Question: Payback Period: Project A Project B Initial Year 1 Year 2 Year 3 Year 4 Year 5 Investment Cash Inflow Cash Inflow Cash Inflow Cash

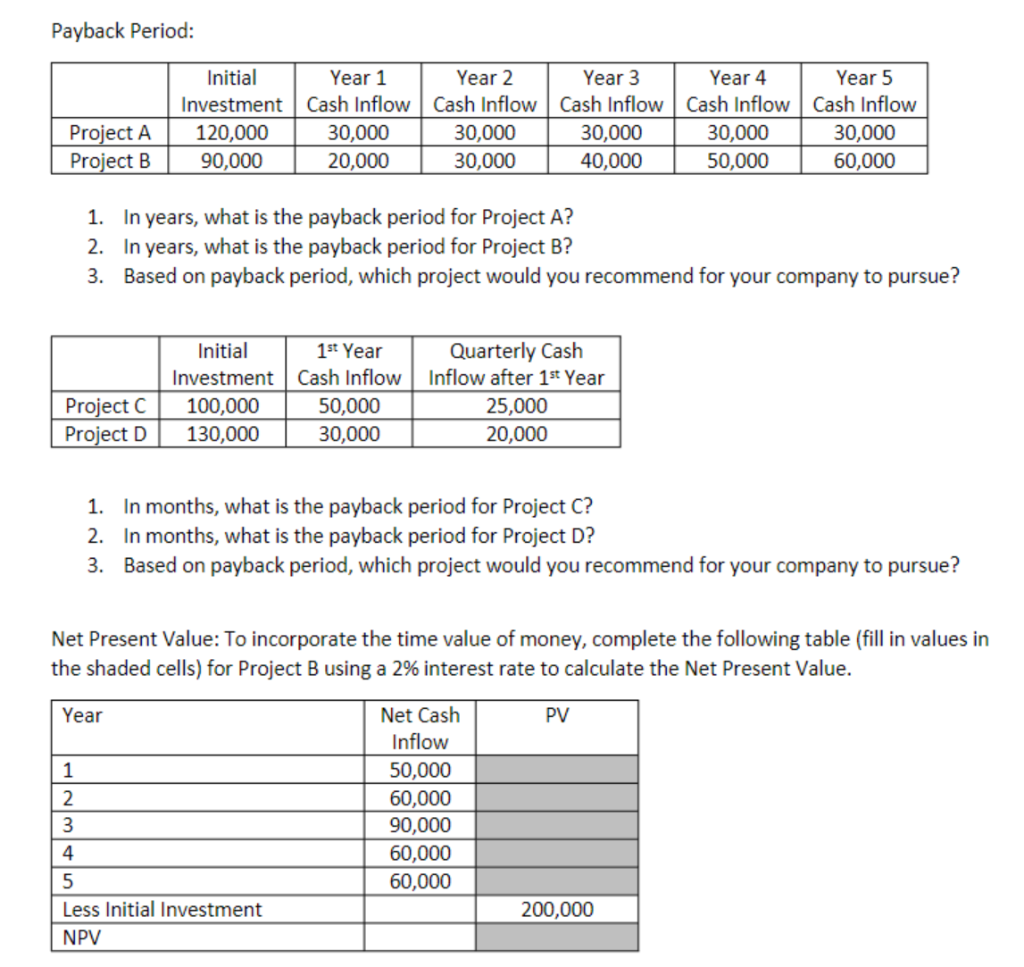

Payback Period: Project A Project B Initial Year 1 Year 2 Year 3 Year 4 Year 5 Investment Cash Inflow Cash Inflow Cash Inflow Cash Inflow Cash Inflow 120,000 30,000 30,000 30,000 30,000 30,000 90,000 20,000 30,000 40,000 50,000 60,000 1. In years, what is the payback period for Project A? 2. In years, what is the payback period for Project B? 3. Based on payback period, which project would you recommend for your company to pursue? Initial Investment 100,000 130,000 1st Year Cash Inflow 50,000 30,000 Quarterly Cash Inflow after 1st Year 25,000 20,000 Project C Project D 1. In months, what is the payback period for Project C? 2. In months, what is the payback period for Project D? 3. Based on payback period, which project would you recommend for your company to pursue? Net Present Value: To incorporate the time value of money, complete the following table (fill in values in the shaded cells) for Project B using a 2% interest rate to calculate the Net Present Value. Year PV 1 2 3 4 Net Cash Inflow 50,000 60,000 90,000 60,000 60,000 5 Less Initial Investment NPV 200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts