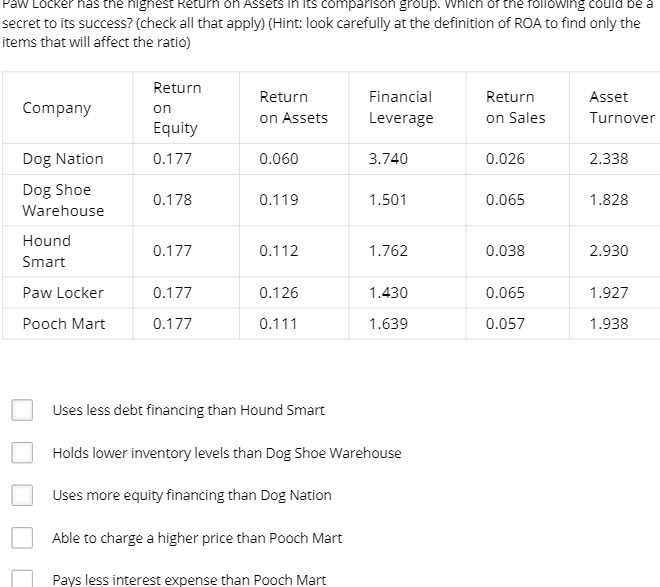

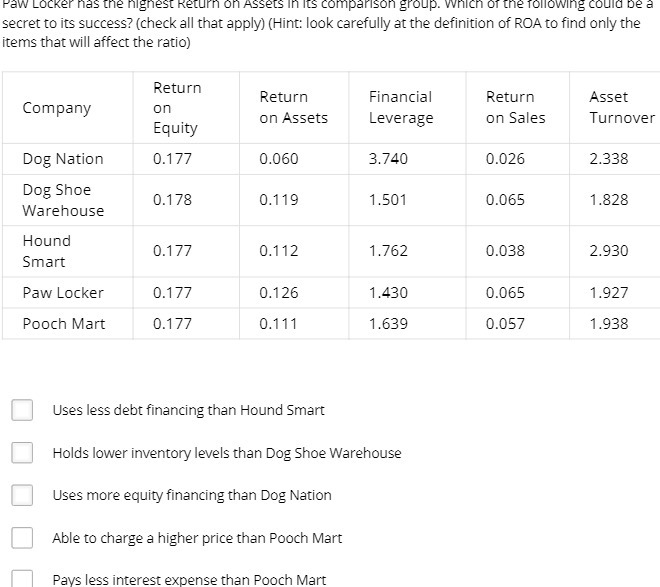

Question: Paw Locker has the highest Return on Assets In Its comparison group. Which of the following could be a secret to its success? (check all

Paw Locker has the highest Return on Assets In Its comparison group. Which of the following could be a secret to its success? (check all that apply) (Hint: look carefully at the definition of ROA to find only the items that will affect the ratio) Return Company on Return Financial Return Asset Equity on Assets Leverage on Sales Turnover Dog Nation 0.177 0.060 3.740 0.026 2.338 Dog Shoe Warehouse 0.178 0.119 1.501 0.065 1.828 Hound Smart 0.177 0.112 1.762 0.038 2.930 Paw Locker 0.177 0.126 1.430 0.065 1.927 Pooch Mart 0.177 0.111 1.639 0.057 1.938 Uses less debt financing than Hound Smart Holds lower inventory levels than Dog Shoe Warehouse Uses more equity financing than Dog Nation Able to charge a higher price than Pooch Mart Pays less interest expense than Pooch Mart

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts