Question: Payback Period, Net Present Value Analysis, and Qualitative Considerations The plant manager of Jurassic Industries is considering the purchase of new automated assembly equipment. The

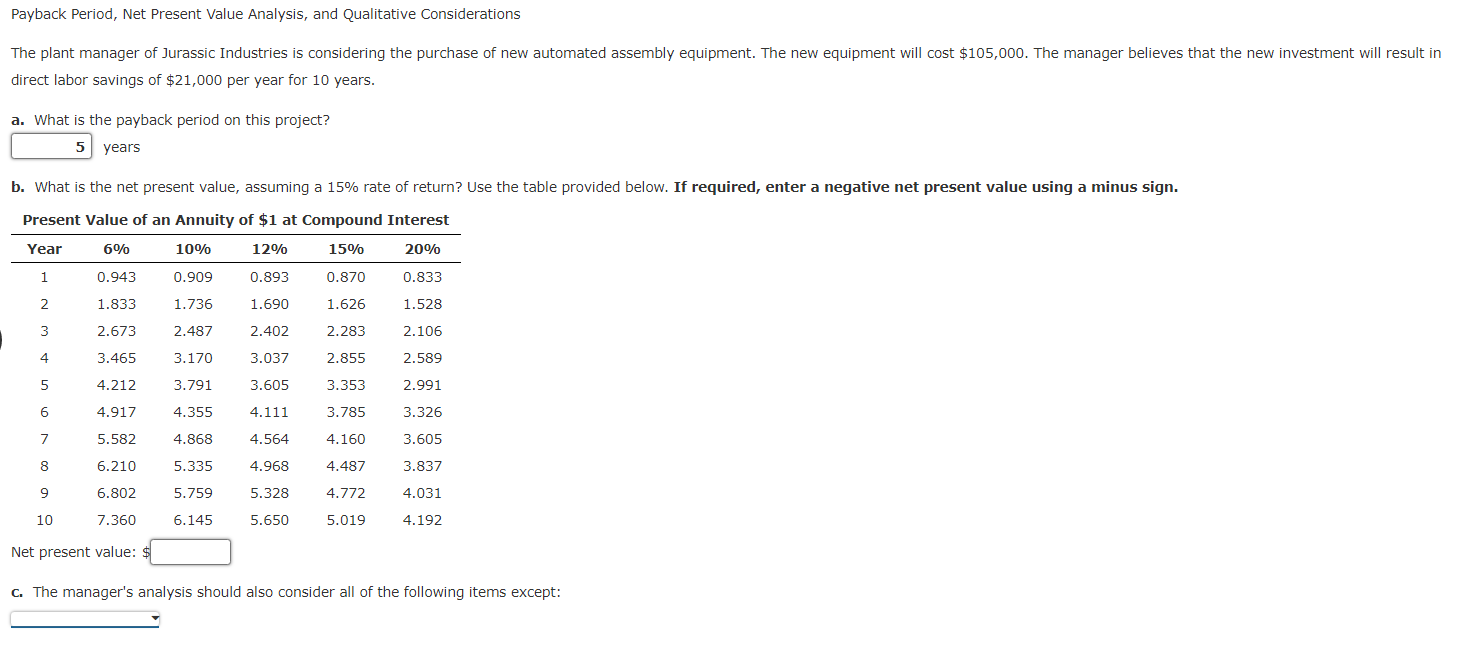

Payback Period, Net Present Value Analysis, and Qualitative Considerations The plant manager of Jurassic Industries is considering the purchase of new automated assembly equipment. The new equipment will cost $105,000. The manager believes that the new investment will result in direct labor savings of $21,000 per year for 10 years. a. What is the payback period on this project? 5 years b. What is the net present value, assuming a 15% rate of return? Use the table provided below. If required, enter a negative net present value using a minus sign. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Net present value: $ C. The manager's analysis should also consider all of the following items except

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts