Question: Payroll Fundamentals 1 1. Multiple Choice (Circle the correct answer number) - 10 marks a. You have made a substantial contribution to your personal registered

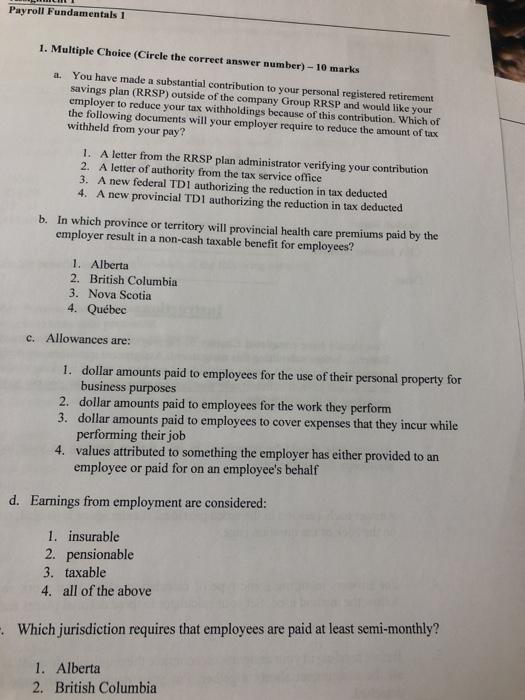

Payroll Fundamentals 1 1. Multiple Choice (Circle the correct answer number) - 10 marks a. You have made a substantial contribution to your personal registered retirement savings plan (RRSP) outside of the company Group RRSP and would like your employer to reduce your tax withholdings because of this contribution. Which of the following documents will your employer require to reduce the amount of tax withheld from your pay? 1. A letter from the RRSP plan administrator verifying your contribution 2. A letter of authority from the tax service office 3. A new federal TDI authorizing the reduction in tax deducted 4. A new provincial TDI authorizing the reduction in tax deducted b. In which province or territory will provincial health care premiums paid by the employer result in a non-cash taxable benefit for employees? 1. Alberta 2. British Columbia 3. Nova Scotia 4. Qubec c. Allowances are: 1. dollar amounts paid to employees for the use of their personal property for business purposes 2. dollar amounts paid to employees for the work they perform 3. dollar amounts paid to employees to cover expenses that they incur while performing their job 4. values attributed to something the employer has either provided to an employee or paid for on an employee's behalf d. Earnings from employment are considered: 1. insurable 2. pensionable 3. taxable 4. all of the above Which jurisdiction requires that employees are paid at least semi-monthly? 1. Alberta 2. British Columbia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts