Question: PC Shopping Network may upgrade its modem pool. It last upgraded 2 years ago, when it spent $170 million on equipment with an assumed life

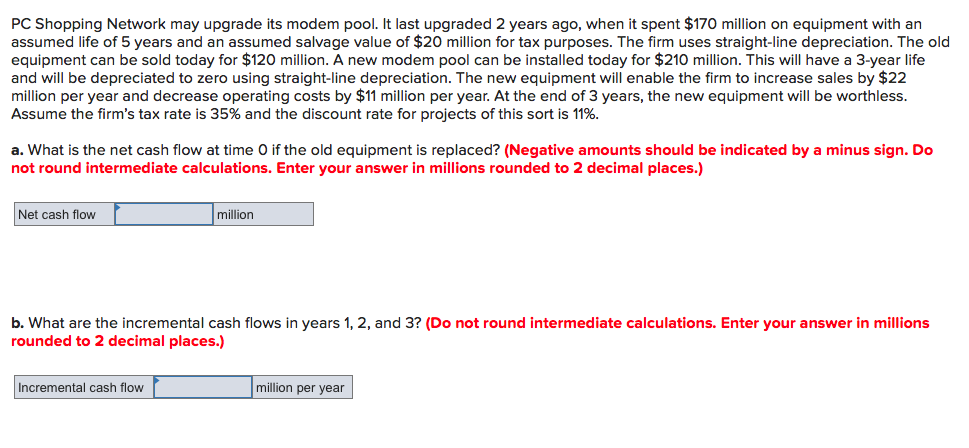

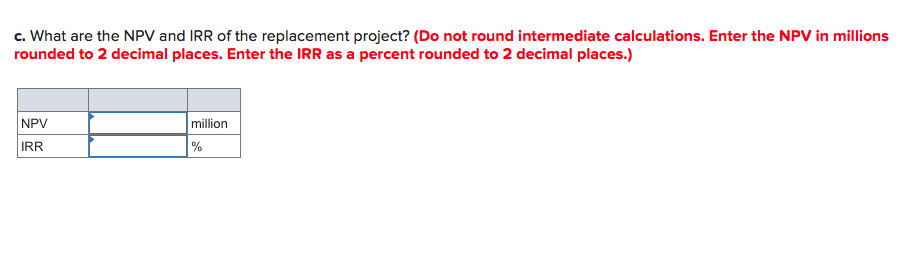

PC Shopping Network may upgrade its modem pool. It last upgraded 2 years ago, when it spent $170 million on equipment with an assumed life of 5 years and an assumed salvage value of $20 million for tax purposes. The firm uses straight-line depreciation. The old equipment can be sold today for $120 million. A new modem pool can be installed today for $210 million. This will have a 3-year life and will be depreciated to zero using straight-line depreciation. The new equipment will enable the firm to increase sales by $22 million per year and decrease operating costs by $11 million per year. At the end of 3 years, the new equipment will be worthless Assume the firm's tax rate is 35% and the discount rate for projects of this sort is 11%. a. What is the net cash flow at time O if the old equipment is replaced? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Net cash flow million b. What are the incremental cash flows in years 1, 2, and 3? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Incremental cash flow million per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts