Question: PDE SUMMER 2021 Final ACT 202.pc X + o File C:/Users/Saimon/Downloads/SUMMER%202021%20Final%20ACT%20202.pdf O : 5 of 6 Q + L Page view A Read aloud Draw

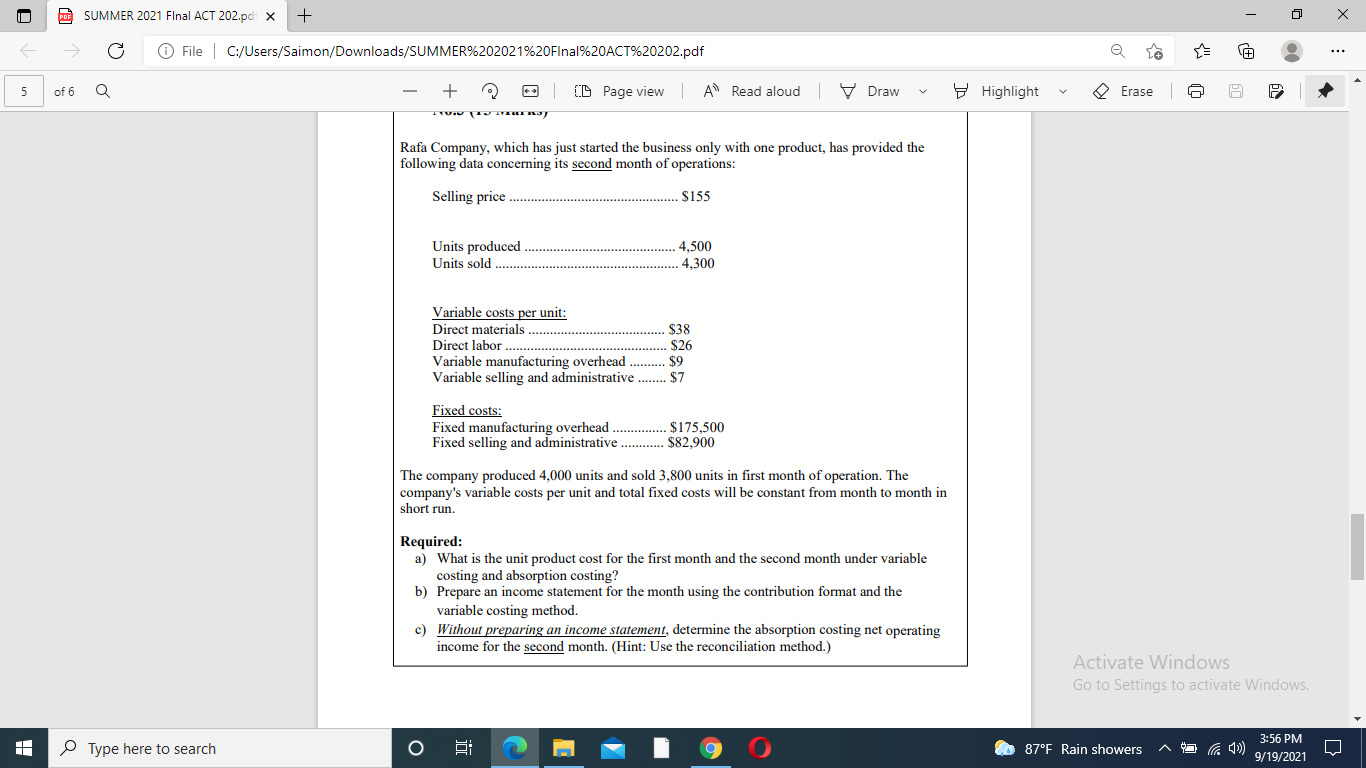

PDE SUMMER 2021 Final ACT 202.pc X + o File C:/Users/Saimon/Downloads/SUMMER%202021%20Final%20ACT%20202.pdf O : 5 of 6 Q + L Page view A Read aloud Draw Highlight Erase A A 19 T. EVELLERS Rafa Company, which has just started the business only with one product, has provided the following data concerning its second month of operations: Selling price $155 Units produced Units sold 4,500 4,300 Variable costs per unit: Direct materials $38 Direct labor $26 Variable manufacturing overhead .......... $9 Variable selling and administrative ........ $7 Fixed costs: Fixed manufacturing overhead $175,500 Fixed selling and administrative ......... $82,900 The company produced 4,000 units and sold 3,800 units in first month of operation. The company's variable costs per unit and total fixed costs will be constant from month to month in short run. Required: a) What the unit product cost for the first month and the second month under variable costing and absorption costing? b) Prepare an income statement for the month using the contribution format and the variable costing method. c) Without preparing an income statement, determine the absorption costing net operating income for the second month. (Hint: Use the reconciliation method.) Activate Windows Go to Settings to activate Windows. Type here to search j 87F Rain showers 3:56 PM olla ) 9/19/2021 L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts