Question: Patrick is a recently divorced single father and will be filing head of household and itemizes. As a result of the divorce from his husband

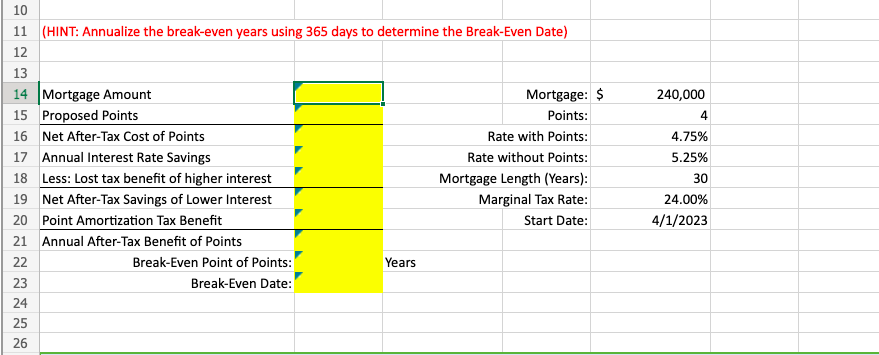

Patrick is a recently divorced single father and will be filing head of household and itemizes. As a result of the divorce from his husband he will need to refinance the mortgage on the home. The bank has offered Patrick the option of paying points on the mortgage in order to receive an annual interest rate reduction. Patrick will also make interest-only payments for the first four years. Patrick has asked you to produce a calculation to assist in determining whether or not paying points makes the most financial sense from a tax perspective.

- Complete the analysis using formulas and references to the data provided in E14:E20.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts