Question: Payroll Register Note : Round your final answers to the nearest cent. Payroll Register Payroll Register This is the first task to completing Olney Company's

Payroll Register

Note : Round your final answers to the nearest cent. Payroll Register

Payroll Register

This is the first task to completing Olney Company's payroll register. Complete the steps outlined below:

Record the regular hours and the overtime hours worked for each employee, using the time clerk's report as your reference. For salaried workers, complete the Regular Earnings column and show the hourly overtime rate and earnings only if overtime was worked.

Record the Total Earnings for each employee by adding the Regular Earnings and the Overtime Earnings. values to the nearest two decimal places, eg to Payroll Register

Payroll Register the gross earnings upon which the federal tax to be withheld is determined.

Complete the steps outlined below.

Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction.

Determine and record the federal income taxes for each employee.

rightarrow Refer to each employee's filing status.

rightarrow Click the link below to view the WageBracket Method tables.

Determine and record the state income taxes for each employee using the State of Pennsylvania's rate of

Determine and record the local income taxes for the Chalfont Boro residents at the rate of

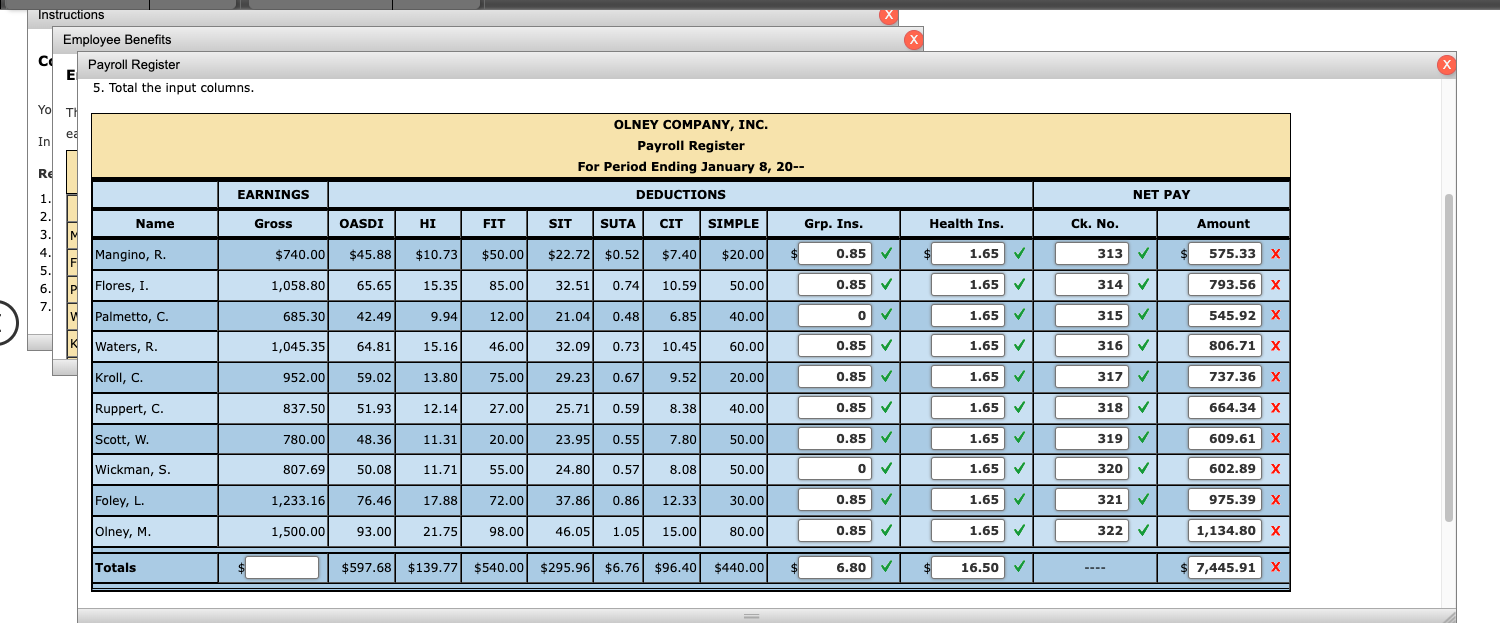

Total each input column.

Note: Round your final answers to the cent. Enter all amounts as positive numbers.

Click here to access the WageBracket Method Tables.

begintabularccccccccccccccccccccc

hline multicolumncbegintabularl

OLNEY COMPANY, INC.

Employee Payroll Register

For Period Ending January

endtabular

hline & EARNINGS & multicolumncDEDUCTIONS & multicolumnrNET PAY

hline Name & Gross & OASDI & HI & multicolumncFIT & multicolumncSIT & SUTA & multicolumncCIT & multicolumncSIMPLE Ded. & Grp Ins. & Health Ins. & Ck No & Amount

hline Mangino, R & $ & $ & $ & $ & & X & $ & & checkmark & & $ & & checkmark & $ & & checkmark & & & &

hline Flores, I. & & & & & & x & & & checkmark & & & & checkmark & & & checkmark & & & &

hline Palmetto, C & & & & & & x & & & checkmark & & & & checkmark & & & checkmark & & & &

hline Waters, R & & & & & & X & & & checkmark & & & & checkmark & & & checkmark & & & &

hline & nmennl & ment & and & I & & v & I & & & & & n n & & & an & & & & &

hline

endtabular Completing the Payroll Register

The Employee Payroll Register presents all the computations previously performed as it applies to this payroll period.

Complete the following steps:

Record the amount to be withheld for group insurance.

Record the amount to be withheld for health insurance.

Each worker is to be paid by check. Assign check numbers provided to the correct employee.

Compute the net pay for each employee.

Total the input columns.

begintabularcccccccccccccccccccc

hline multicolumncbegintabularl

OLNEY COMPANY, INC.

Payroll Register

For Period Ending January

endtabular

hline & EARNINGS & multicolumncDEDUCTIONS & multicolumncNET PAY

hline Name & Gross & OASDI & HI & FIT & SIT & SUTA & CIT & SIMPLE & multicolumncGrp Ins. & multicolumncHealth Ins. & multicolumnlCk No & multicolumncAmount

hline Mangino, R & $ & $ & $ & $ & $ & $ & $ & $ & $ & & checkmark & $ & & checkmark & & checkmark & $ & & x

hline Flores, I. & & & & & & & & & & & checkmark & & & checkmark & & checkmark & & & x

hline Palmetto, C & & & & & & & & & & & checkmark & & & checkmark & & checkmark & & & x

hline Waters, R & & & & & & & & & & & checkmark & & & checkmark & & checkmark & & & x

hline Kroll, C & & & & & & & & & & & checkmark & & & checkmark & & checkmark & & & x

hline Ruppert, C & & & & & & & & & & & checkmark & & & checkmark & & checkmark & & & X

hline

endtabular

Feedback Employee Benefits

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock