Question: Payroll Taxes, Deposits, and Reports Problem Set B Computing and recording employer's payroll tax expense. The payroll register of Cliff's Auto Detailers showed total employee

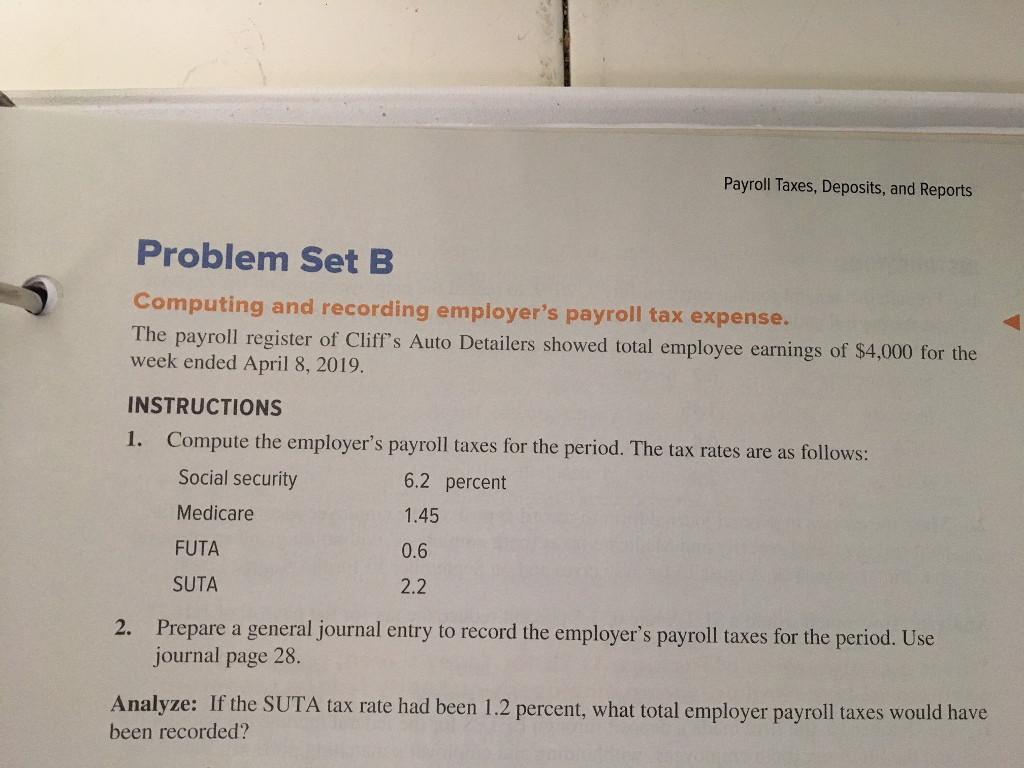

Payroll Taxes, Deposits, and Reports Problem Set B Computing and recording employer's payroll tax expense. The payroll register of Cliff's Auto Detailers showed total employee earnings of $4,000 for the week ended April 8, 2019. INSTRUCTIONS 1. Compute the employer's payroll taxes for the period. The tax rates are as follows: Social security 6.2 percent Medicare 1.45 FUTA SUTA 2.2 0.6 2. Prepare a general journal entry to record the employer's payroll taxes for the period. Use journal page 28. Analyze: If the SUTA tax rate had been 1.2 percent, what total employer payroll taxes would have been recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts