Question: Payback, Net Present Value, Internal Rate of Return, Intangible Benefits, Inflation Adjustment For discount factors use Exhibit 128-1 and Exhibit 128-2. Foster Company wants to

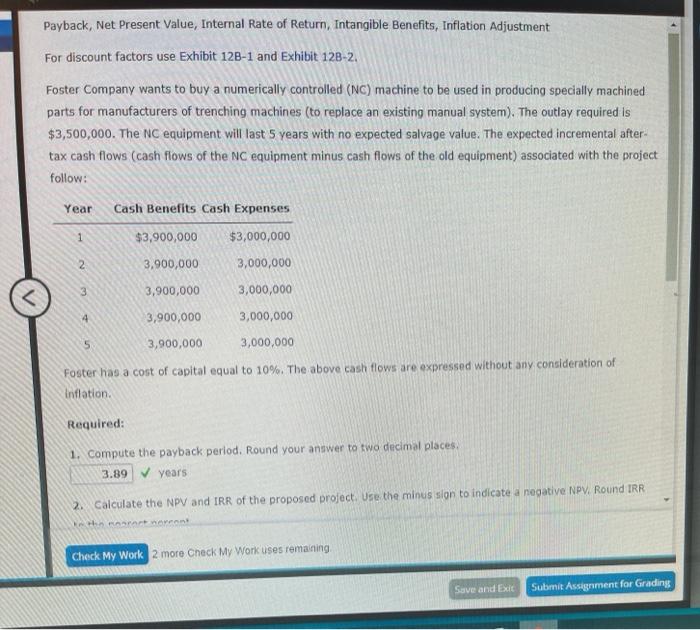

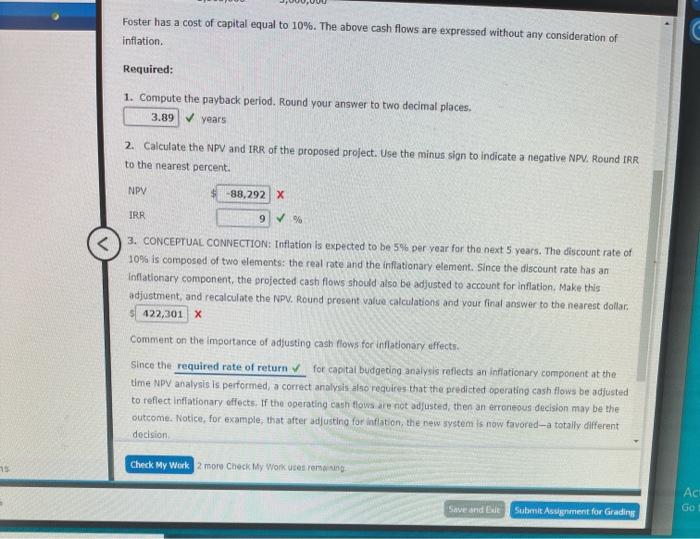

Payback, Net Present Value, Internal Rate of Return, Intangible Benefits, Inflation Adjustment For discount factors use Exhibit 128-1 and Exhibit 128-2. Foster Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines (to replace an existing manual system). The outlay required is $3,500,000. The NC equipment will last 5 years with no expected salvage value. The expected incremental after tax cash flows (cash flows of the NC equipment minus cash flows of the old equipment) associated with the project follow: Year Cash Benefits Cash Expenses 1 $3,900,000 $3,000,000 2 3.900,000 3,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts