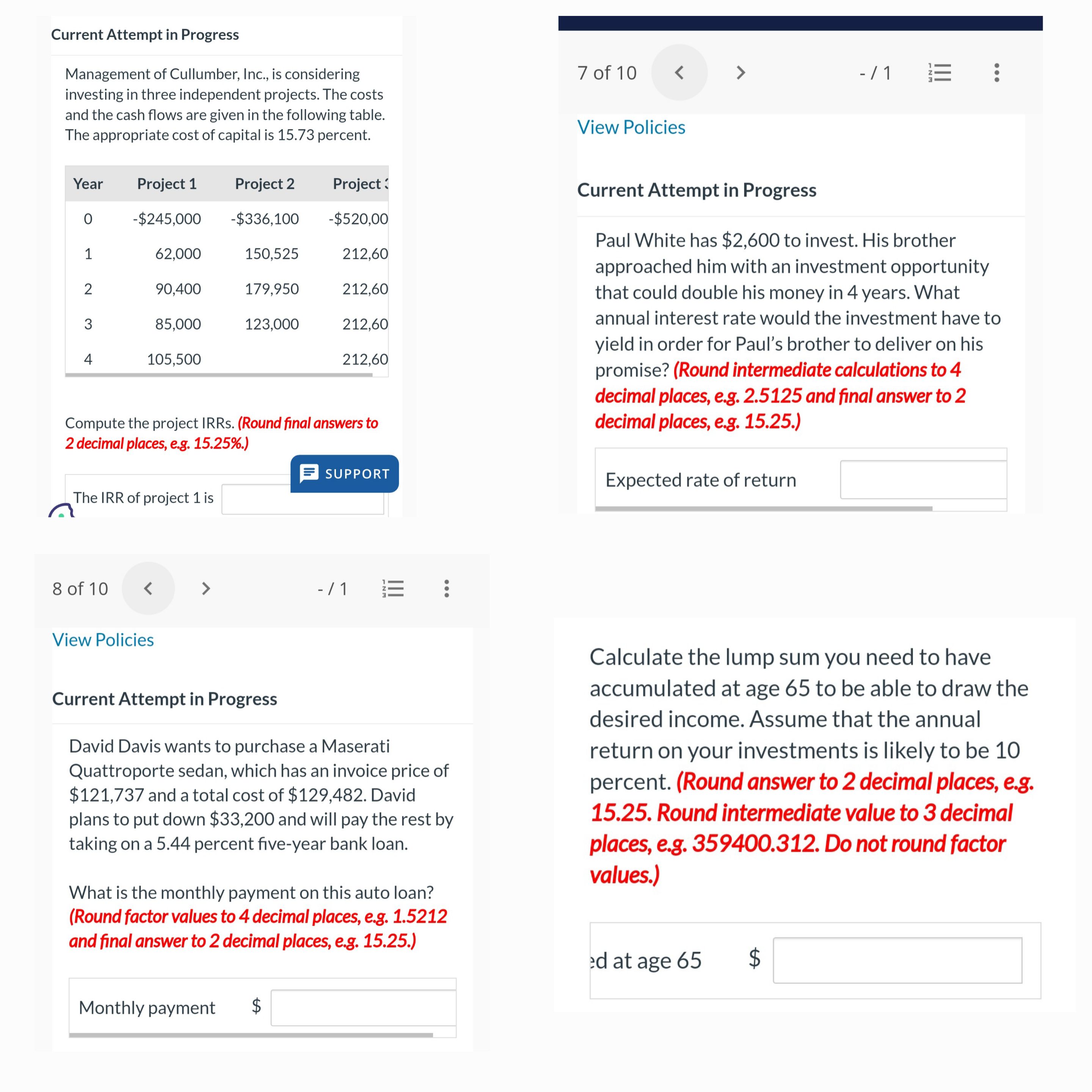

Question: Paul White has $ 2 , 6 0 0 to invest. His brother approached him with an investment opportunity that could double his money in

Paul White has $ to invest. His brother approached him with an investment opportunity that could double his money in years. What annual interest rate would the investment have to yield in order for Pauls brother to deliver on his promise? Round intermediate calculations to decimal places, eg and final answer to decimal places, eg

Expected rate of return enter the expected rate of return in percentages rounded to decimal places

David Davis wants to purchase a Maserati Quattroporte sedan, which has an invoice price of $ and a total cost of $ David plans to put down $ and will pay the rest by taking on a percent fiveyear bank loan.What is the monthly payment on this auto loan? Round factor values to decimal places, eg and final answer to decimal places, egMonthly payment $enter the amount of monthly payment in dollars rounded to decimal places

MTM Lab Competency Assessment

of

View Policies

Show Attempt History

Current Attempt in Progress

Assume you are now years old and will start working as soon as you graduate from college. You plan to start saving for your retirement on your th birthday and retire on your th birthday. After retirement, you expect to live at least until you are You wish to be able to withdraw $in todays dollars every year from the time of your retirement until you are years old ie for years The average inflation rate is likely to be percent.

Problem a

Your answer is incorrect.

Calculate the lump sum you need to have accumulated at age to be able to draw the desired income. Assume that the annual return on your investments is likely to be percent. Round answer to decimal places, eg Round intermediate value to decimal places, eg Do not round factor values.

Lump sum amount accumulated at age $enter the lump sum amount accumulated at age in dollars rounded to decimal places

of View PoliciesCurrent Attempt in ProgressManagement of Cullumber, Inc., is considering investing in three independent projects. The costs and the cash flows are given in the following table. The appropriate cost of capital is percent.YearProject Project Project $$$Compute the project IRRs. Round final answers to decimal places, egThe IRR of project is enter percentages rounded to decimal places project is enter percentages rounded to decimal places and project is enter percentages rounded to decimal places Identify the projects that should be accepted.Cullumber should accept projects

Current Attempt in Progress

Management of Cullumber, Inc., is considering

investing in three independent projects. The costs

and the cash flows are given in the following table.

The appropriate cost of capital is percent.

Compute the project IRRs. Round final answers to

decimal places, eg

The IRR of project is

of

vdots

View Policies

Current Attempt in Progress

David Davis wants to purchase a Maserati

Quattroporte sedan, which has an invoice price of

$ and a total cost of $ David

plans to put down $ and will pay the rest by

taking on a percent fiveyear bank loan.

What is the monthly payment on this auto loan?

Round factor values to decimal places, eg

and final answer to decimal places, eg

Monthly payment

of

vdots

View Policies

Current Attempt in Progress

Paul White has $ to invest. His brother

approached him with an investment opportunity

that could double his money in years. What

annual interest rate would the investment have to

yield in order for Paul's brother to deliver on his

promise? Round intermediate calculations to

decimal places, eg and final answer to

decimal places, eg

Expected rate of return

Calculate the lump sum you need to have

accumulated at age to be able to draw the

desired income. Assume that the annual

return on your investments is likely to be

percent. Round answer to decimal places, eg

Round intermediate value to decimal

places, eg Do not round factor

values.

at age $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock