Question: Parts A & D only 11. Duration reflects whether the future cash payments of an asset are relatively short-term (low duration) or long-term (high duration).

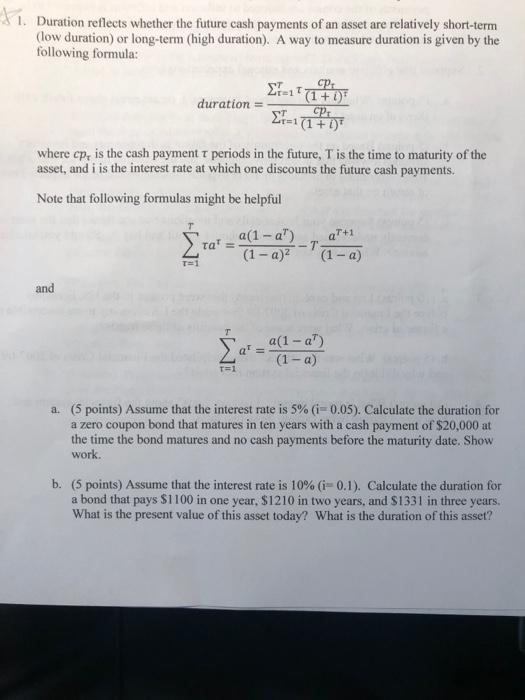

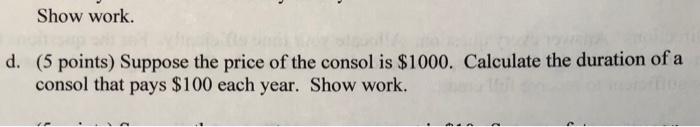

11. Duration reflects whether the future cash payments of an asset are relatively short-term (low duration) or long-term (high duration). A way to measure duration is given by the following formula: T CP: duration CPE EF=1 (1+0) where cp, is the cash payment i periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful a(1 - a") ta' = -T (1-a) (1-a) T=1 and et a(1-a) (1-a) T=1 a. 5 points) Assume that the interest rate is 5% (i=0.05). Calculate the duration for a zero coupon bond that matures in ten years with a cash payment of $20,000 at the time the bond matures and no cash payments before the maturity date. Show work. b. (5 points) Assume that the interest rate is 10% (i=0.1). Calculate the duration for a bond that pays $1100 in one year, $1210 in two years, and $1331 in three years. What is the present value of this asset today? What is the duration of this asset? Show work. d. (5 points) Suppose the price of the consol is $1000. Calculate the duration of a consol that pays $100 each year. Show work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts