Question: Payroll Records & Accounting There are 3 problems to solve please. The employees of Ethereal Bank are paid on a semimonthly basis. All employees are

Payroll Records & Accounting

There are problems to solve please.

The employees of Ethereal Bank are paid on a semimonthly basis. All employees are single. There are no pretax deductions.

Required:

Compute the FICA taxes for the employees for the November payroll. All employees have been employed for the entire calendar year.

Note: Round "Social Security Tax" and "Medicare Tax" to decimal places.

tabletableSemimonthlyPaytableYTD Pay forNovember Pay DatetableSocialSecurity Taxfor November Pay DatetableMedicare Taxfor November Pay DateR Bellagio,$rrB Khumalo,$S Schriver,$K Saetang,$T Ahmad,$M Petrova,$ Required:

Using the percentage method for manual payroll with Ws from or later in pendix C calculate the federal withholding

amounts for the following employees. No information was included in Step of the W and no box was checked in Step

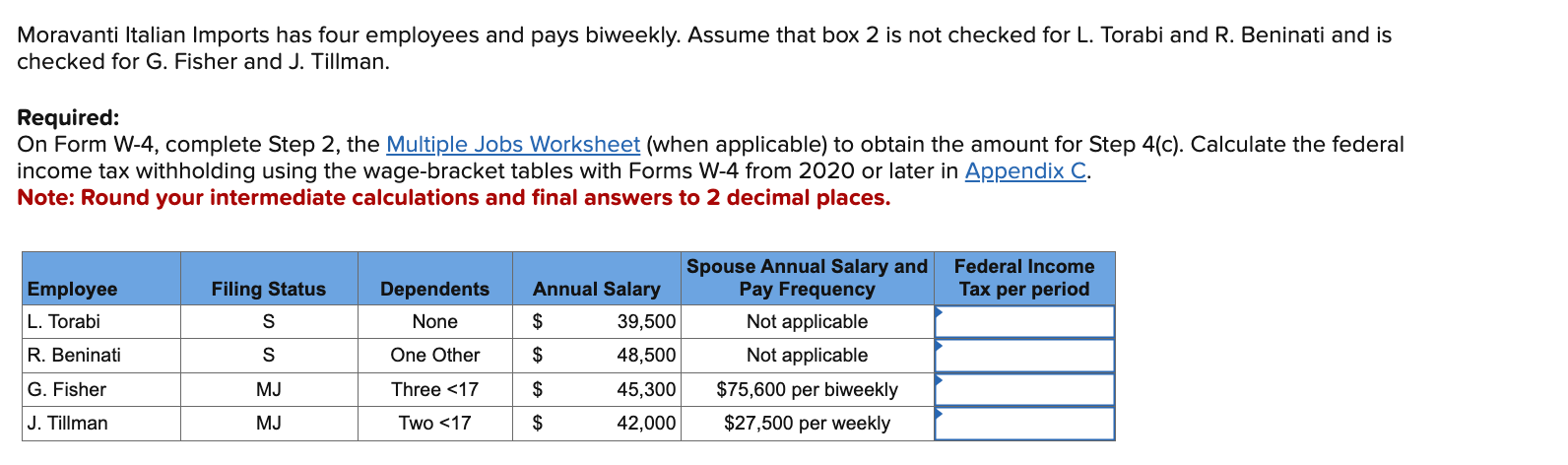

Note: Round your intermediate calculations and final answers to decimal places.Moravanti Italian Imports has four employees and pays biweekly. Assume that box is not checked for L Torabi and R Beninati and is checked for G Fisher and J Tillman.

Required:

On Form W complete Step the Multiple Jobs Worksheet when applicable to obtain the amount for Step c Calculate the federal income tax withholding using the wagebracket tables with Forms W from or later in Appendix C

Note: Round your intermediate calculations and final answers to decimal places.

tableEmployeeFiling Status,Dependents,Annual Salary,tableSpouse Annual Salary andPay FrequencytableFederal IncomeTax per periodL Torabi,SNone,$Not applicable,R Beninati,SOne Other,$Not applicable,G Fisher,MJThree $$ per biweekly,J Tillman,MJTwo $$ per weekly,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock