Question: PB 9 - 3 ( Algo ) Analyzing and Recording Long - Lived Asset Transactions with Partial - Year Depreciation [ LO 9 - 2

PBAlgo Analyzing and Recording LongLived Asset Transactions with PartialYear Depreciation LO LO LO

The following information applies to the questions displayed below.

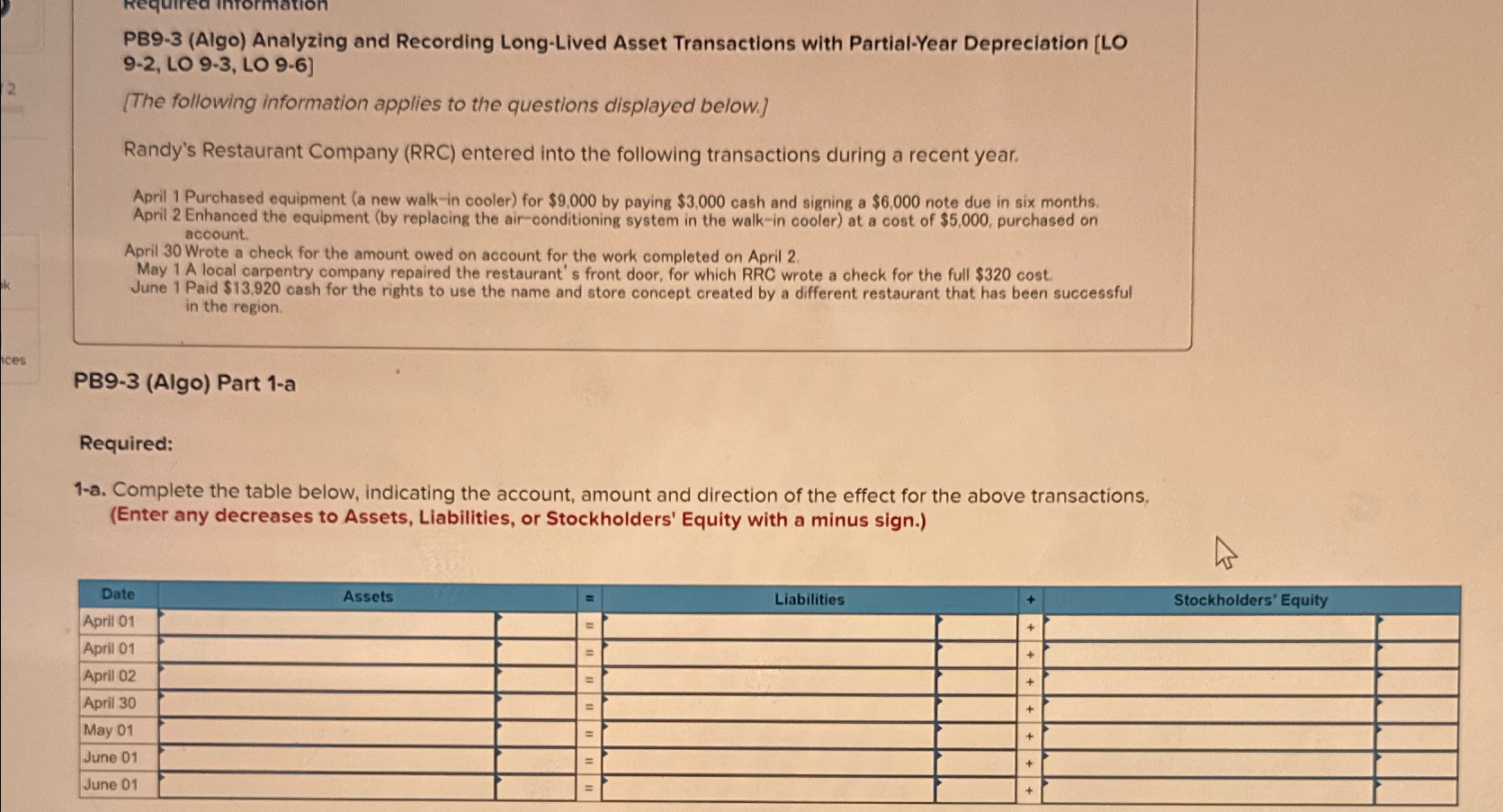

Randy's Restaurant Company RRC entered into the following transactions during a recent year.

April Purchased equipment a new walkin cooler for $ by paying $ cash and signing a $ note due in six months.

April Enhanced the equipment by replacing the airconditioning system in the walkin cooler at a cost of $ purchased on account.

April Wrote a check for the amount owed on account for the work completed on April

May A local carpentry company repaired the restaurant's front door, for which RRC wrote a check for the full $ cost

June Paid $ cash for the rights to use the name and store concept created by a different restaurant that has been successful in the region.

PBAlgo Part a

Required:

a Complete the table below, indicating the account, amount and direction of the effect for the above transactions,

Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.

tableDateAssets,Liabilities,Stockholders' EquityApril April April April May June June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock