Question: pay. No computer e poyees and Tomos. following for the last monthly pay of the year: a. The total wages of each part-time employee for

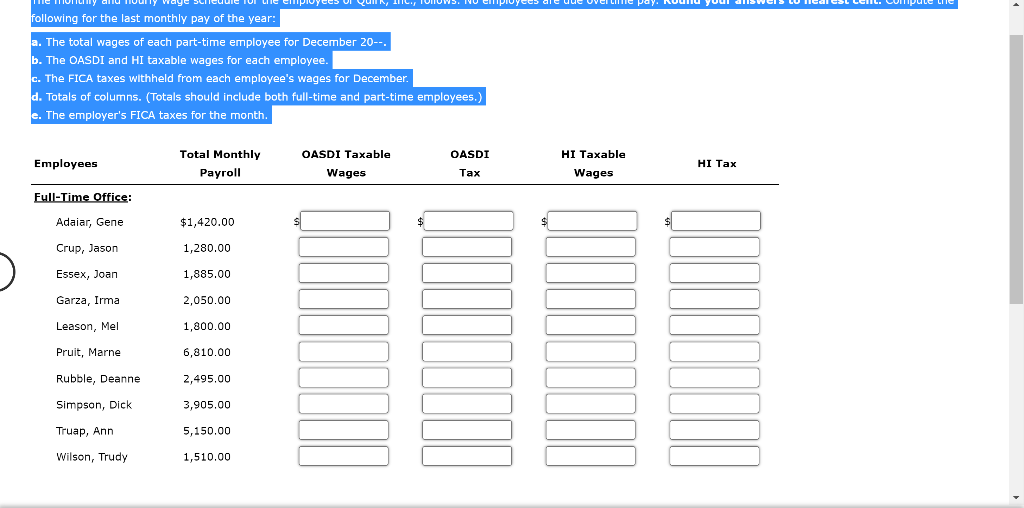

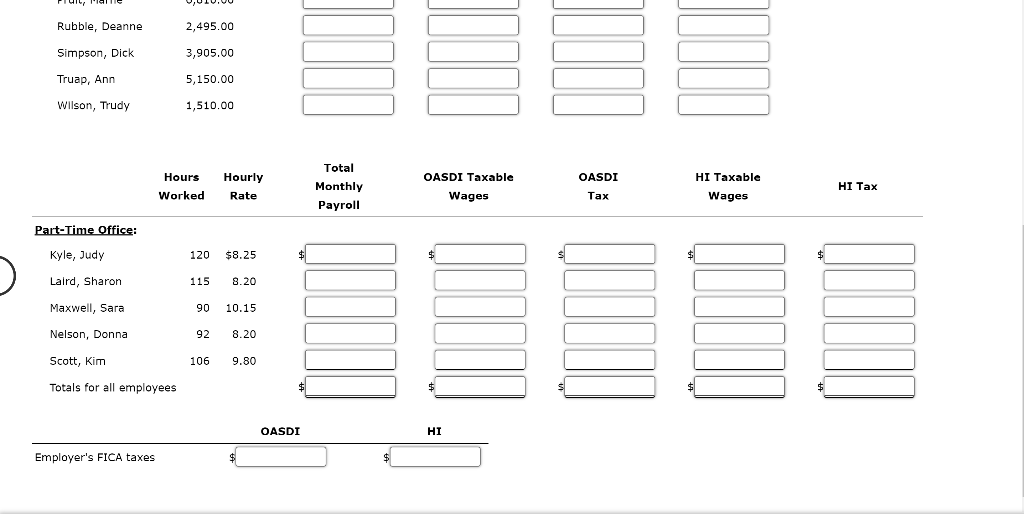

pay. No computer e poyees and Tomos. following for the last monthly pay of the year: a. The total wages of each part-time employee for December 20--. b. The OASDI and HI taxable wages for each employee. c. The FICA taxes withheld from each employee's wages for December. d. Totals of columns. (Totals should include both full-time and part-time employees.) e. The employer's FICA taxes for the month. OASDI HI Taxable Employees Total Monthly Payroll OASDI Taxable Wages HI Tax Tax Wages Full-Time Office: Adaiar, Gene $1,420.00 $ Crup, Jason 1,280.00 Essex, Joan 1,885.00 Garza, Irma 2,050.00 Leason, Mel 1,800.00 Pruit, Marne 6,810.00 Rubble, Deanne 2,495.00 Simpson, Dick 3,905.00 Truap, Ann 5,150.00 Wilson, Trudy 1,510.00 Rubble, Deanne 2,495.00 Simpson, Dick 3,905.00 Truap, Ann 5,150.00 Wilson, Trudy 1,510.00 OASDI HI Taxable Hours Worked Hourly Rate Total Monthly Payroll OASDI Taxable Wages HI Tax Tax Wages Part-Time Office: Kyle, Judy 120 $8.25 $ $ Laird, Sharon 115 8.20 Maxwell, Sara 90 10.15 Nelson, Donna 92 8.20 Scott, Kim 106 9.80 Totals for all employees $ OASDI HI Employer's FICA taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts