Question: Parts a - e of this problem are the same as Problem 5 in Chapter 1 0 of this workbook. ) Suppose that the following

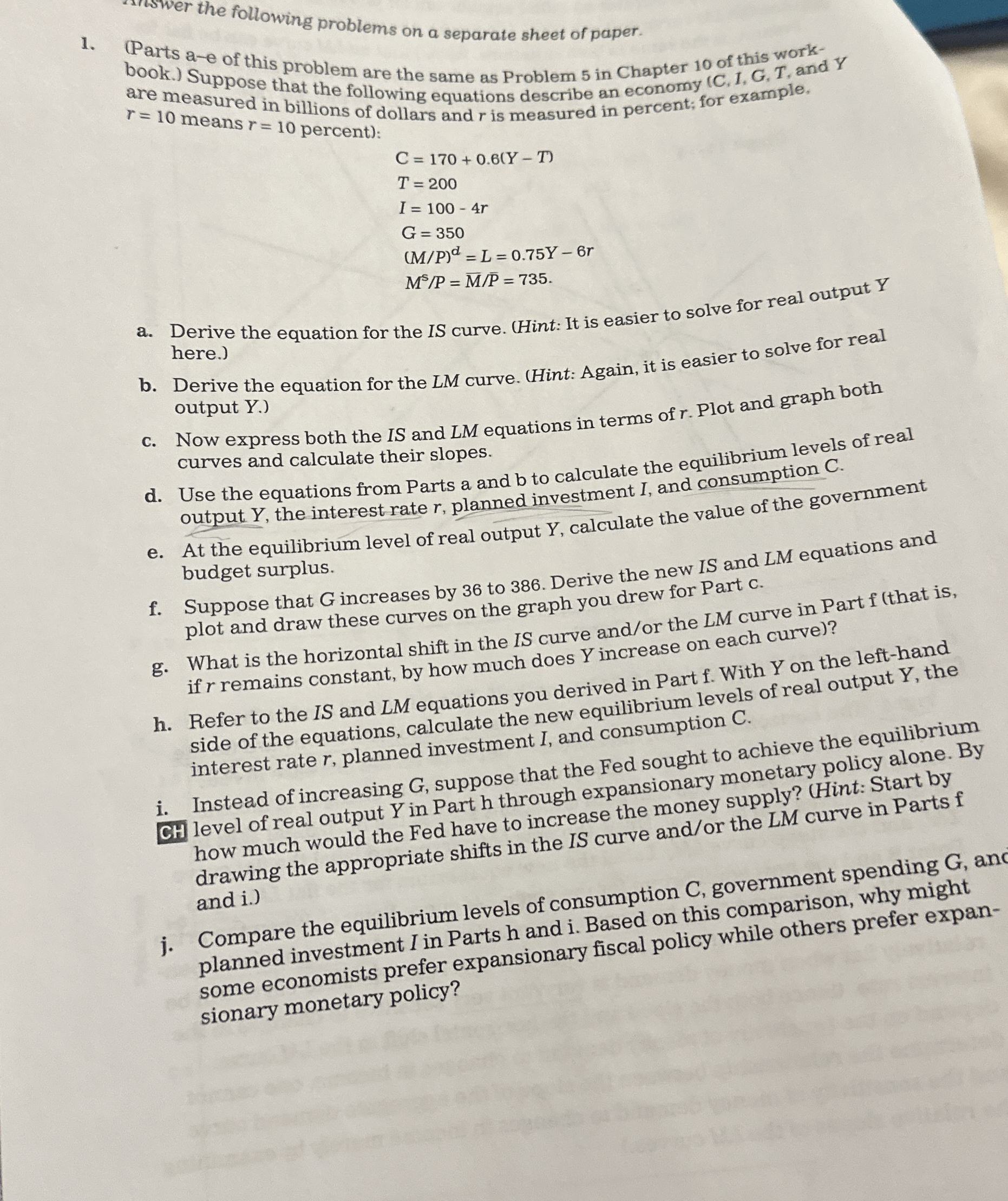

Parts ae of this problem are the same as Problem in Chapter of this workbook. Suppose that the following equations describe an economy C I, G T and Y are measured in billions of dollars and is measured in percent; for example. means percent:

bar

a Derive the equation for the IS curve. Hint: It is easier to solve for real output here.

b Derive the equation for the LM curve. Hint: Again, it is easier to solve for real output Y

c Now express both the IS and LM equations in terms of Plot and graph both curves and calculate their slopes.

d Use the equations from Parts a and to calculate the equilibrium levels of real output the interest rate planned investment I, and consumption

e At the equilibrium level of real output calculate the value of the government budget surplus.

f Suppose that increases by to Derive the new IS and LM equations and plot and draw these curves on the graph you drew for Part c

g What is the horizontal shift in the IS curve andor the LM curve in Part that is if remains constant, by how much does increase on each curve

h Refer to the IS and LM equations you derived in Partf. With Y on the lefthand side of the equations, calculate the new equilibrium levels of real output the interest rate planned investment I, and consumption

i Instead of increasing G suppose that the Fed sought to achieve the equilibrium CH level of real output in Part through expansionary monetary policy alone. By how much would the Fed have to increase the money supply? Hint: Start by drawing the appropriate shifts in the IS curve andor the LM curve in Parts and i

j Compare the equilibrium levels of consumption government spending an planned investment I in Parts and i Based on this comparison, why might some economists prefer expansionary fiscal policy while others prefer expansionary monetary policy?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock