Question: Patterson Development sometimes sells property on an installment basis. In those cases, Patterson reports income in its income statement in the year of the sale

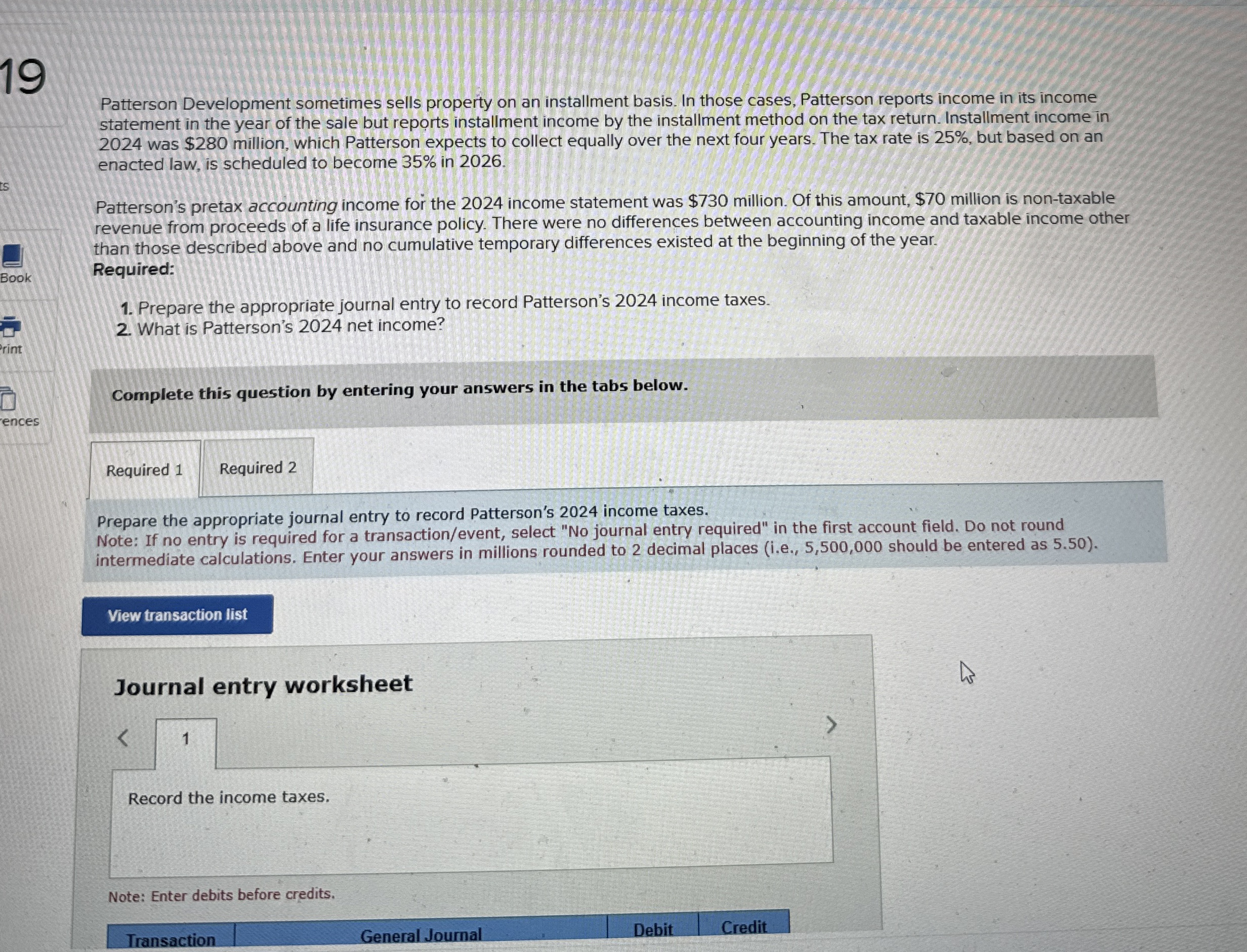

Patterson Development sometimes sells property on an installment basis. In those cases, Patterson reports income in its income

statement in the year of the sale but reports installment income by the installment method on the tax return. Installment income in

was $ million, which Patterson expects to collect equally over the next four years. The tax rate is but based on an

enacted law, is scheduled to become in

Patterson's pretax accounting income for the income statement was $ million. Of this amount, $ million is nontaxable

revenue from proceeds of a life insurance policy. There were no differences between accounting income and taxable income other

than those described above and no cumulative temporary differences existed at the beginning of the year.

Required:

Prepare the appropriate journal entry to record Patterson's income taxes.

What is Patterson's net income?

Complete this question by entering your answers in the tabs below.

Required

Prepare the appropriate journal entry to record Patterson's income taxes.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Do not round

intermediate calculations. Enter your answers in millions rounded to decimal places ie should be entered as

Journal entry worksheet

Record the income taxes.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock