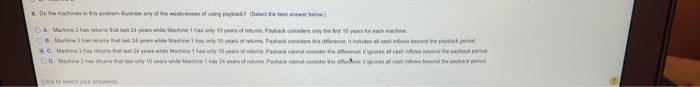

Question: Payback comparisons Nova Products has a 4 -year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose

CWCANON d. Do the machine problemlery of the song The payback period the first machine a Round to be done) 1 7 8 ARD w E R T Y C S D F G H N C V N M contro option command & Domains of www Oswamy considers only Awwwww wybocksted Wanywa pro Www

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts