Question: PCM, Inc., is a direct marketer of computer hardware, software, peripherals, and electronics. In a recent annual report, the company reported that its revenue is

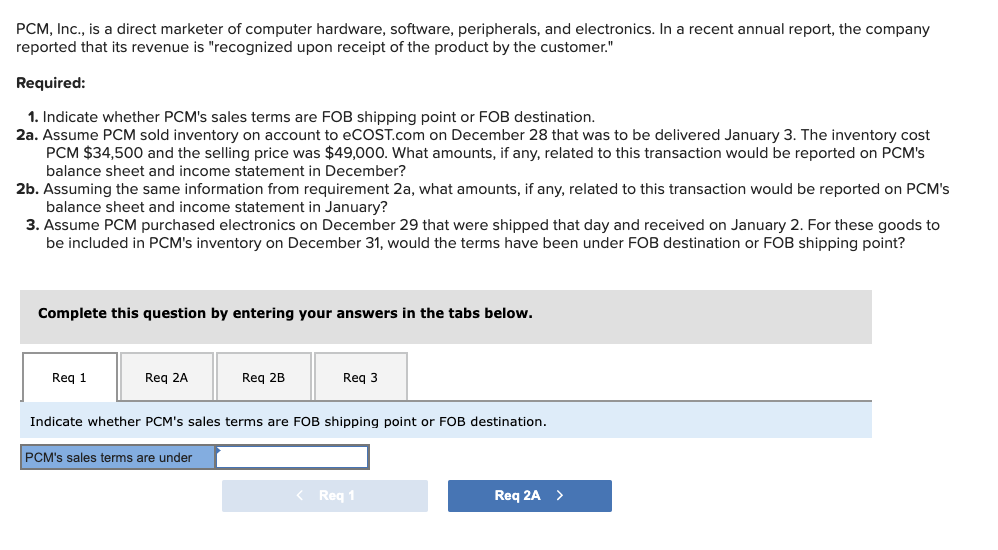

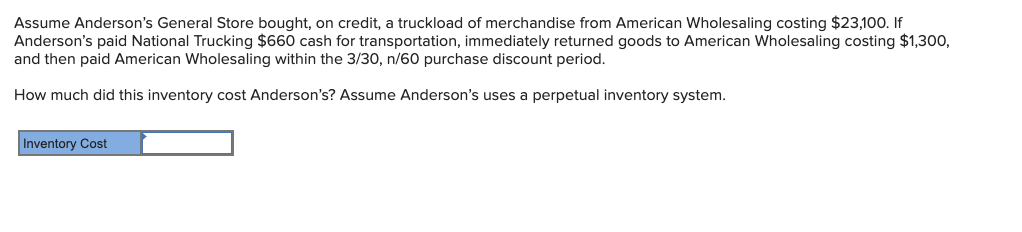

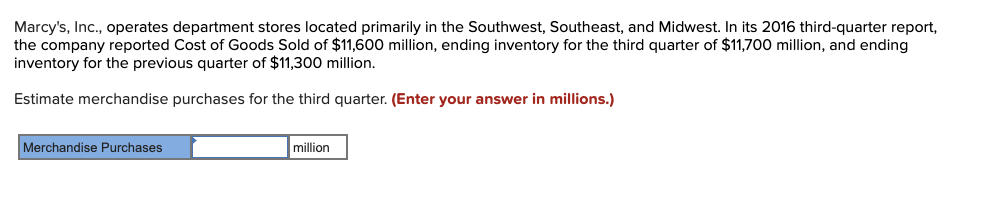

PCM, Inc., is a direct marketer of computer hardware, software, peripherals, and electronics. In a recent annual report, the company reported that its revenue is "recognized upon receipt of the product by the customer." Required: 1. Indicate whether PCM's sales terms are FOB shipping point or FOB destination. 2a. Assume PCM sold inventory on account to eCOST.com on December 28 that was to be delivered January 3. The inventory cost PCM $34,500 and the selling price was $49,000. What amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in December? 2b. Assuming the same information from requirement 2a, what amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in January? 3. Assume PCM purchased electronics on December 29 that were shipped that day and received on January 2. For these goods to be included in PCM's inventory on December 31, would the terms have been under FOB destination or FOB shipping point? Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Req 2B Reg 3 Indicate whether PCM's sales terms are FOB shipping point or FOB destination. PCM's sales terms are under Assume Anderson's General Store bought, on credit, a truckload of merchandise from American Wholesaling costing $23,100. If Anderson's paid National Trucking $660 cash for transportation, immediately returned goods to American Wholesaling costing $1,300, and then paid American Wholesaling within the 3/30, n/60 purchase discount period. How much did this inventory cost Anderson's? Assume Anderson's uses a perpetual inventory system. Inventory Cost Marcy's, Inc., operates department stores located primarily in the Southwest, Southeast, and Midwest. In its 2016 third-quarter report, the company reported Cost of Goods Sold of $11,600 million, ending inventory for the third quarter of $11,700 million, and ending inventory for the previous quarter of $11,300 million. Estimate merchandise purchases for the third quarter. (Enter your answer in millions.) Merchandise Purchases million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts