in an economy. The total value of the shares of firm A is $5 billion and the total value of the shares of firm B is $7 billion. For firm A the standard deviation of the returns on its shares is 20 percent and the expected return is 12 percent. For firm B the standard deviation is 30 percent and the expected return is 16 percent. There is also a risk free asset with a rate of return of 5 percent and total value of S5 billion. The assumptions of the CAPM are satisfied What is the expected return on a portfolio consisting of 50 percent in the risk free asset and fifty percent in the market portfolio? (c) Suppose the assumptions of the CAPM are satisfied. You have discovered three well-diversified portfolios with no unique risk. They have the following characteristics Portfolio Expected Return Beta 6% 1 4% 0 0.8 22%- 1.2 (i) Can these three investments lie on the security market line? (ii) Give a zero-investment, zero-risk portfolio with positive expected return that has either +$1 or -$1 invested in portfolio A (iii) What is the expected payoff on this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts