Question: Patrick needs to purchase a forklift for his warehouse operations. The forklift cost is $20,000. Using MACRS, and a 5-year property class, what is the

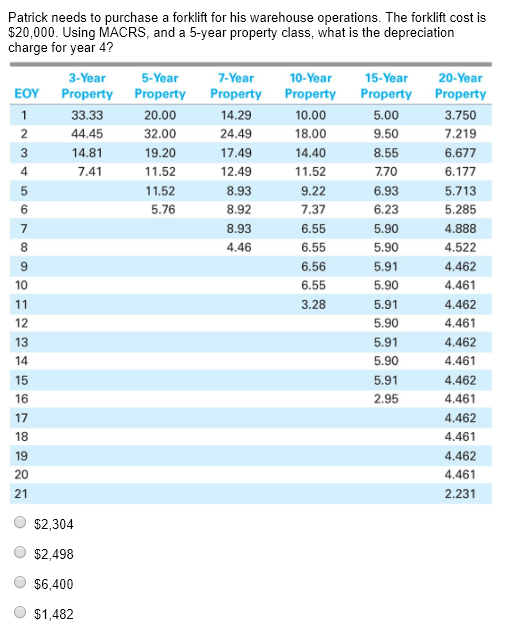

Patrick needs to purchase a forklift for his warehouse operations. The forklift cost is $20,000. Using MACRS, and a 5-year property class, what is the depreciation charge for year 4? 20-Year Property EOY 3.750 3-Year Property 33.33 44.45 14.81 7.41 2 5-Year Property 20.00 32.00 19.20 11.52 11.52 5.76 7-Year Property 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10-Year Property 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 15-Year Property 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 $2,304 $2,498 $6,400 $1,482

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts