Question: parts A1-B please Problem: Module 2 Textbook Problem 14 Learning Objectives: 2-9 Calculate straight-line depreciation and show how it affects financial statements 2-10 Calculate double-declining-balance

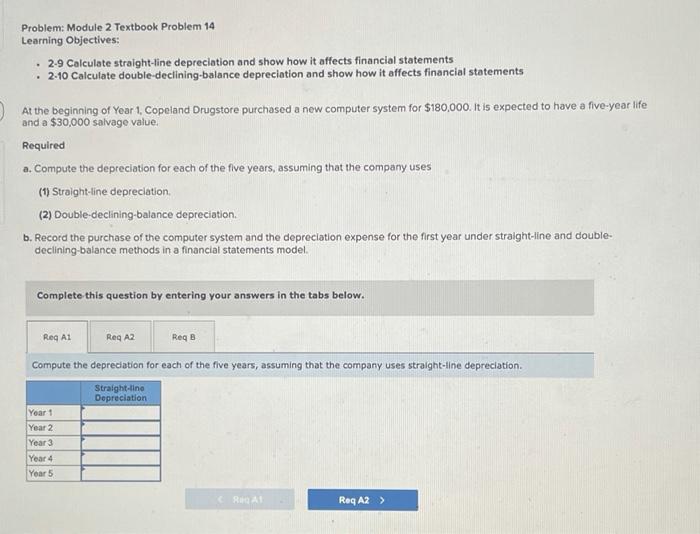

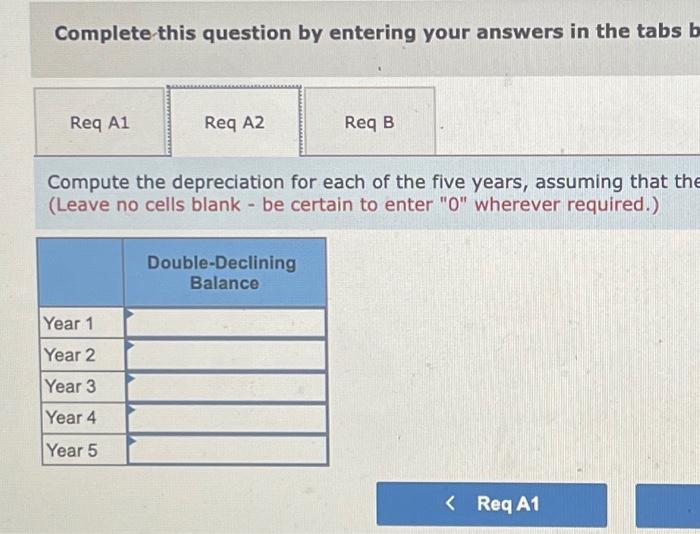

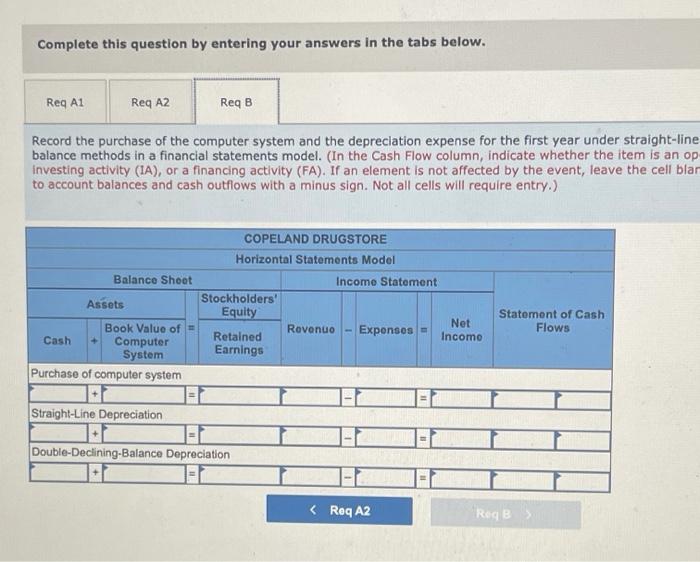

Problem: Module 2 Textbook Problem 14 Learning Objectives: 2-9 Calculate straight-line depreciation and show how it affects financial statements 2-10 Calculate double-declining-balance depreciation and show how it affects financial statements At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $180,000. It is expected to have a five-year life and a $30,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation (2) Double-declining balance depreciation b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double- declining-balance methods in a financial statements model. Complete this question by entering your answers in the tabs below. Reg A1 Reg AZ ReqB Compute the depreciation for each of the five years, assuming that the company uses straight-line depreciation. Straight-line Depreciation Year 1 Year 2 Year 3 Year 4 Year 5 REA Reg A2 > Complete this question by entering your answers in the tabs b Req A1 Req A2 Req B Compute the depreciation for each of the five years, assuming that the (Leave no cells blank - be certain to enter "0" wherever required.) Double-Declining Balance Year 1 Year 2 Year 3 Year 4 Year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts