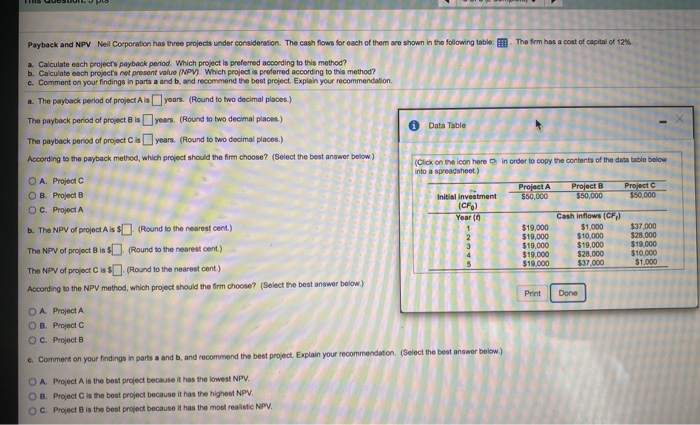

Question: Payback and NPV Nell Corporation has three projects under consideration. The cash flows for each of them are shown in the following table. The firm

Payback and NPV Nell Corporation has three projects under consideration. The cash flows for each of them are shown in the following table. The firm has 1 ok on the con here in order to copy the contents of the datatable below Project A $60,000 Project $50,000 Project $50,000 Investment a. Calculate each project's payback period. Which project is preferred according to this method? b. Calculate each project's not present Value (NPV). Which project is preferred according to this method? c. Comment on your findings in parts a and b, and recommend the best project Explain your recommendation . The payak period of project is yours. (Round to two decimal places) The payback period of projects yours. (Round to two decimal places) The payback period of project is yours. (Round to two decimal places) According to the payback method, which project should the firm choose? (Select the O A. Project O B. Project B OC. Project A b. The NPV of project Ass (Round to the nearest cent.) The NPV of project Bins (Round to the nearest cont.) The NPV of project Cis.(Round to the nearest cent) According to NPV method, which project should the firm choose? (Select the best answer below) O A Project O B. Project OC. Projects $19.000 $19.000 $19,000 $19.000 Cash inflows (CF) $1.000 $10.000 $19,000 $28.000 $37.000 $28.000 $19.000 e. Comment on your findings in parts a and b, and recommend the best project. Explain your recommendation (Select the best answer O A Project A is the best project because it has the lowest NPV. OB, Project is the best project because it has the highest NPV. OC. Project is the best project because it has the most reali NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts