Question: Patrick is a 10% shareholder in Patricks pie, a bakery that is organized as a C corporation. During the year, Patrick worked full time for

Patrick is a 10% shareholder in Patricks pie, a bakery that is organized as a C corporation. During the year, Patrick worked full time for the corporation. The corporation had total income of $70,000, but did not make any distribution to shareholders during the year. How much of the total to Pat?

Patrick is a 10% shareholder in Patricks pie, a bakery that is organized as a C corporation. During the year, Patrick worked full time for the corporation. The corporation had total income of $70,000, but did not make any distribution to shareholders during the year. How much of the total to Pat?

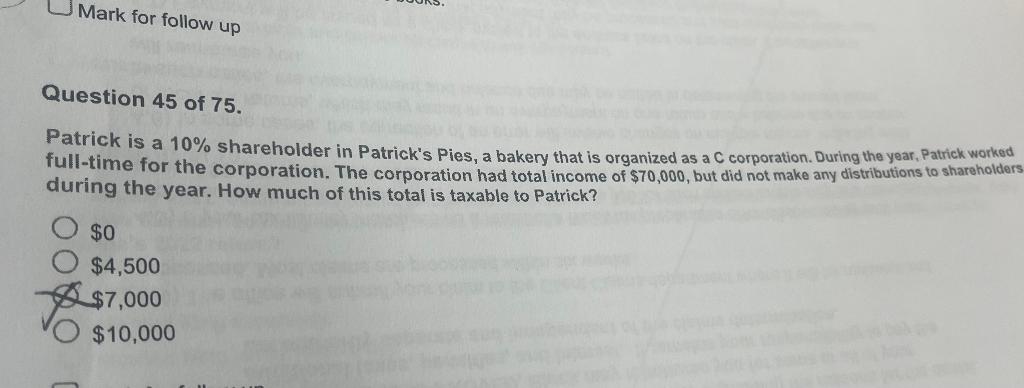

Question 45 of 75 . Patrick is a 10% shareholder in Patrick's Pies, a bakery that is organized as a c corporation. During the year, Patrick workod full-time for the corporation. The corporation had total income of $70,000, but did not make any distributions to shareholder during the year. How much of this total is taxable to Patrick? $0 $4,500 88$7,000 $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts