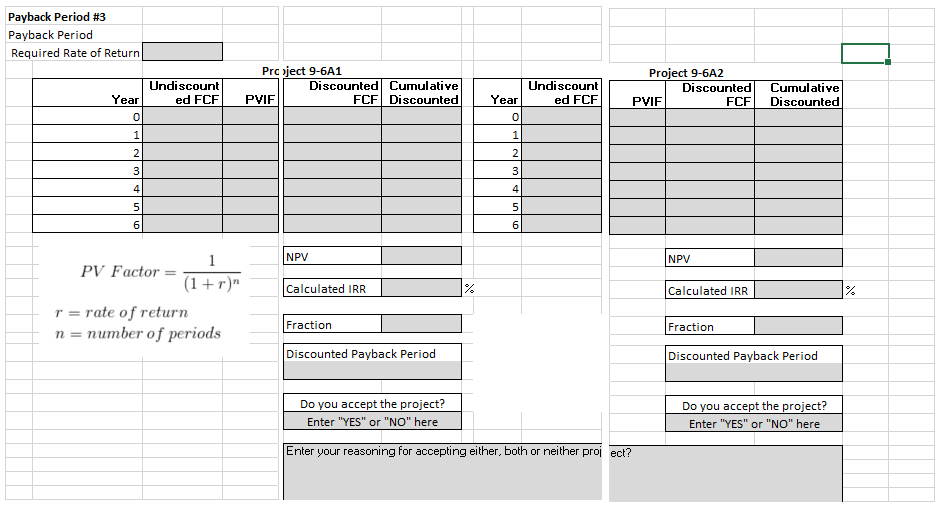

Question: Payback 4: You are considering two independent projects, Project 9-6A1 and Project 9-6A2. The initial cash outlay associated with Project 9-6A1 is $50,000 and the

- Payback 4: You are considering two independent projects, Project 9-6A1 and Project 9-6A2. The initial cash outlay associated with Project 9-6A1 is $50,000 and the initial cash outlay associated with Project 9-6A2 is $70,000. The required rate of return on both projects is 12 percent. Project 9-6A1 has expected free cash flows of $12,000 for years 1-6. Project 9-6A2 has expected free cash flows of $13,000 for years 1-6. You have an expected Payback Period of 5 years.

-

- What are the projects payback (Undiscounted FCF) and discounted payback periods Discounted FCF)? This is the schedule of outlays and free cash flows over the life of the project. Hint: Complete the table.

- What is each projects NPV (Net Present Value)?

- What is each projects Discounted Payback Period in years?

- What is each projects IRRs (Internal Rate of Return)?

- Do you accept either, both, or neither project? Explain your reasoning.

Please fill in the blanks, thank you!

Payback Period #3 Payback Period Required Rate of Return Undiscount ed FCF Project 9-6A1 Discounted Cumulative PVIF FCF Discounted Undiscount ed FCF Project 9-6A2 Discounted PVIF FCF Year 0 Year 0 Cumulative Discounted 1 1 2 2 3 3 4 4 5 5 6 6 NPV NPV Calculated IRR Calculated IRR PV Factor = (1 + r)" r = rate of return n = number of periods Fraction Fraction Discounted Payback Period Discounted Payback Period Do you accept the project? Enter "YES" or "NO" here Do you accept the project? Enter "YES" or "NO" here Enter your reasoning for accepting either, both or neither project

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock