Question: Paste * BIU > Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 X B D E F G

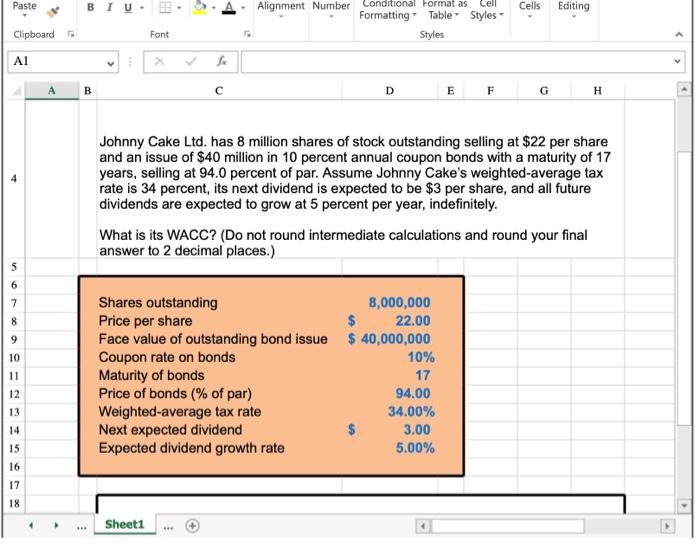

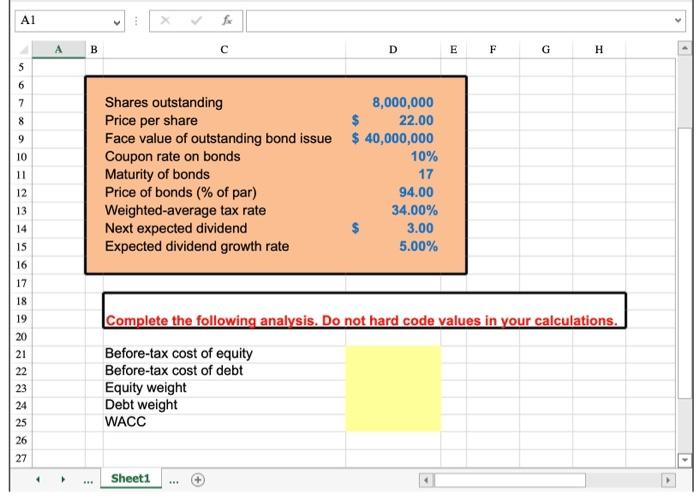

Paste * BIU > Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 X B D E F G H Johnny Cake Ltd. has 8 million shares of stock outstanding selling at $22 per share and an issue of $40 million in 10 percent annual coupon bonds with a maturity of 17 years, selling at 94.0 percent of par. Assume Johnny Cake's weighted average tax rate is 34 percent, its next dividend is expected to be $3 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely. What is its WACC? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 6 7 8 9 10 11 Shares outstanding 8,000,000 Price per share $ 22.00 Face value of outstanding bond issue $ 40,000,000 Coupon rate on bonds 10% Maturity of bonds 17 Price of bonds (% of par) 94.00 Weighted average tax rate 34.00% Next expected dividend 3.00 Expected dividend growth rate 5.00% 12 13 14 15 16 17 18 Sheet1 A1 fx B D E F G H . 7 8 9 10 11 Shares outstanding 8,000,000 Price per share $ 22.00 Face value of outstanding bond issue $ 40,000,000 Coupon rate on bonds 10% Maturity of bonds 17 Price of bonds (% of par) 94.00 Weighted-average tax rate 34.00% Next expected dividend 3.00 Expected dividend growth rate 5.00% 12 13 14 15 16 Complete the following analysis. Do not hard code values in your calculations. 17 18 19 20 21 22 23 24 25 26 27 Before-tax cost of equity Before-tax cost of debt Equity weight Debt weight WACC Sheet1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts