Question: payroll compliance - True or False Questions (8 points) 1) All jurisdictions require that employees receive their pay according to a specified frequency. 2) British

payroll compliance

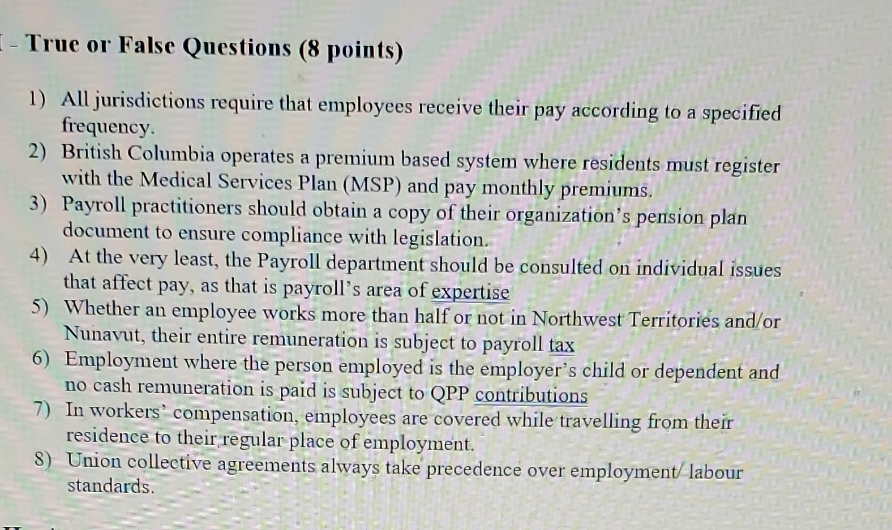

- True or False Questions (8 points) 1) All jurisdictions require that employees receive their pay according to a specified frequency. 2) British Columbia operates a premium based system where residents must register with the Medical Services Plan (MSP) and pay monthly premiums. 3) Payroll practitioners should obtain a copy of their organization's pension plan document to ensure compliance with legislation. 4) At the very least, the Payroll department should be consulted on individual issues that affect pay, as that is payroll's area of expertise 5) Whether an employee works more than half or not in Northwest Territories and/or Nunavut, their entire remuneration is subject to payroll tax 6) Employment where the person employed is the employer's child or dependent and no cash remuneration is paid is subject to QPP contributions 7) In workers' compensation, employees are covered while travelling from their residence to their regular place of employment. 8) Union collective agreements always take precedence over employment labour standards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts