Question: Passing Criteria: 4 5 Lesson 2 3 - Passive Activity Losses - Trade or Business Activities Tested Objective: 2 3 - 3 Compute the amount

Passing Criteria:

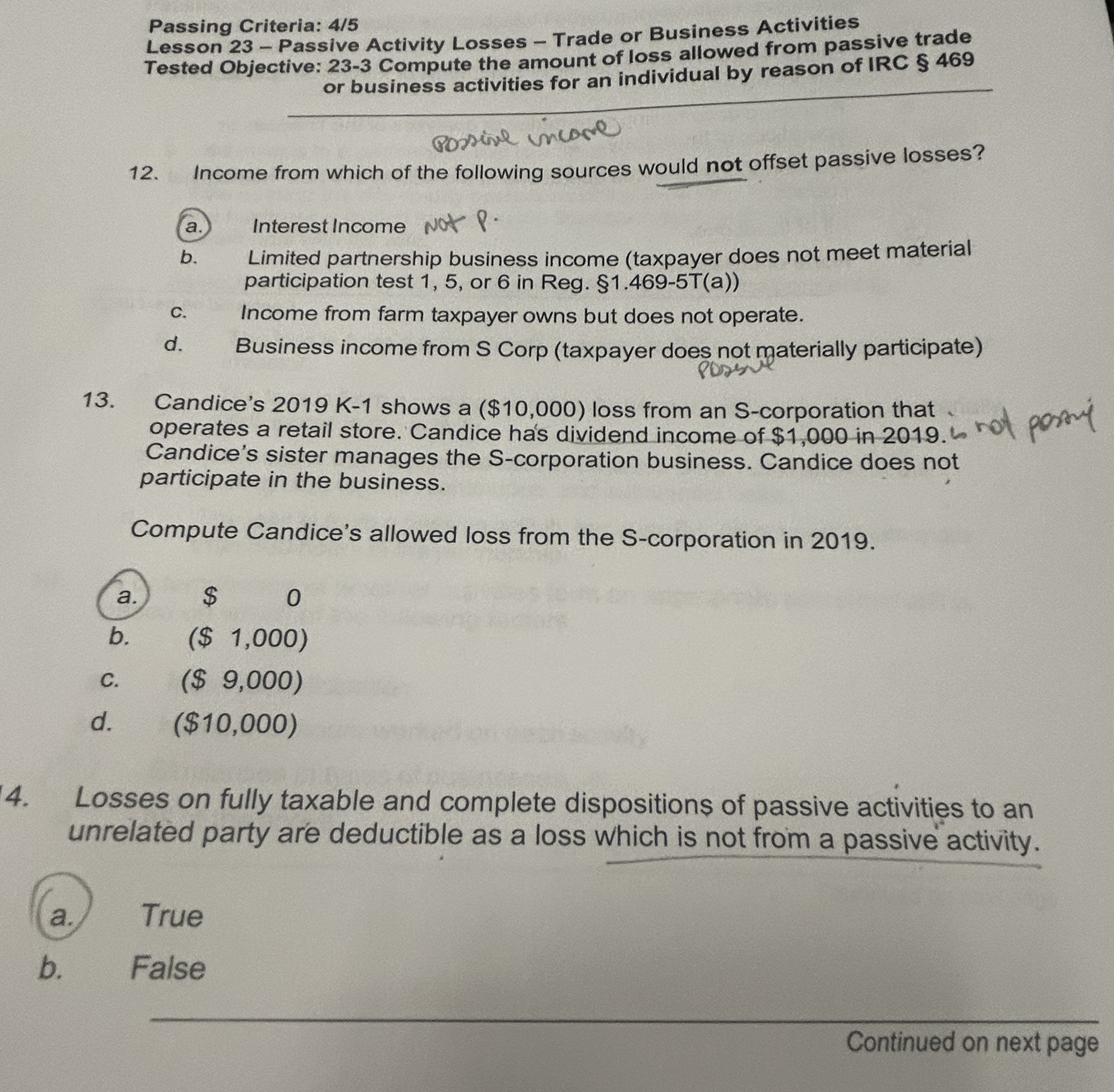

Lesson Passive Activity Losses Trade or Business Activities Tested Objective: Compute the amount of loss allowed from passive trade or business activities for an individual by reason of IRC

Possine incose

Income from which of the following sources would not offset passive losses?

a Interest Income not

b Limited partnership business income taxpayer does not meet material participation test or in Reg. Ta

c Income from farm taxpayer owns but does not operate.

d Business income from S Corp taxpayer does not materially participate

Candice's shows a $ loss from an Scorporation that operates a retail store. Candice has dividend income of $ in in Candice's sister manages the Scorporation business. Candice does not participate in the business.

Compute Candice's allowed loss from the Scorporation in

a $

b$

c$

d$

Losses on fully taxable and complete dispositions of passive activities to an unrelated party are deductible as a loss which is not from a passive activity.

a True

b False

Continued on next page

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock