Question: ( PCP and butterfly spread ) Recall from Chapter 1 7 that a butterfly is an options strategy built on four trades at one expiration

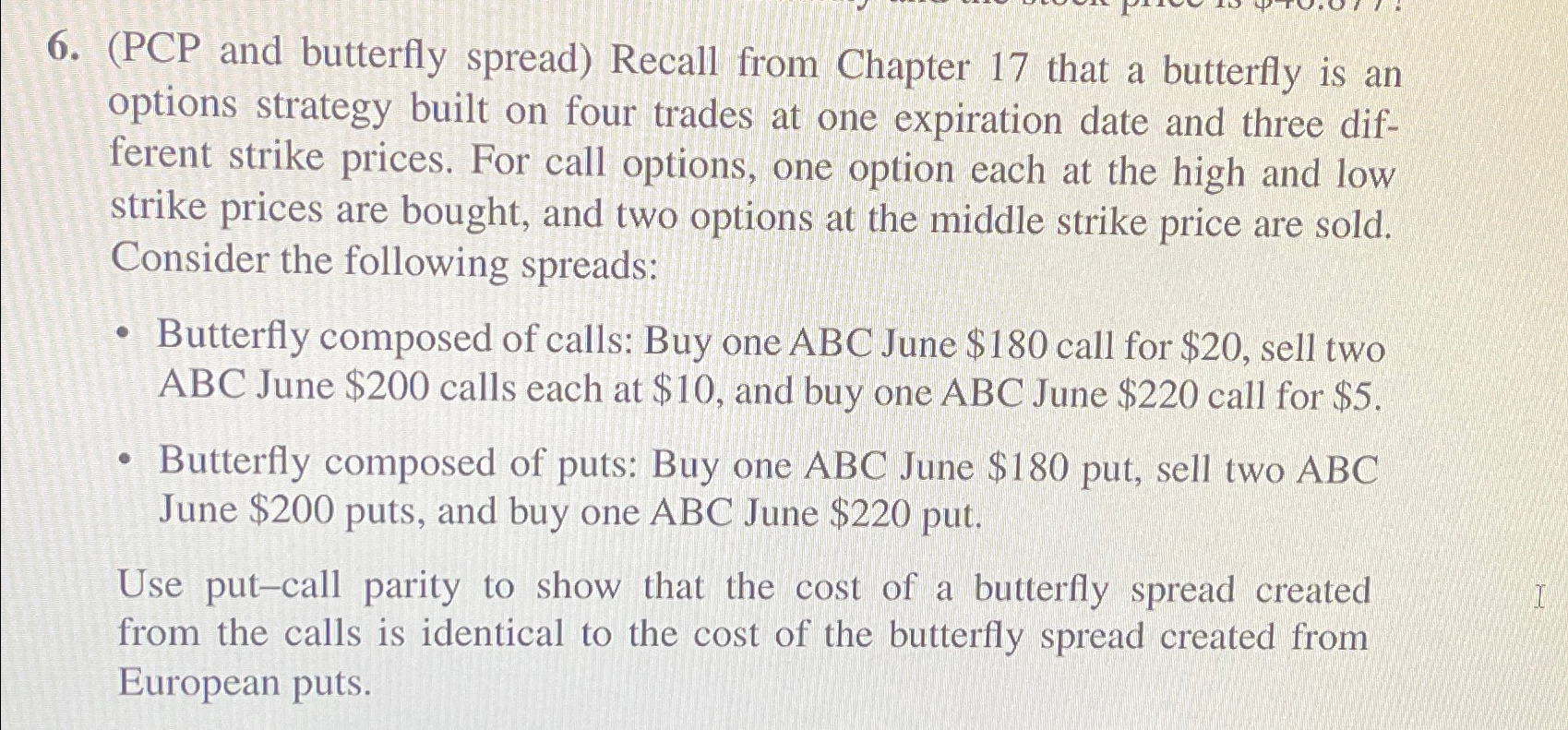

PCP and butterfly spread Recall from Chapter that a butterfly is an options strategy built on four trades at one expiration date and three different strike prices. For call options, one option each at the high and low strike prices are bought, and two options at the middle strike price are sold. Consider the following spreads:

Butterfly composed of calls: Buy one ABC June $ call for $ sell two ABC June $ calls each at $ and buy one ABC June $ call for $

Butterfly composed of puts: Buy one ABC June $ put, sell two ABC June $ puts, and buy one ABC June $ put.

Use putcall parity to show that the cost of a butterfly spread created from the calls is identical to the cost of the butterfly spread created from European puts.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock