Question: Paying Off Installment Loans Some installment loans include terms that charge a penalty if the borrower pays off the loan earlier than its maturity date.

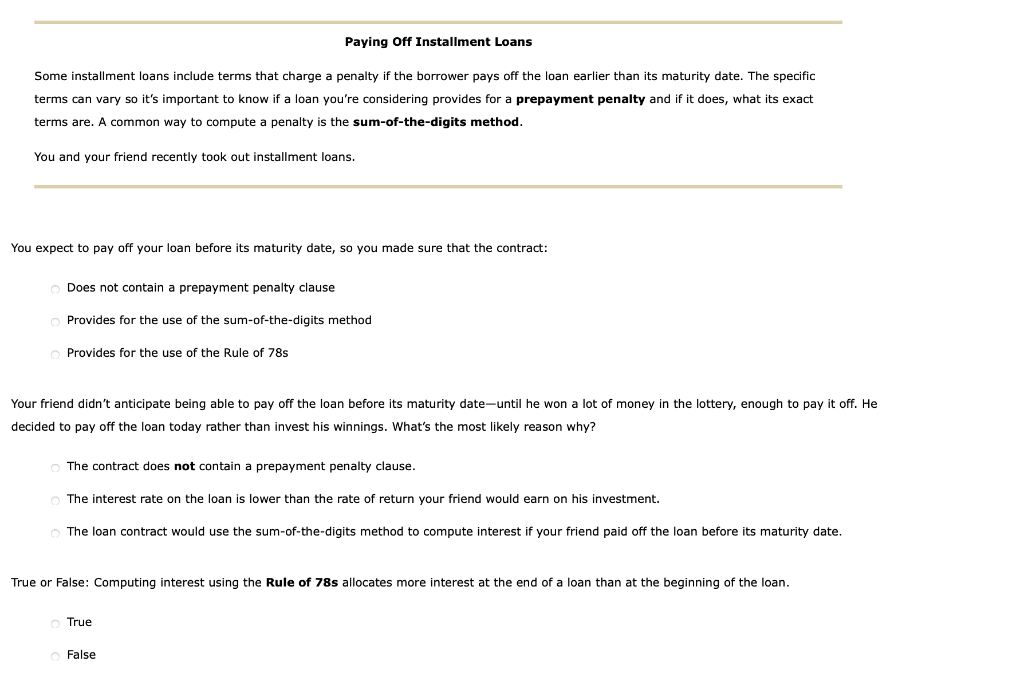

Paying Off Installment Loans Some installment loans include terms that charge a penalty if the borrower pays off the loan earlier than its maturity date. The specific terms can vary so it's important to know if a loan you're considering provides for a prepayment penalty and if it does, what its exact terms are. A common way to compute a penalty is the sum-of-the-digits method. You and your friend recently took out installment loans. You expect to pay off your loan before its maturity date, so you made sure that the contract: Does not contain a prepayment penalty clause Provides for the use of the sum-of-the-digits method Provides for the use of the Rule of 78s Your friend didn't anticipate being able to pay off the loan before its maturity date-until he won a lot of money in the lottery, enough to pay it off. He decided to pay off the loan today rather than invest his winnings. What's the most likely reason why? The contract does not contain a prepayment penalty clause. The interest rate on the loan is lower than the rate of return your friend would earn on his investment. The loan contract would use the sum-of-the-digits method to compute interest if your friend paid off the loan before its maturity date. True or False: Computing interest using the Rule of 78s allocates more interest at the end of a loan than at the beginning of the loan. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts