Question: PD ACCA Assessment resto + Automatic Loom 2 marks its objectives? Dud Bank Ltd had appointed a receiver to recover the money owed by Auzzie

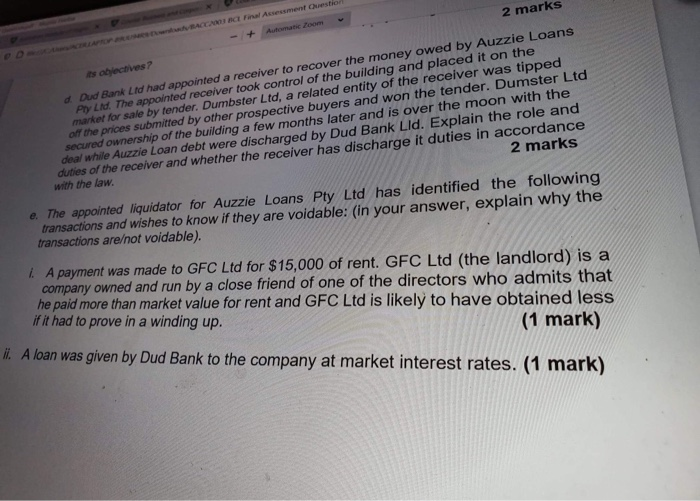

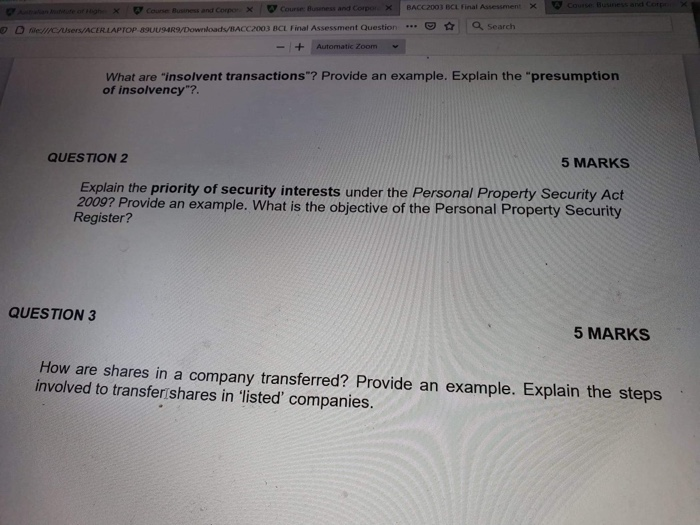

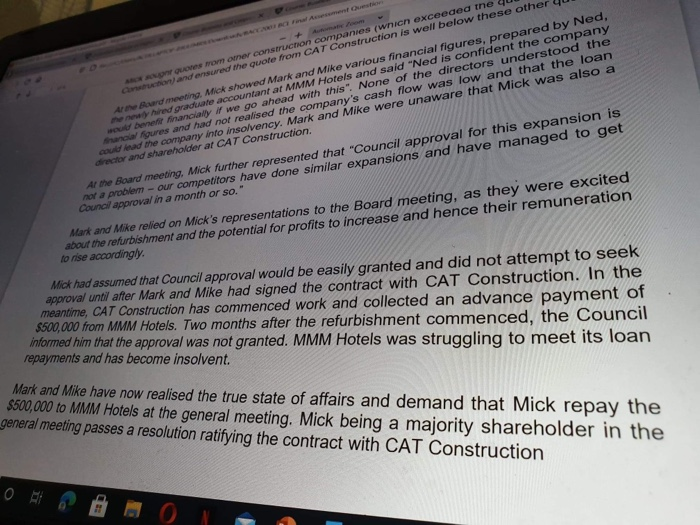

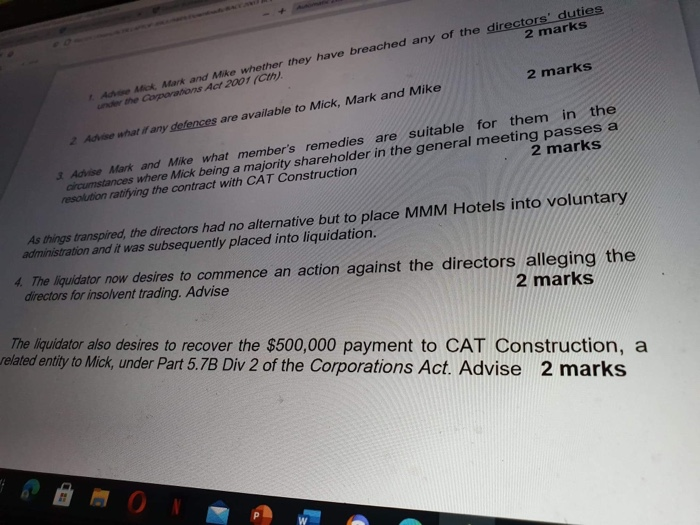

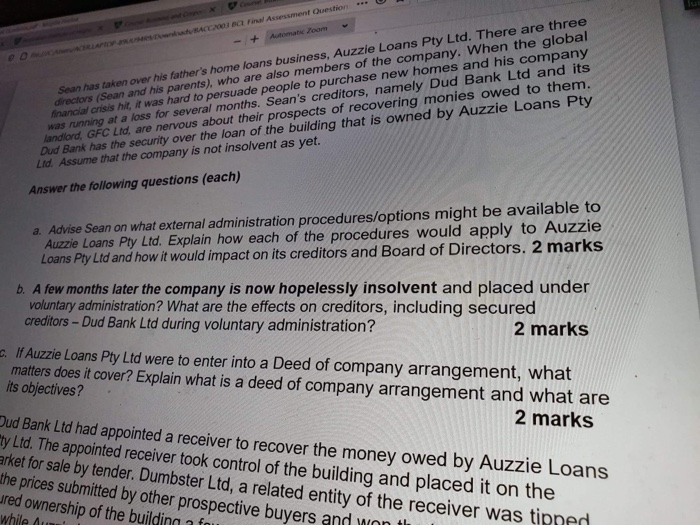

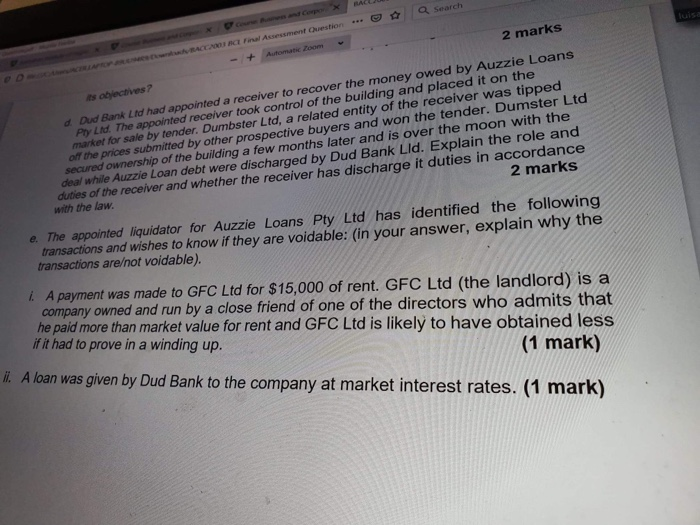

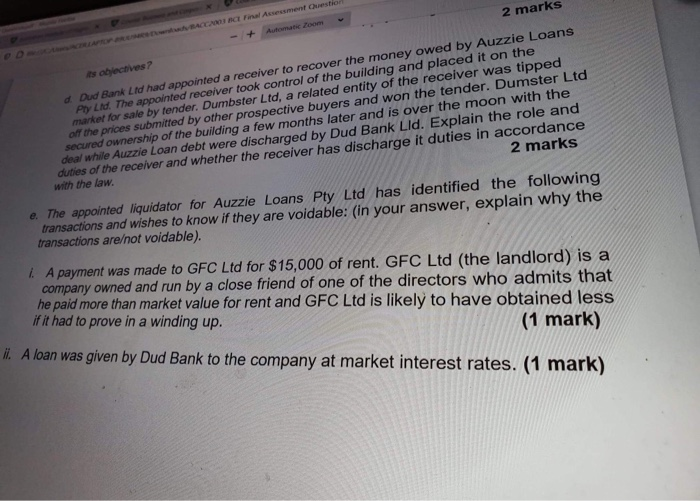

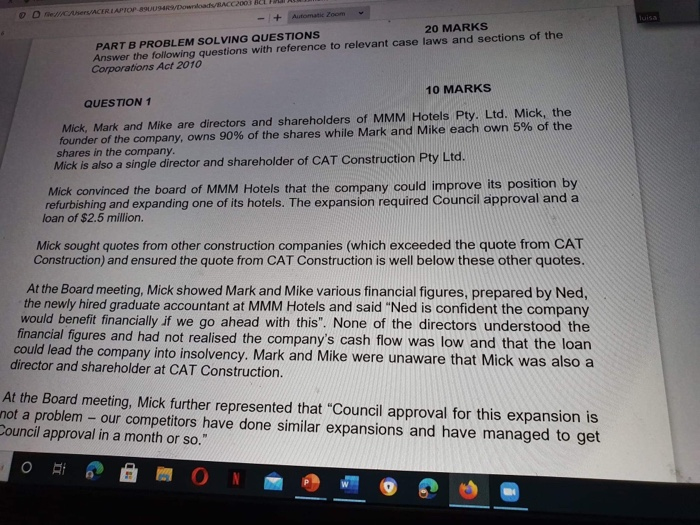

PD ACCA Assessment resto + Automatic Loom 2 marks its objectives? Dud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans Phy Lid. The appointed receiver took control of the building and placed it on the market for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped off the prices submitted by other prospective buyers and won the tender. Dumster Ltd secured ownership of the building a few months later and is over the moon with the deal while Auzzie Loan debt were discharged by Dud Bank Lid. Explain the role and duties of the receiver and whether the receiver has discharge it duties in accordance with the law. 2 marks e. The appointed liquidator for Auzzie Loans Pty Ltd has identified the following transactions and wishes to know if they are voidable: (in your answer, explain why the transactions areot voidable). . A payment was made to GFC Ltd for $15,000 of rent. GFC Ltd (the landlord) is a company owned and run by a close friend of one of the directors who admits that he paid more than market value for rent and GFC Ltd is likely to have obtained less if it had to prove in a winding up. (1 mark) li. A loan was given by Dud Bank to the company at market interest rates. (1 mark) x Course Business and Corpo x BACC2003 BCL Final Assessment Course Business and Corpon Search DAWCUsers ACER LAPTOP 89UUMR/Downloads/BACC2003 BCL Final Assessment Question *** + Automatic Zoom What are "insolvent transactions"? Provide an example. Explain the "presumption of insolvency"? QUESTION 2 5 MARKS Explain the priority of security interests under the Personal Property Security Act 2009? Provide an example. What is the objective of the Personal Property Security Register? QUESTION 3 5 MARKS How are shares in a company transferred? Provide an example. Explain the steps involved to transfer shares in 'listed companies. ANO ons momoner construcnon companies (wnich exceeded the Action and ensured the quote from CAT Construction is well below these other Bord meeting. Mick showed Mark and Mike various financial figures, prepared by Ned, red graduate accountant at MMM Hotels and said "Ned is confident the company wou benefit financially if we go ahead with this". None of the directors understood the than Mures and had not realised the company's cash flow was low and that the loan cou nad the company into insolvency. Mark and Mike were unaware that Mick was also a director and shareholder at CAT Construction. Ar me Board meeting, Mick further represented that "Council approval for this expansion is not a problem - our competitors have done similar expansions and have managed to get Council approval in a month or so." Mark and Mike relied on Mick's representations to the Board meeting, as they were excited about the refurbishment and the potential for profits to increase and hence their remuneration to rise accordingly. Mick had assumed that Council approval would be easily granted and did not attempt to seek approval until after Mark and Mike had signed the contract with CAT Construction. In the meantime, CAT Construction has commenced work and collected an advance payment of $500,000 from MMM Hotels. Two months after the refurbishment commenced, the Council informed him that the approval was not granted. MMM Hotels was struggling to meet its loan repayments and has become insolvent. Mark and Mike have now realised the true state of affairs and demand that Mick repay the $500,000 to MMM Hotels at the general meeting. Mick being a majority shareholder in the general meeting passes a resolution ratifying the contract with CAT Construction 2 marks Ado Abot Mark and Mike whether they have breached any of the directors' duties the Corporations Act 2001 (CM). 2 marks 2 Adid what if any defences are available to Mick, Mark and Mike Arise Mark and Mike what member's remedies are suitable for them in the circumstances where Mick being a majority shareholder in the general meeting passes a resolution ratifying the contract with CAT Construction 2 marks As things transpired, the directors had no alternative but to place MMM Hotels into voluntary administration and it was subsequently placed into liquidation. 4. The liquidator now desires to commence an action against the directors alleging the directors for insolvent trading. Advise 2 marks The liquidator also desires to recover the $500,000 payment to CAT Construction, a related entity to Mick, under Part 5.7B Div 2 of the Corporations Act. Advise 2 marks DRITANIC BC Final Assessment Question Sean has taken over his father's home loans business, Auzzie Loans Pty Ltd. There are three directors (Sean and his parents), who are also members of the company. When the global financial crisis hit, it was hard to persuade people to purchase new homes and his company was running at a loss for several months. Sean's creditors, namely Dud Bank Ltd and its landlord, GFC Ltd, are nervous about their prospects of recovering monies owed to them. Dud Bank has the security over the loan of the building that is owned by Auzzie Loans Pty Lid. Assume that the company is not insolvent as yet. Answer the following questions (each) a. Advise Sean on what external administration procedures/options might be available to Auzzie Loans Pty Ltd. Explain how each of the procedures would apply to Auzzie Loans Pty Ltd and how it would impact on its creditors and Board of Directors. 2 marks b. A few months later the company is now hopelessly insolvent and placed under voluntary administration? What are the effects on creditors, including secured creditors - Dud Bank Ltd during voluntary administration? 2 marks . If Auzzie Loans Pty Ltd were to enter into a Deed of company arrangement, what matters does it cover? Explain what is a deed of company arrangement and what are its objectives? 2 marks Oud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans ty Ltd. The appointed receiver took control of the building and placed it on the arket for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped the prices submitted by other prospective buyers and ured ownership of the buildina while au Mon a search Automatic zoom DACCU ACE Acsessment Ouestion 2 marks sobiectives? Dud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans Phy Lid. The appointed receiver took control of the building and placed it on the market for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped off the prices submitted by other prospective buyers and won the tender. Dumster Ltd secured ownership of the building a few months later and is over the moon with the deal while Auzzie Loan debt were discharged by Dud Bank Lid. Explain the role and duties of the receiver and whether the receiver has discharge it duties in accordance with the law. 2 marks e. The appointed liquidator for Auzzie Loans Pty Ltd has identified the following transactions and wishes to know if they are voidable: (in your answer, explain why the transactions areot voidable). 1. A payment was made to GFC Ltd for $15,000 of rent. GFC Ltd (the landlord) is a company owned and run by a close friend of one of the directors who admits that he paid more than market value for rent and GFC Ltd is likely to have obtained less if it had to prove in a winding up. (1 mark) ii. A loan was given by Dud Bank to the company at market interest rates. (1 mark) PDRACCARAT Final Assessment Chestor 2 marks its abiectives? d Dud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans Phy Lid. The appointed receiver took control of the building and placed it on the market for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped off the prices submitted by other prospective buyers and won the tender. Dumster Ltd secured ownership of the building a few months later and is over the moon with the deal while Auzzie Loan debt were discharged by Dud Bank Lid. Explain the role and duties of the receiver and whether the receiver has discharge it duties in accordance with the law. 2 marks e. The appointed liquidator for Auzzie Loans Pty Ltd has identified the following transactions and wishes to know if they are voidable: (in your answer, explain why the transactions areot voidable). 1. A payment was made to GFC Ltd for $15,000 of rent. GFC Ltd (the landlord) is a company owned and run by a close friend of one of the directors who admits that he paid more than market value for rent and GFC Ltd is likely to have obtained less if it had to prove in a winding up. (1 mark) ll. A loan was given by Dud Bank to the company at market interest rates. (1 mark) ODCAS/ACERI APTOP 89UUSARDownload ACC200 A + Automatic Zoom luisa PART B PROBLEM SOLVING QUESTIONS 20 MARKS Answer the following questions with reference to relevant case laws and sections of the Corporations Act 2010 QUESTION 1 10 MARKS Mick, Mark and Mike are directors and shareholders of MMM Hotels Pty Ltd. Mick, the founder of the company, owns 90% of the shares while Mark and Mike each own 5% of the shares in the company. Mick is also a single director and shareholder of CAT Construction Pty Ltd. Mick convinced the board of MMM Hotels that the company could improve its position by refurbishing and expanding one of its hotels. The expansion required Council approval and a loan of $2.5 million. Mick sought quotes from other construction companies (which exceeded the quote from CAT Construction) and ensured the quote from CAT Construction is well below these other quotes. At the Board meeting, Mick showed Mark and Mike various financial figures, prepared by Ned, the newly hired graduate accountant at MMM Hotels and said "Ned is confident the company would benefit financially if we go ahead with this". None of the directors understood the financial figures and had not realised the company's cash flow was low and that the loan could lead the company into insolvency. Mark and Mike were unaware that Mick was also a director and shareholder at CAT Construction. At the Board meeting, Mick further represented that "Council approval for this expansion is not a problem - our competitors have done similar expansions and have managed to get Council approval in a month or so." o PD ACCA Assessment resto + Automatic Loom 2 marks its objectives? Dud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans Phy Lid. The appointed receiver took control of the building and placed it on the market for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped off the prices submitted by other prospective buyers and won the tender. Dumster Ltd secured ownership of the building a few months later and is over the moon with the deal while Auzzie Loan debt were discharged by Dud Bank Lid. Explain the role and duties of the receiver and whether the receiver has discharge it duties in accordance with the law. 2 marks e. The appointed liquidator for Auzzie Loans Pty Ltd has identified the following transactions and wishes to know if they are voidable: (in your answer, explain why the transactions areot voidable). . A payment was made to GFC Ltd for $15,000 of rent. GFC Ltd (the landlord) is a company owned and run by a close friend of one of the directors who admits that he paid more than market value for rent and GFC Ltd is likely to have obtained less if it had to prove in a winding up. (1 mark) li. A loan was given by Dud Bank to the company at market interest rates. (1 mark) x Course Business and Corpo x BACC2003 BCL Final Assessment Course Business and Corpon Search DAWCUsers ACER LAPTOP 89UUMR/Downloads/BACC2003 BCL Final Assessment Question *** + Automatic Zoom What are "insolvent transactions"? Provide an example. Explain the "presumption of insolvency"? QUESTION 2 5 MARKS Explain the priority of security interests under the Personal Property Security Act 2009? Provide an example. What is the objective of the Personal Property Security Register? QUESTION 3 5 MARKS How are shares in a company transferred? Provide an example. Explain the steps involved to transfer shares in 'listed companies. ANO ons momoner construcnon companies (wnich exceeded the Action and ensured the quote from CAT Construction is well below these other Bord meeting. Mick showed Mark and Mike various financial figures, prepared by Ned, red graduate accountant at MMM Hotels and said "Ned is confident the company wou benefit financially if we go ahead with this". None of the directors understood the than Mures and had not realised the company's cash flow was low and that the loan cou nad the company into insolvency. Mark and Mike were unaware that Mick was also a director and shareholder at CAT Construction. Ar me Board meeting, Mick further represented that "Council approval for this expansion is not a problem - our competitors have done similar expansions and have managed to get Council approval in a month or so." Mark and Mike relied on Mick's representations to the Board meeting, as they were excited about the refurbishment and the potential for profits to increase and hence their remuneration to rise accordingly. Mick had assumed that Council approval would be easily granted and did not attempt to seek approval until after Mark and Mike had signed the contract with CAT Construction. In the meantime, CAT Construction has commenced work and collected an advance payment of $500,000 from MMM Hotels. Two months after the refurbishment commenced, the Council informed him that the approval was not granted. MMM Hotels was struggling to meet its loan repayments and has become insolvent. Mark and Mike have now realised the true state of affairs and demand that Mick repay the $500,000 to MMM Hotels at the general meeting. Mick being a majority shareholder in the general meeting passes a resolution ratifying the contract with CAT Construction 2 marks Ado Abot Mark and Mike whether they have breached any of the directors' duties the Corporations Act 2001 (CM). 2 marks 2 Adid what if any defences are available to Mick, Mark and Mike Arise Mark and Mike what member's remedies are suitable for them in the circumstances where Mick being a majority shareholder in the general meeting passes a resolution ratifying the contract with CAT Construction 2 marks As things transpired, the directors had no alternative but to place MMM Hotels into voluntary administration and it was subsequently placed into liquidation. 4. The liquidator now desires to commence an action against the directors alleging the directors for insolvent trading. Advise 2 marks The liquidator also desires to recover the $500,000 payment to CAT Construction, a related entity to Mick, under Part 5.7B Div 2 of the Corporations Act. Advise 2 marks DRITANIC BC Final Assessment Question Sean has taken over his father's home loans business, Auzzie Loans Pty Ltd. There are three directors (Sean and his parents), who are also members of the company. When the global financial crisis hit, it was hard to persuade people to purchase new homes and his company was running at a loss for several months. Sean's creditors, namely Dud Bank Ltd and its landlord, GFC Ltd, are nervous about their prospects of recovering monies owed to them. Dud Bank has the security over the loan of the building that is owned by Auzzie Loans Pty Lid. Assume that the company is not insolvent as yet. Answer the following questions (each) a. Advise Sean on what external administration procedures/options might be available to Auzzie Loans Pty Ltd. Explain how each of the procedures would apply to Auzzie Loans Pty Ltd and how it would impact on its creditors and Board of Directors. 2 marks b. A few months later the company is now hopelessly insolvent and placed under voluntary administration? What are the effects on creditors, including secured creditors - Dud Bank Ltd during voluntary administration? 2 marks . If Auzzie Loans Pty Ltd were to enter into a Deed of company arrangement, what matters does it cover? Explain what is a deed of company arrangement and what are its objectives? 2 marks Oud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans ty Ltd. The appointed receiver took control of the building and placed it on the arket for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped the prices submitted by other prospective buyers and ured ownership of the buildina while au Mon a search Automatic zoom DACCU ACE Acsessment Ouestion 2 marks sobiectives? Dud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans Phy Lid. The appointed receiver took control of the building and placed it on the market for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped off the prices submitted by other prospective buyers and won the tender. Dumster Ltd secured ownership of the building a few months later and is over the moon with the deal while Auzzie Loan debt were discharged by Dud Bank Lid. Explain the role and duties of the receiver and whether the receiver has discharge it duties in accordance with the law. 2 marks e. The appointed liquidator for Auzzie Loans Pty Ltd has identified the following transactions and wishes to know if they are voidable: (in your answer, explain why the transactions areot voidable). 1. A payment was made to GFC Ltd for $15,000 of rent. GFC Ltd (the landlord) is a company owned and run by a close friend of one of the directors who admits that he paid more than market value for rent and GFC Ltd is likely to have obtained less if it had to prove in a winding up. (1 mark) ii. A loan was given by Dud Bank to the company at market interest rates. (1 mark) PDRACCARAT Final Assessment Chestor 2 marks its abiectives? d Dud Bank Ltd had appointed a receiver to recover the money owed by Auzzie Loans Phy Lid. The appointed receiver took control of the building and placed it on the market for sale by tender. Dumbster Ltd, a related entity of the receiver was tipped off the prices submitted by other prospective buyers and won the tender. Dumster Ltd secured ownership of the building a few months later and is over the moon with the deal while Auzzie Loan debt were discharged by Dud Bank Lid. Explain the role and duties of the receiver and whether the receiver has discharge it duties in accordance with the law. 2 marks e. The appointed liquidator for Auzzie Loans Pty Ltd has identified the following transactions and wishes to know if they are voidable: (in your answer, explain why the transactions areot voidable). 1. A payment was made to GFC Ltd for $15,000 of rent. GFC Ltd (the landlord) is a company owned and run by a close friend of one of the directors who admits that he paid more than market value for rent and GFC Ltd is likely to have obtained less if it had to prove in a winding up. (1 mark) ll. A loan was given by Dud Bank to the company at market interest rates. (1 mark) ODCAS/ACERI APTOP 89UUSARDownload ACC200 A + Automatic Zoom luisa PART B PROBLEM SOLVING QUESTIONS 20 MARKS Answer the following questions with reference to relevant case laws and sections of the Corporations Act 2010 QUESTION 1 10 MARKS Mick, Mark and Mike are directors and shareholders of MMM Hotels Pty Ltd. Mick, the founder of the company, owns 90% of the shares while Mark and Mike each own 5% of the shares in the company. Mick is also a single director and shareholder of CAT Construction Pty Ltd. Mick convinced the board of MMM Hotels that the company could improve its position by refurbishing and expanding one of its hotels. The expansion required Council approval and a loan of $2.5 million. Mick sought quotes from other construction companies (which exceeded the quote from CAT Construction) and ensured the quote from CAT Construction is well below these other quotes. At the Board meeting, Mick showed Mark and Mike various financial figures, prepared by Ned, the newly hired graduate accountant at MMM Hotels and said "Ned is confident the company would benefit financially if we go ahead with this". None of the directors understood the financial figures and had not realised the company's cash flow was low and that the loan could lead the company into insolvency. Mark and Mike were unaware that Mick was also a director and shareholder at CAT Construction. At the Board meeting, Mick further represented that "Council approval for this expansion is not a problem - our competitors have done similar expansions and have managed to get Council approval in a month or so." o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts